Pound / Canadian Dollar Week Ahead Forecast: Supported at 1.7150 as BoC, BoE Eyed

- Written by: James Skinner

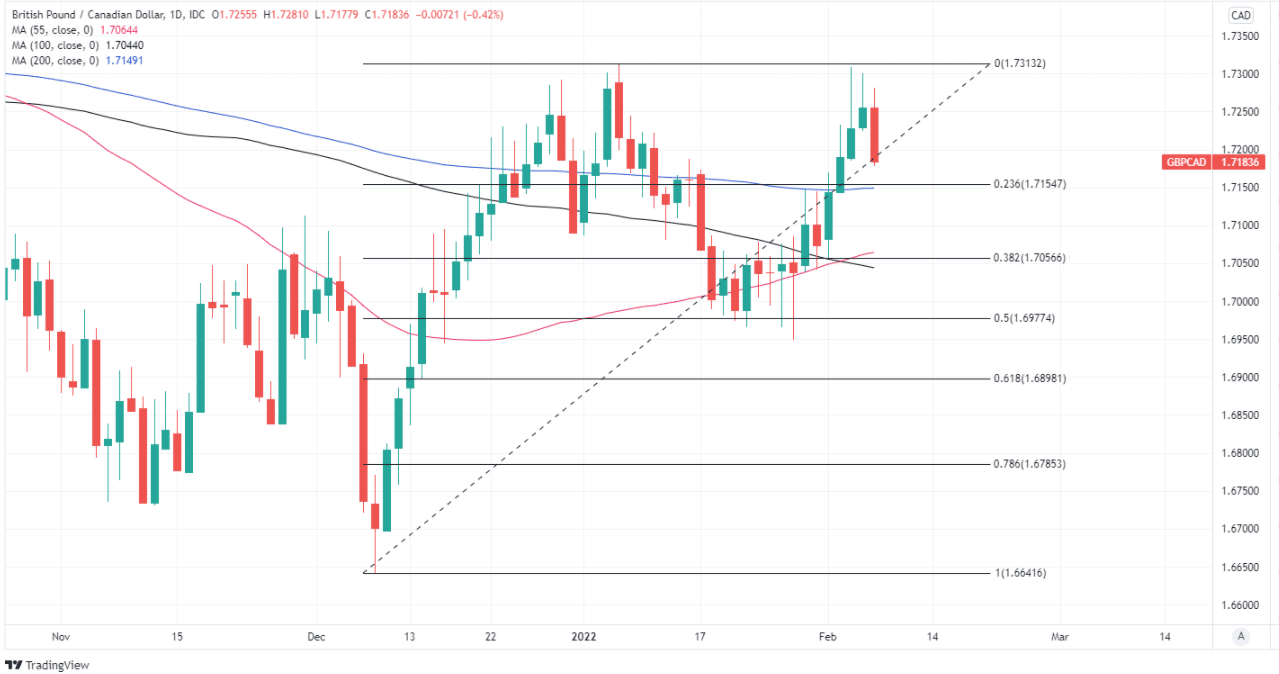

- GBP/CAD looking to hold above 1.7150

- But recovery momentum wanes at 1.73

- Choppy consolidation range likely ahead

- BoC, BoE speeches in focus for GBP/CAD

Above: BoC Governor Macklem. Image © Bank of Canada, Reproduced Under CC Licensing.

The Pound to Canadian Dollar rate entered the new week in retreat toward an important level of support near 1.7050 on the charts, where it could be likely to stabilise ahead of midweek remarks from Bank of Canada (BoC) and Bank of England (BoE) officials and key U.S. economic figures.

Pound Sterling tried for a second time but failed to recover above the 1.73 handle against the Canadian Dollar last week before opening on Monday with losses that took it back beneath 1.72 and toward a 200-day average that has frequently offered both support and resistance to GBP/CAD of late.

Once back in the region of 1.7149 GBP/CAD could derive support from its 200-day average as well as potentially the 23.8% Fibonacci retracement of its December recovery located at 1.7454.

But whether Sterling can keep its head above that particular waterline beyond the midweek session likely depends on what the market makes of Wednesday’s address to the Canadian Chamber of Commerce by BoC Governor Tiff Macklem.

“The governor will also speak to the media afterwards where he is likely to asked about the policy outlook and perhaps provide some support for the CAD. The Fed’s Mester (voter, hawk) talks Wednesday as well and may provide some insight into the Fed’s initial take of the stronger than expected payroll report,” says Shaun Osborne, chief FX strategist at Scotiabank.

Above: GBP/CAD shown at daily intervals with selected moving-averages and Fibonacci retracements of December recovery indicating possibly areas of technical support for Sterling.

- Reference rates at publication:

GBP to CAD spot: 1.7185 - High street bank rates (indicative): 1.6584 - 1.6700

- Payment specialist rates (indicative: 1.7030 - 1.7100

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

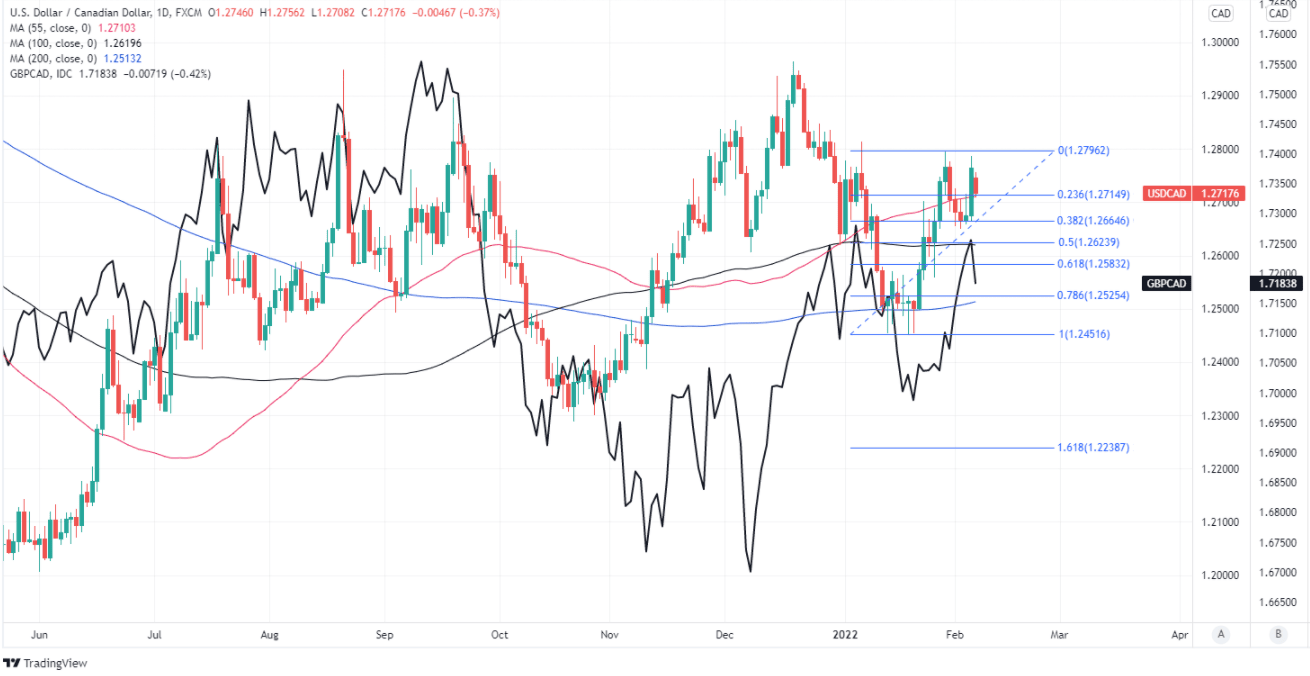

GBP/CAD is highly sensitive to the twists and turns of USD/CAD and has benefited in recent weeks from the latter exchange rate’s leg higher in the wake of January’s BoC decision to provide advanced notice to Canadian businesses and households before lifting its interest rate.

Some investors had bet that January would see Canadian policymakers begin reversing their coronavirus-inspired interest rate cuts, which reduced the cash rate from 1.75% to 0.25% in March 2020, and were left disappointed by the BoC’s decision to take a more patient approach.

“Although the January employment data suggest that the economy will undershoot the Bank’s Q1 GDP forecast, we expect the Governor to emphasize the temporary nature of the Omicron hit in those figures, keeping expectations on track for a March rate hike,” says Avery Shenfeld, chief economist at CIBC Capital Markets.

Wednesday’s speech from Governor Macklem comes hard on the heels of employment figures showing the labour market handing back two months of hard won gains in January following the reimposition of restrictions on some business activities related to the Omicron coronavirus strain.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

With prior strength in Canada’s labour market a key pillar of the BoC’s judgment that “a series” of interest rate rises is likely to be necessary this year, those figures lifted USD/CAD last Friday and in turn helped to boost GBP/CAD.

The reverse would be possible this Wednesday if it transpires that January’s data does little to alter the outlook for the BoC's interest rate.

“The daily chart reflects solid support for the USD at 1.2650/60 this week; spot tested that support zone five times overall since Monday and the USD never really looked in danger of breaking lower. The rebound in funds today through 1.2725 (highs tested a few times this week as well) leaves the door open for a push to the 1.28 area again,” Scotiabank’s Osborne and colleagues said on Friday.

Whether it’s Wednesday’s speech from Governor Macklem or the broad trend in the U.S. Dollar, anything that keeps USD/CAD under pressure over the coming days would generally be a headwind for GBP/CAD.

The market will also navigate the release of U.S. inflation figures midweek as well as speeches from the BoE’s chief economist Huw Pill and Governor Andrew Bailey.

"Chief Economist Huw Pill will speak on Tuesday and BoE Governor Bailey will speak at the CityUK annual dinner after the markets in London have closed on Thursday. On the data front, the primary event will be the US CPI data for January. We have not yet hit the peak and further increases in the annual rates of CPI are expected," says Lee Hardman, a currency analyst at MUFG.

Above: USD/CAD shown at daily intervals with selected moving-averages and Fibonacci retracements of 2022 recovery indicating possible areas of technical support for USD and resistance for CAD. Shown alongside Pound to Canadian Dollar rate.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“At the end of the week we will get GDP data from the UK. The emergence of the Omicron variant in the UK is likely to be on show with a marked slowdown in GDP growth in December. The data is unlikely to trigger much volatility given this weakness has already been discounted and expectations are high for a rebound in Q1 2022,” Hardman and colleagues also said, writing in a Friday research briefing.

Wednesday and Thursday remarks from Governor Bailey and chief economist Pill are the highlight of the week in the UK calendar and would be a source of downside risk for GBP/CAD if they bring market attention back to bear on an economic growth outlook that has been subdued by surging costs of energy and other items, or on the market’s potentially excessive expectations for Bank Rate this year.

The BoE’s emphasis last Thursday of risks to the economic outlook and the excessive expectations of financial markets is one reason why GBP/CAD was unable to recover above the 1.73 handle ahead of the weekend.

"The MPC’s policy signal – combining February’s vote and forecasts – appears to be for a much greater front-loading of monetary policy with a view to limiting the peak in Bank Rate. The MPC’s central projection for CPI inflation rests on Bank Rate peaking at 1.4% (throughout 2023). Prima facie, that level of policy rates is deemed to be too high,” says Ross Walker, chief UK economist at Natwest Markets.

"We accordingly revise (quite substantially) our BoE Bank Rate forecast and now look for +25bp at the next meeting on 17 March to 0.75%, with further +25bp increases in May 2022 to 1.0% and August 2022 to 1.25%. On our forecast, Bank Rate gets to the same end-point (1.25%) but much earlier (May 2023 previously)," Walker wrote in a research briefing following the BoE’s policy decision last Thursday.