GBP/CAD Forecast Lower in 2023 by Canada's NBC

- Written by: Gary Howes

Image © Adobe Stock

National Bank of Canada (NBC) has released research showing the Canadian Dollar will be one of 2023's better-performing currencies amidst ongoing economic outperformance, while the Pound and Euro will continue to struggle.

Forecasts released by the Canadian lender show the Pound to Canadian Dollar exchange rate (GBP/CAD) will trend lower, suggesting mid-December's 1.68 could prove to be the peak for buyers of the Canadian currency.

Analysts say that although the Canadian economy will slow in 2023 it should avoid a 'hard landing', i.e. it won't suffer a significant and enduring recession, which contrasts favourably with most global peers.

"The geopolitical situation is still pointing towards continued price pressures," says Stéfane Marion, Chief Economist & Strategist at NBC.

Regarding the Eurozone and UK economies, don't expect "a significant improvement in the fortunes on either side of the Channel," says Marion. "Looking ahead we remain cautious for both currencies".

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

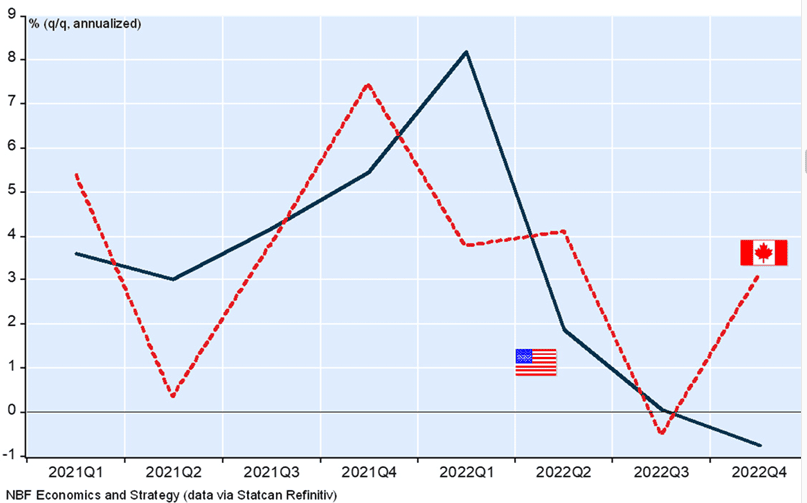

The Canadian Dollar was one of 2022's best-performing currencies, aided by strong oil prices and an economy that outperformed in tandem with that of the U.S.

The U.S. is Canada's main trading partner and U.S. economic outperformance continues to prove beneficial to the smaller Canadian economy and confer relative strength on its currency.

But NBC's economists find that Canada should even outperform its southern neighbour in 2023 and, as a result, "we sill see the possibility of a significant appreciation of the CAD against the greenback in 2023," says Marion.

Above: Full-time Canadian employment rebounds.

Canada's economy is now 3% bigger than it was ahead of the Covid crisis but the final GDP report of 2022 revealed a sharp retreat in final domestic demand, that some commentators said signalled an impending and sharp slowdown.

"Is the Canadian economy starting to crumble and enter a recession?" queries Marion.

"We don't think so," is his answer.

If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

The economist points out that consumer spending grew an "unsustainable" 9.5% in the second quarter, so a contraction in the third quarter was to be expected.

Fears that a lull in full-time job creation in the third quarter would precipitate a further decline in consumption should be allayed by the significant rebound seen in the final quarter.

"Nevertheless, the Canadian economy remains vulnerable to rising interest rates, given that 30% of outstanding mortgages are at variable rates," says Marion.

The risk to the outlook is that the Bank of Canada raises rates too high and too fast, resulting in a 'hard landing' for the Canadian economy.

For now, NBC doesn't expect such an outcome.

"A soft landing of the economy requires that the labour market remain resilient and that the Bank of Canada pauses its tightening campaign soon. But for that to happen, inflation must subside. Fortunately, things are moving in the right direction," says Marion.

NBC forecasts GBP/CAD to trade at 1.63 by the end of the first quarter of 2023, which is not far off from the current level in spot.

But the trend is lower with 1.59 pencilled in for the end of the second quarter and 1.53 for the end of the third quarter.

The USD/CAD profile sees 1.35, 1.30 and 1.25 for these points in the future, down from the current level in spot at 1.36.

The EUR/CAD forecast profile is 1.42, 1.38 and 1.35 from the current level in spot at 1.4375.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes