Canadian Dollar Charts Pointing GBP/CAD toward Recovery Road, Scotiabank Says

- Written by: James Skinner

Image © Pound Sterling Live

The Pound to Canadian Dollar exchange rate may be in the early stages of a corrective recovery that could reverse a more meaningful portion of its multi-month slide, according to technical analysis from Scotiabank, which could see GBP/CAD trading up toward 1.65 in the weeks ahead.

Sterling fell by more than six percent against the Canadian Dollar in the first half of the year with the bulk of this decline coming in the second quarter and a period in which fundamental drivers of the two currencies have diverged markedly.

But this month’s Bank of England (BoE) monetary policy decision appears to have marked an inflection point for how the market views Sterling while the 400 point rally by GBP/CAD following the announcement has left reversal signals behind in its wake on the charts.

“Price action overall last week was hugely GBP-bullish after it had sunk to its lowest point since 2013. After making its low, the GBP rally formed a large, bullish key week reversal signal,” says Juan Manuel Herrera, a strategist at Scotiabank.

“The extended, one-way move lower in the GBP since the February high suggests some potential at least for a more significant correction (towards 1.6450/1.6650) in the coming weeks,” Herrera and colleagues said this week following a review of the Canadian Dollar’s charts.

Above: Pound to Canadian Dollar rate shown at daily intervals with Fibonacci retracements of February downtrend indicating various areas of short-term technical resistance for Sterling. Click image for closer inspection.

Above: Pound to Canadian Dollar rate shown at daily intervals with Fibonacci retracements of February downtrend indicating various areas of short-term technical resistance for Sterling. Click image for closer inspection.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

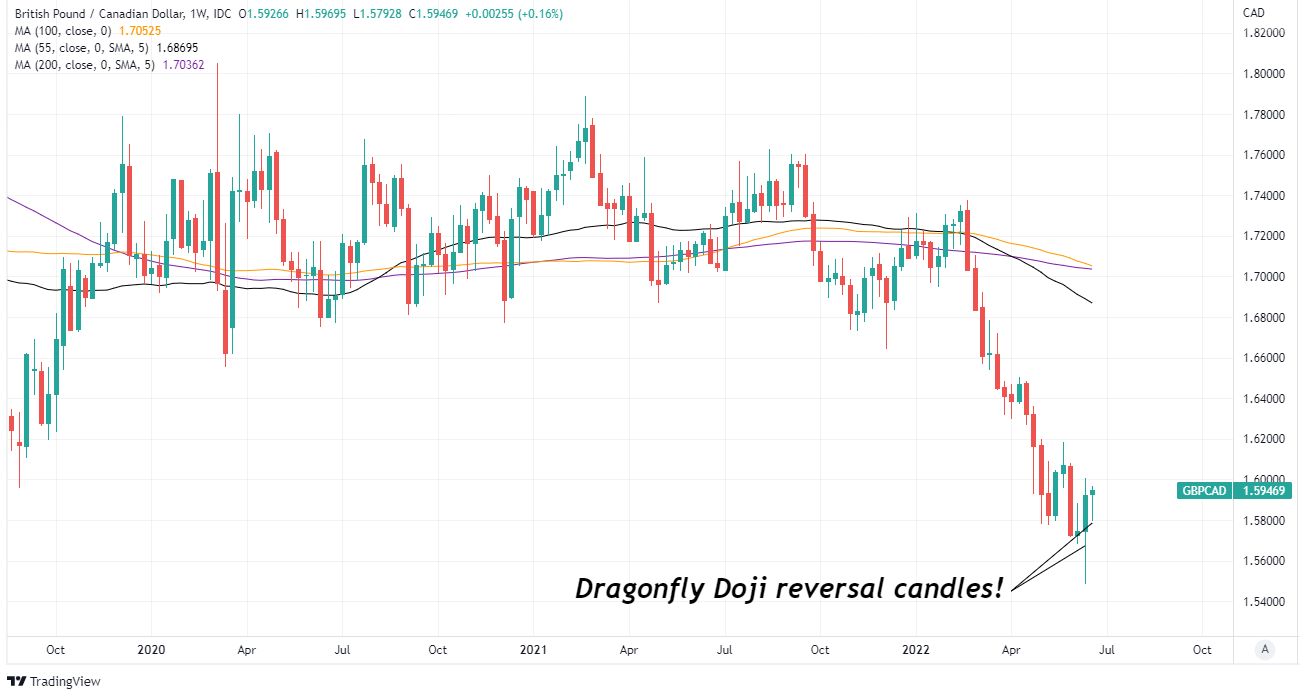

Price action from this week and last has left behind a series of reversal signals on the weekly charts while also leading the Pound to Canadian Dollar rate to begin eroding technical resistance from a Fibonacci retracement of the February downtrend located around 1.5932.

This is a promising development for an exchange rate that had repeatedly set new 10-year lows during the prior weeks while Scotiabank says that a rise above the nearby 1.60 level would be suggestive of a further recovery being in store for the weeks ahead.

“GBP gains above 1.60 should see the GBP rebound extend towards 1.62/1.63 (congestion resistance),” Herrera and colleagues said this week.

GBP/CAD fell heavily during recent months due to a mixture of outperformance by the Canadian Dollar and underperformance by Pound Sterling.

The Pound fell heavily following the Russian invasion of Ukraine in late February, which prompted the BoE’s Monetary Policy Committee to cut forecasts for the economy in the years ahead and to become more cautious about raising Bank Rate.

Above: Pound to Canadian Dollar rate shown at weekly intervals. Click image for closer inspection.

Above: Pound to Canadian Dollar rate shown at weekly intervals. Click image for closer inspection.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Doubts about whether the BoE would be likely to meet ‘hawkish’ expectations for its interest rate were a precursor for the market building a ‘short positions’ against the Pound that has come close to the size of that seen during the years immediately after the Brexit referendum.

Those doubts were partially dispelled this month although as much as half of GBP/CAD’s declines have been driven by an outperforming Canadian Dollar that has seemingly benefited from the aggressive shift in the Bank of Canada’s (BoC) monetary policy stance since March.

“With the communications blackout starting next Tuesday, we think the bank is well positioned for a 75bps hike next month but it has not been clearly teed up (though markets have essentially fully priced this in),” says Shaun Osborne, chief FX strategist at Scotiabank.

The BoC has lifted its interest rate three times since March including twice in increments of 0.50%, taking it up from 0.25% to 1.5% by June when the bank warned that it would act “more forcefully” if inflation or inflation expectations merit it in the months ahead.

This and the Federal Reserve decision to increase U.S. interest rates by 0.75% just last week already led financial markets to anticipate would be likely to follow in its footsteps on July 13 and since then Canadian inflation figures have surprised further on the upside of the market and BoC’s expectations.

“The inflation reading, with broad price gains outside of energy and food, had limited impact on the CAD,” Scotiabank’s Osborne observed on Thursday.