GBP/CAD Testing Nine Month Highs as BoC Risk Looms

- Written by: James Skinner

"An underlying issue for the CAD may be the lack of faith in the Bank of Canada delivering a more aggressive rate hike at tomorrow’s policy decision" - Scotiabank.

Image © Pound Sterling Live

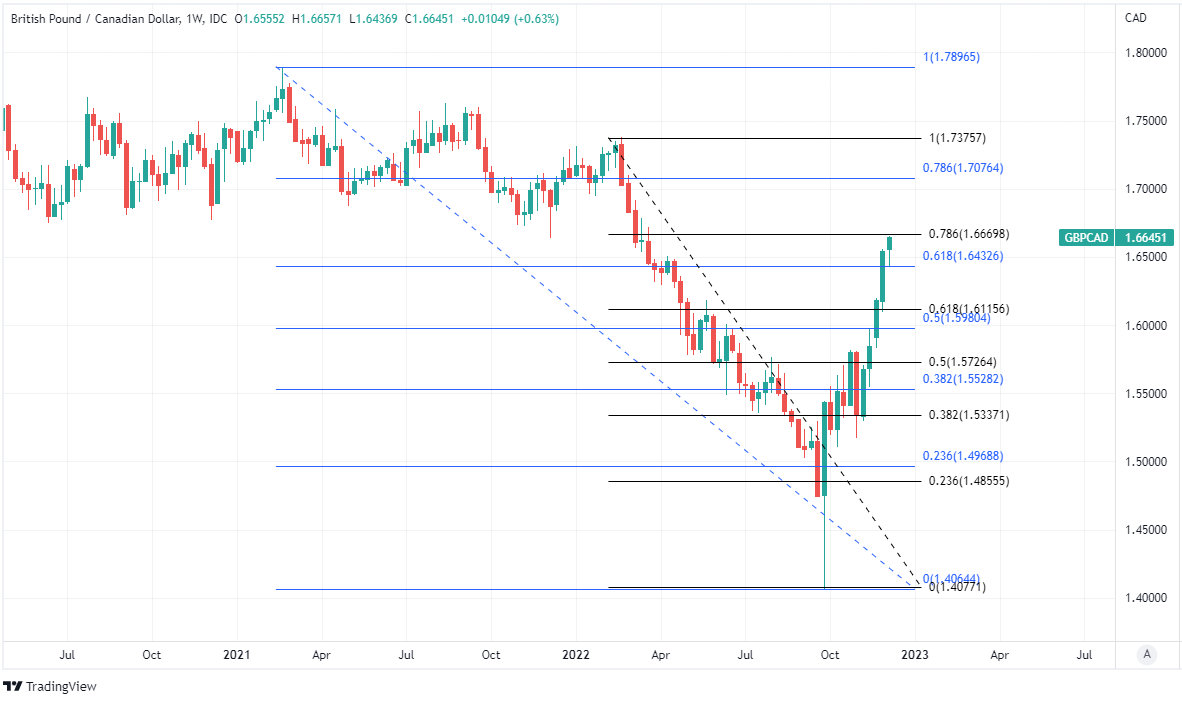

The Pound to Canadian Dollar exchange rate (GBP/CAD) reached nine-month highs early in the new week following a near seven percent gain in November but obstacles on the charts could now obstruct its path higher unless the Bank of Canada (BoC) adds further to the Loonie's burdens this Wednesday.

Canada's Dollar remained an underperformer among comparable counterparts on Tuesday when it featured as the only currency in the G10 grouping to cede ground to an otherwise retreating U.S. Dollar in price action that enabled GBP/CAD to edge back above 1.66 for the first time since March.

Sterling was already carrying a hat-trick of intraday gains while wandering further onto overbought ground on the charts and toward the 78.6% Fibonacci retracement of the 2022 downtrend, which could potentially frustrate the recovery in GBP/CAD ahead of this Wednesday's BoC decision.

"The GBP rally has developed quickly and delivered steady gains since early Nov," says Shaun Osborne, chief FX strategist at Scotiabank.

"In the short run, however, the rally may be running out of steam; the GBP is starting to look overbought and the rally overextended on the intraday and daily oscillators," Osborne writes in a Monday review of the Canadian Dollar charts.

Above: Pound to Canadian Dollar rate shown at daily intervals with Fibonacci retracements of 2022 downtrend indicating possible areas of technical resistance for Sterling and relative-strength-index (RSI) measure of momentum; currently at its highest since early 2018. Click image for closer inspection.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Osborne says any corrective losses in GBP/CAD should remain limited in the short-term but has also warned that it could fall as far back as 1.60 if Sterling comes under pressure for reasons of its own in the months ahead, reasons relating to the UK economy for instance.

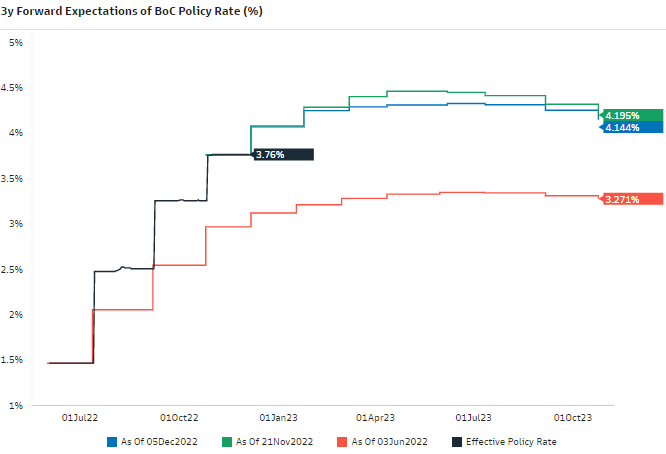

The big risk for the Pound to Canadian Dollar rate this week, however, is in relation to whether the BoC lifts its cash rate to 4% or 4.25% on Wednesday and what it says about the outlook for borrowing costs going forward.

"There are two main things to watch for. The first is whether the Bank will hike by 25bps or 50bps, while the second is whether there’s a change in the key sentence in the final paragraph," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

"Our base case is that the Bank will hike rates by 50bps, and introduce some conditionality to the final sentence to imply that the next rate decision in early January will be “0 or 25bps”. Markets are currently pricing in 34bps," he writes in a Monday market commentary.

Governor Tiff Macklem said back in October that the end of the BoC's interest rate cycle is drawing closer but that further increases in the cash rate were still likely and this week financial markets will be looking for clues about how much further the benchmark is likely to rise.

Above: Changes in market-implied expectations for Bank of Canada cash rate between selected dates. Source: Goldman Sachs Marquee. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"Our economists expect the Bank to deliver another 50bp hike, but under-delivery remains a risk on two fronts. First, it is possible that the BoC sees enough justification to hike by 25bps only, given the moderation in sequential underlying inflation. Second, we think that the BoC is likely to pause soon and the statement or press conference may already signal this next week," says Karen Reichgott Fishman, a senior economist at Goldman Sachs.

"CAD has had a solid performance this year on the BoC’s aggressive hiking cycle but has underperformed the rest of G10 recently. This is mostly related to lower oil prices and lower yields (and a weaker USD on crosses). However, CAD on crosses remains our preferred expression in an environment of USD strength, which we expect to persist over the next 3 to 6 months," Fishman and colleagues write in a Friday research briefing.

For the Canadian Dollar this week's big risk is of the BoC signalling that its interest rate cycle will either end or be placed on hold sooner than financial markets have anticipated, prompting a downward revision to expectations implied by bond and interest rate derivative markets.

That could have modest adverse implications for the Loonie and be supportive of GBP/CAD but the Loonie has proven less susceptible to strength in the U.S. Dollar this year so Sterling would potentially come under pressure again if the greenback strengthens afresh in the weeks ahead.

"The CAD showed some signs of stabilizing on some of the key crosses yesterday but those gains look fleeting this morning, with EURCAD pushing on the new cycle highs, (ditto for GBPCAD). An underlying issue for the CAD may be the lack of faith in the Bank of Canada delivering a more aggressive rate hike at tomorrow’s policy decision," Scotiabank's Osborne said on Tuesday.

Above: Pound to Canadian Dollar rate shown at weekly intervals with Fibonacci retracements of February 2021 and February 2022 downtrends indicating possible areas of technical resistance for Sterling. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.