Canadian Dollar Softer as Economy Flatlines

- Written by: Gary Howes

Image © Bank of Canada

The Canadian Dollar fell on the release of GDP data that showed the Canadian economy 'flatlined' in the final quarter of the year, reassuring investors that the Bank of Canada would keep interest rates at current levels over the coming weeks.

The Canadian Dollar fell against the Dollar, Pound, Euro and the majority of its G10 peers after Statistics Canada said GDP declined 0.1% in the month to December, defying market expectations for an expansion of 0.1%.

The quarter saw no growth registered at all, and the annualised figure for the final quarter also turned out a 0% figure.

"The Canadian economy surprisingly stalled in the final quarter of 2022," says Andrew Grantham, Senior Economist at CIBC Capital Markets.

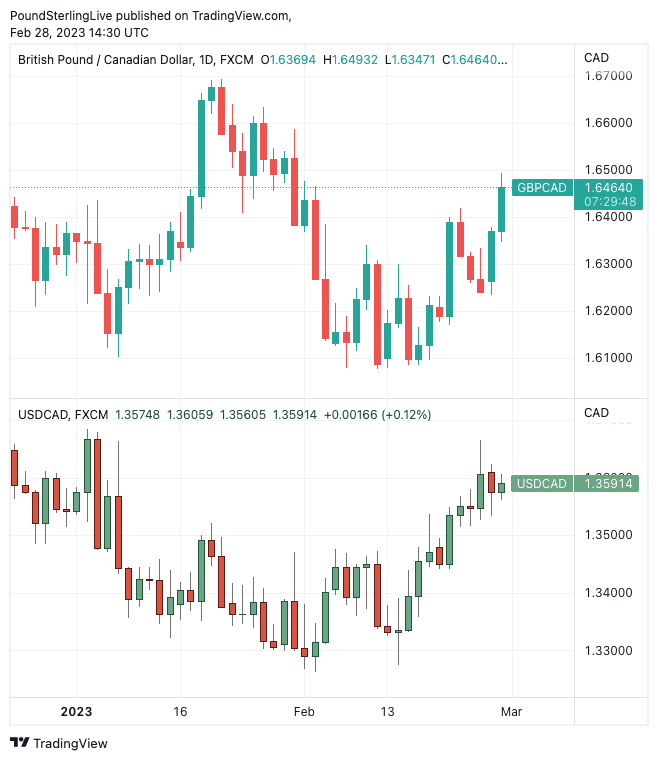

The Pound to Canadian Dollar exchange rate rallied to its highest level since January 31 at 1.6475 on the outcome amidst the broader retreat in the Canadian currency.

Against the U.S. Dollar the Canadian unit was only a touch softer at 1.3585, reflecting the broader malaise facing the USD at month end, however it had been as low as 1.3560 ahead of the release.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The losses to the Canadian Dollar will nevertheless prove relatively limited given the miss on the monthly GDP reading was relatively minor and all the other readings were in line with expectations.

Furthermore, there were some bright spots in the data, notably resilient domestic demand (+0.3% in Q4) which suggested consumers were proving more resilient than might have been expected.

"Early indications suggest that it started the new year on a better footing," says Grantham.

Indeed, StatCan's preliminary estimate for January suggested growth of 0.3% following December's -0.1%.

Above: GBP/CAD (top) and USD/CAD at daily intervals in 2023.

Nevertheless, economists at Royal Bank of Canada say they maintain a baseline expectation that weaker demand is yet to come.

"Household debt service ratio has been rising and will continue to increase into the end of 2024. That combined with moderating wage gain and rising borrowing costs will continue to drive consumer spending lower, keeping a downward pressure on inflation as the economy heads into a mild recession later in 2023," says Claire Fan, Economist at Royal Bank of Canada.

From a monetary policy perspective, Tuesday's data is unlikely to ruffle any feathers at the Bank of Canada which has signalled it is ready to pause its rate hiking cycle as it believes it has done enough for now.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes