Canadian Dollar Bought by BMO Model as Charts Point GBP/CAD toward 1.58

- Written by: James Skinner

- BMO FX model a seller of USD/CAD from 1.2844

- S&P, copper price & bond yield differentials cited

- Charts suggest sideways trend, Scotiabank says

- GBP/CAD charts hint of further recovery to 1.58

Image © Adobe Stock

The Canadian Dollar fundamental value has risen, leading a BMO Capital Markets financial model to tip the Loonie as a buy this week, although the latest technical analysis from Scotiabank suggests USD/CAD is likely to trend sideways and that GBP/CAD may have scope to climb toward 1.58.

Canada’s Dollar was an outperformer alongside the Swedish Krona on Wednesday as stocks rose broadly while crude oil futures climbed in response to a mooted production increase from Organization for Petroleum Exporting Countries (OPEC) members underwhelmed the market.

The U.S. Dollar was lower against most G20 currencies with the exceptions being the Japanese Yen, Swiss Franc and South African Rand, although declines in USD/CAD were as large as in any other U.S. exchange rate, leading the Loonie to rise against most major counterparts.

“The signal was issued because spot USDCAD rallied above the model's fair value at a juncture when the model interprets fair value as generally trending lower,” says Greg Anderson, head of FX strategy at BMO Capital Markets.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

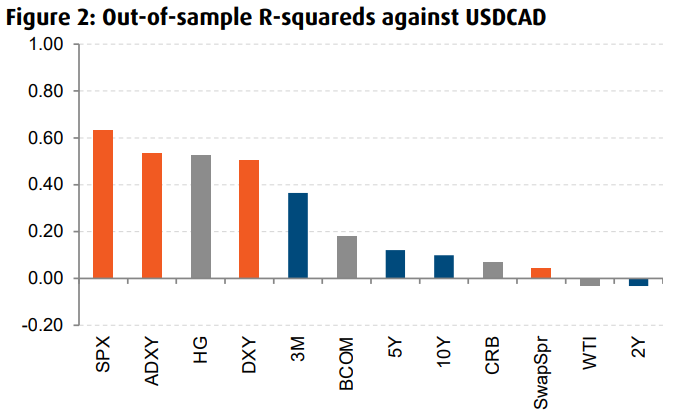

“The model's #1 factor is the level of the S&P 500. The #2 variable is the price of copper. The 3M interest rate differential is the model's third active factor. The entire pecking order of the model's factors is shown in Figure 2,” Anderson said.

Wednesday’s decline in USD/CAD and the Loonie’s outperformance comes after BMO’s financial model, which has a 76% hit rate thus far in 2022, tipped USD/CAD as a sell on Monday when it was trading around 1.2844.

“Many model positions only last for a day or two. And with spot so near to fair value, that seems fairly likely in this instance. The model's last signal only lasted 24 hours,” Anderson also wrote in a Monday note to clients.

The model does not currently rank oil prices, which were up notably on Wednesday, as an active influence on the Canadian Dollar although BMO itself noted earlier this week that Monday’s sharp decline in oil prices did at least appear to have an impact on the Loonie.

“The model takes a long position if fair value is trending higher and spot is below fair value. Conversely, it gets short if fair value is trending lower and spot is above fair value. It is neutral the rest of the time,” Anderson said.

Above: USD/CAD shown at daily intervals with 40-day moving-average.

Above: USD/CAD shown at daily intervals with 40-day moving-average.

USD/CAD fell to six week lows during the Monday session this week before rallying sharply but was trading back below the 1.2844 level on Wednesday, although it remains to be seen how much further it will fall.

Meanwhile, technical analysis from Scotiabank suggests that USD/CAD should continue to trade with a downward bias but that the risk is of a sideways consolidation between roughly the 1.2770 and 1.2910 levels.

“The sharp squeeze higher in the USD over the long weekend in Canada has drawn a line under the USD slide for now but it is not obvious that the USD rebound can extend much further at this point,” says Shaun Osborne, chief FX strategist at Scotiabank.

“The 40-day MA resistance (1.2910) remains intact at writing and shorter-term trend signals are weak or neutral. Rather, we look for more sideways range trading in the USD and still view USD rebounds to the mid/upper 1.28s as a USD-selling opportunity while the 40-day MA holds,” he added.

GBP/CAD, on the other hand, was on course for a third consecutive week of gains by Wednesday while technical indicators on the short and medium-term charts suggest that it could have scope to climb further.

Above: Pound to Canadian Dollar rate shown at daily intervals with selected moving-averages.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

“GBPCAD is showing some tangible signs of strength from a short-term point of view, at least. Since noting that the GBP was oversold last month, the cross has traded higher for two consecutive weeks and is embarking on a third so far this week,” Osborne also said on Monday.

“The “rounded” nature of the low that has developed through Jul may be a sign of a more durable based in development. These sorts of patterns are sometimes followed by a brief, counter-trend consolidation before the rebound accelerates (cup & handle formation), possibly to 1.58+,” he added.

There is a lot to be determined for the Pound, however, on Thursday and by whether the Bank of England (BoE) continues to lift Bank Rate at the same steady pace that it has characterised its monetary policy normalisation process since it first began in December 2021.

There is uncertainty over whether the BoE will lift rates by a typical quarter percentage point to 1.5%, or if it will opt for one of the larger half percentage point increases that have recently been used elsewhere including in Canada.

Interest rate derivative markets err in favour of the latter so GBP/CAD might be at risk of a setback if the BoE elects to raise for the former.

Above: Pound to Canadian Dollar rate shown at weekly intervals with selected moving-averages.

Above: Pound to Canadian Dollar rate shown at weekly intervals with selected moving-averages.