Canadian Dollar's Softer Economy Helps GBP/CAD Rally but BoC Risk Lingers

- Written by: James Skinner

"They said this is because they have not yet finished passing through the cost increases they experienced during the pandemic" - BoC Business Outlook Survey.

Image © Adobe Stock

A falling Canadian Dollar, wobbling U.S. Dollar and rallying Pound all helped GBP/CAD to rally into month-end on Friday after a stalling Canadian economy appeared as if it would make a July increase in the Bank of Canada (BoC) cash rate less likely if not for the potentially offsetting details of the latest business outlook survey.

Canada's Dollar underperformed other major currencies on Friday after strike action in the public sector, a contraction in wholesale trading activity and an absence of growth in the services sector led the local economy to grind to a standstill in April when surprising on the downside of expectations for around 0.2% growth.

There was still growth in just more than half of the industries measured including resources, real estate and construction, however, and Statistics Canada's provisional estimate was for the economy to have rebounded 0.4% in May.

"That will partly reflect a rebound in public administration after the strike ended," says Royce Mendes, an economist at CIBC Capital Markets.

"The quarter as a whole is tracking at a 1.4% annualized pace, which is only slightly above the Bank of Canada's April MPR forecast of 1.0%," he adds.

Above: GBP/CAD shown at 15-minute intervals alongside selected pairs.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Friday's data also followed a softer set of inflation numbers earlier in the week, however, after all bar one of the most closely watched measures fell further than was expected for May on Wednesday, while both outcomes together might make the BoC less likely to raise its cash rate from 4.75% to 5% on July 12.

"Another month of below-consensus real GDP growth should be good news for the Bank of Canada. However, the Bank likely won’t be happy about the sustained output gains in the economy outside of the public sector so far in Q2, particularly in real estate," says Randall Bartlett, a director of Canadian economics at Desjardins.

"Combined with the ongoing reluctance of core CPI inflation to trend toward the Bank’s 2% target, we continue to expect the Bank will hike by another 25 basis points at its July meeting. It will also likely keep the door open to further hikes depending on how the data develop," he adds.

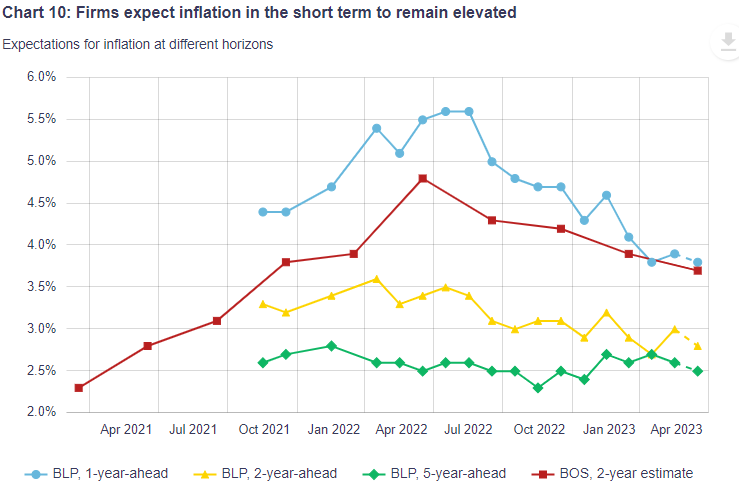

Slowing the economy enough to bring inflation back to 2% has been the primary objective of the BoC's interest rate cycle so far but if this week's data offered signs of partial success on both counts, the second quarter business outlook survey out on Friday was potentially less helpful for those hoping to avoid further increases in borrowing costs.

"Some firms are still planning to make larger and more frequent price increases than usual in the coming year. They said this is because they have not yet finished passing through the cost increases they experienced during the pandemic," the second quarter survey results said prominently on Friday.

Source: Bank of Canada Business Outlook Survey.

"Most businesses anticipate that, in the long term, inflation will be within the Bank of Canada’s inflation-control target range. However, a greater number of firms than in the first-quarter 2023 survey think it will take five years or more for inflation to return close to 2%. They see inflation being held up by high government spending and strong demand," a partial summary of the survey results adds.

The limited improvement in the number of firms reported to be expecting a longer journey back to the 2% inflation target is unlikely to have been welcomed by the BoC, and likewise with the large number still expecting to pass increased material costs to customers by raising prices and inflation.

Inflation expectations of companies and households are monitored closely by the BoC because of their ability to lead to self-perpetuating outcomes while each of the above survey developments are the sorts that could make the bank lean more toward raising the cash rate again sooner rather than later.

"GDP continues to track a positive (but slower) growth in Q2 after a surge in Q1 in large part due to exceptionally strong consumer spending growth. Even after 450 basis points of rate hikes since March 2022, consumer spending has yet to materially soften to-date," says Carrie Freestone, an economist at Royal Bank of Canada.

"The unemployment rate remains exceptionally low at 5.2%. We still expect the lagged impact of monetary policy will result in softening activity in the back half of 2023, but odds are still tilted towards an additional 25 basis point hike from the BoC in July," she adds

Above: GBP/CAD shown at daily intervals alongside selected pairs.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes