GBP/CAD Week Ahead Forecast: Momentum Firmly Favouring Gains

- Written by: Gary Howes

- GBPCAD trend indicators pointing higher

- 1.6766 now forms key support area

- Developments in GBPUSD also crucial

- No major events on CAD calendar this week

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate can extend higher over the coming days, aided by increasing expectations for Bank of Canada interest rate cuts and a falling U.S. Dollar.

Canada's close economic and financial linkages with the United States explain why the Canadian Dollar is tied to the U.S. Dollar's prospects, particularly against the European currencies.

GBP/CAD is, therefore, likely to reflect developments in GBP/USD, and recent price action is supportive in this regard. As our week ahead forecasts for the GBPUSD show, the outlook for Sterling has improved notably over recent days, and further gains can be expected short term.

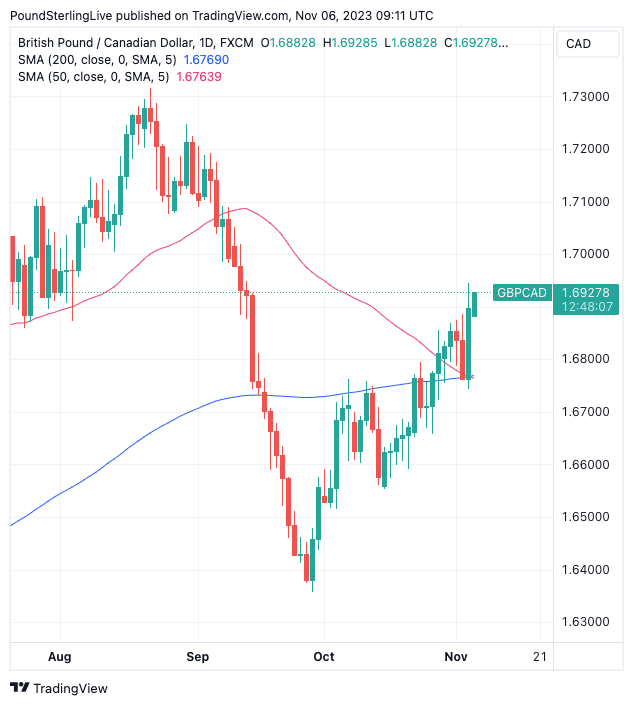

Above: GBPCAD at daily intervals with the 200-day and 50-day moving averages annotated. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The above chart confirms GBPCAD to be in a short-term uptrend, with Friday's 0.80% surge injecting some confidence into the rally.

Note how the jump came off a base where the 50-day and 200-day moving averages intersect: this level at 1.6766 now forms a key support area. In the event GBPCAD does retreat, we would look for gains to stall here.

That the exchange rate is above these two moving averages confirms momentum is positive (the RSI at 63 also reinforces this momentum) and advocates for further advances.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

How far can these advances extend? The first upside target level to anticipate is the loose conglomeration of support and resistance points near 1.7030-1.70320.

A break above here opens up the belly of the approach to the 2023 highs at 1.73.

Be aware that the attainment of this level will be highly dependent on GBPUSD also holding an advance, owing to the strong linkages of the North American currencies.

CAD and USD slipped last week as investors pared expectations for further rate hikes at the Federal Reserve and Bank of Canada.

In fact, markets brought forward expectations for rate cuts after both U.S. and Canadian labour market data releases disappointed when released on Friday.

Global risk assets - including the Pound - rose after the U.S. non-farm employment report undershot expectations, as did Canada's employment report, which was released at alongside that of the U.S.

Canada's Labour Force Survey meanwhile revealed 17.5K jobs were created in October, which was below the 22.5K the market expected and down significantly on September's 63.8K reading.

Odds of another Bank of Canada interest rate hike receded further after Statistics Canada revealed the unemployment rate rose to 5.7% from 5.5%, which was above the 5.6% the market was expecting.

"We remain of the view that the Bank of Canada's next move will be a cut in the second quarter of 2024," says Marc Desormeaux, Principal Economist at Desjardins Bank.

By buying GBPCAD, markets are signalling they reckon the BoC cut will precede that of the Bank of England. With this in mind, keep an eye on Bank of England Governor Andrew Bailey on Tuesday; he is due to speak in Ireland and could provide further guidance on the path of UK interest rates.

Last week, he was firm in his view that rates would need to remain high for a more extended period and pushed back against the market's move to fully price the first rate cut at the Bank of England to fall by September 2024.

If he maintains this guidance, then the Pound can remain supported.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes