Pound / Canadian Dollar Rate Seen Drawing Dip Buyers On Slippage Near to 1.69

- Written by: James Skinner

- GBP/CAD tipped as buy on dips at Scotiabank

- Risk of short-term slip to 1.69 & below grows

- With USD/CAD risking slide to 1.22 on oil rally

- But BoC stance may limit or reverse CAD rally

Image © Adobe Stock

Spot Market Rate at Publication:

GBP/CAD: 1.7014

The Pound-to-Canadian Dollar rate has edged higher following last week’s sharp bounce from multi-month lows, leading some analysts to suggest that further dips should be bought into, although Sterling remained at risk of a further short-term setback this Wednesday.

Pound Sterling was softer across the board in the mid-week session after the Office for National Statistics estimate of September inflation surprised on the lower side of market expectations, although GBP/CAD held above the recently reclaimed 1.70 handle.

The Pound-to-Canadian Dollar rate had approached its May and overall 2021 low when falling 1.6890 last Friday before reversing back above 1.70 in a resounding fashion ahead of the weekend, only to then struggle for further momentum this week.

“We note Friday’s bullish key reversal/outside range session signal. The bullish reversal signal must be respected and the fact that the GBP has steadied and shown some signs of relative strength close to where the cross has based on a number of occasions since early 2020 adds to our sense of caution in looking for additional downside movement in the cross from here,” says Juan Manuel Herrera, a strategist at Scotiabank.

Herrera and the Scotiabank team said on Tuesday that any move above 1.7050 or 1.7060 would signal that a more durable recovery is in the pipeline and has suggested that clients of the bank buy the Pound-to-Canadian Dollar exchange rate on “minor dips” in anticipation of this.

Above: Pound-to-Canadian Dollar rate shown at daily intervals with major moving-averages.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The trouble for Sterling is that USD/CAD remains under pressure given the U.S. Dollar has softened against a range of counterparts while commodity currencies like the Loonie have continued to draw interest from the speculative part of the market following strong gains for resource prices.

This poses a risk to the Pound-to-Canadian Dollar rate, which tends to have a positive correlation with USD/CAD and is always at all times a close reflection of the relative performance between that and the main Sterling exchange rate GBP/USD.

The Scotiabank team has warned of a possible multi-week decline to 1.22, which would see the Pound-to-Canadian Dollar rate probing below 1.69 if in the interim the main Sterling exchange rate GBP/USD proves unable to overcome this week’s high around 1.3830.

“We think it makes sense to work toward a short USDCAD position (if one doesn't have one on yet). We would put anywhere above 1.2400 as the sell zone, with a target of 1.2150 roughly a month from now,” says Greg Anderson, global head of FX strategy at BMO Capital Markets in a recent note.

Others too are also flagging scope for further USD/CAD losses, with some looking for the October 27 Bank of Canada (BoC) monetary policy decision to act as a catalyst for a break beneath 1.23 and a decline to 1.22 or below in subsequent trading.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Our CAD bullishness goes far beyond any mechanical CAD-oil relationship, however. We are more inclined to hang our hat on domestic fundamentals and a further repricing in BoC tightening,” says Vassili Serebriakov a strategist at UBS.

“The BoC is not alone in downplaying near-term inflation pressures but it's also clear that in Canada's case this momentum is broader based than elsewhere,” Serebriakov wrote in a Tuesday research note.

Serebriakov and the UBS team said on Tuesday that Canada’s Dollar is “cheap” on their estimates and have tipped USD/CAD to decline as far as 1.20 during the weeks and months ahead as a result of this, as well as their expectations for BoC monetary policy.

USD/CAD has continued to put pressure on a major support level just above 1.2350 throughout the week, which is the last technical barrier that could keep it from falling back to early July lows near the round number of 1.23.

Much still depends however, on if the BoC maintains its reserved assessment of the Canadian inflation outlook next week, given that financial markets have begun to wager that the BoC would lift interest rates as many as four times in 2022 in order to address rising inflation rates.

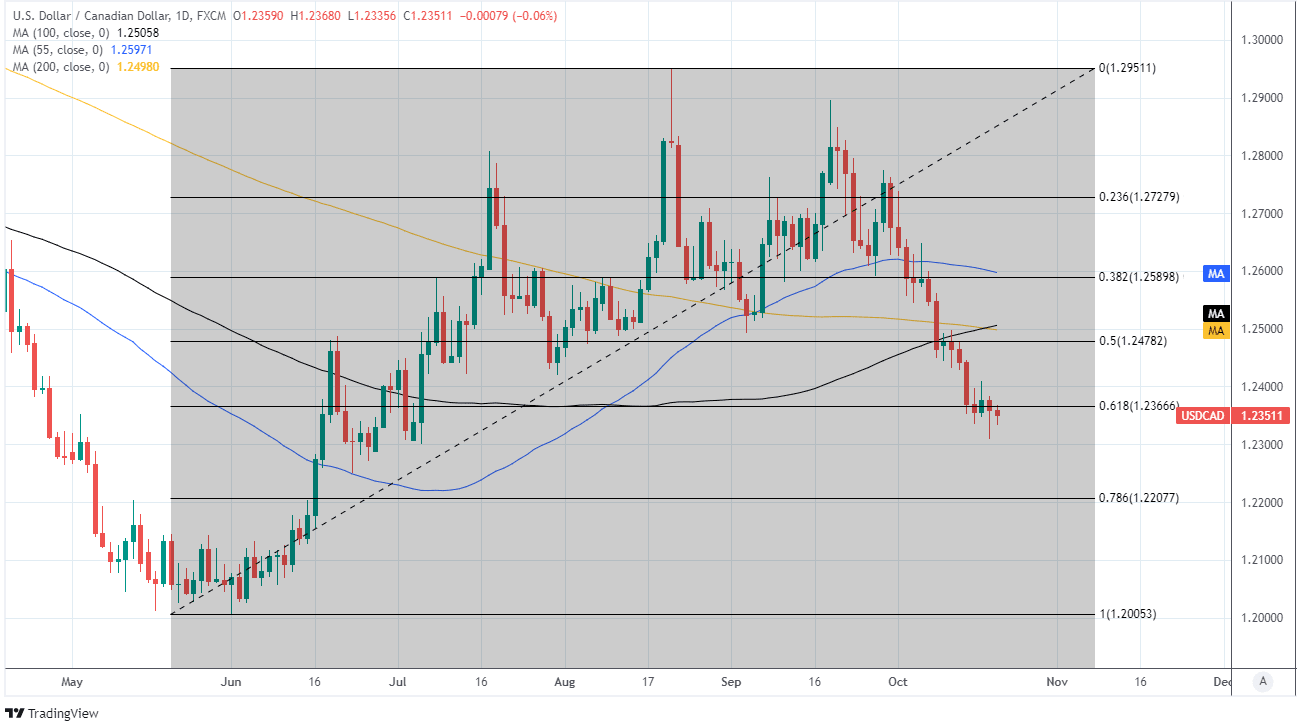

Above: USD/CAD shown at daily intervals with major moving-averages indicating areas of possible technical resistance to USD recovery, and Fibonacci retracements of June rally highlighting possible areas of technical support for USD and resistance for CAD.

Canadian inflation rose further above the 2% Bank of Canada when climbing from 4.1% to 4.4% in September, Statistics Canada figures suggested on Wednesday, while annual price growth edged higher from 3.2% to 3.5% when gasoline price changes are excluded from the calculations.

Inflation has risen above central bank targets in many parts of the world during recent months following further pandemic-related disruption in supplies of some goods and more recently due to increases in energy costs associated with shortages of renewable energy in Europe.

“Markets have taken cues from a more hawkish Bank of England, an upside surprise in Canadian employment, the jump in oil and gas prices and, of course, firming inflation,” says Avery Shenfeld, chief economist at CIBC Capital Markets, who sees the BoC as likely to disappoint the market this month.

“The Bank of Canada’s take on these events is likely to differ, as not too subtly hinted in media remarks by Governor Macklem,” Shenfeld also says.

This year’s price increases have added to earlier commodity price inflation and their persistence has prompted some central banks including the Bank of England to worry that businesses and households could come to expect higher inflation as a matter of course.

Above: Two year ahead expectations for Canadian inflation. Source: BoC Business Outlook Survey.

While the BoE has made clear it would be prepared to lift interest rates under such circumstances, BoC Governor Tiff Macklem indicated when addressing the Council on Foreign Relations on October 07 that he’s unconvinced of this being a risk in Canada.

“The market has been getting a bit carried away, in our view. The BoC has been clear that it would tie liftoff to the closure of the output gap,” says Jimmy Jean, chief economist and strategist at Desjardins

Analysts and economists at many Canadian firms are also doubtful that Canadian inflation pressures would require the same kind of interest rate response that has come to be anticipated by financial markets, and this could mean that October’s BoC policy update is a risk to the Canadian Dollar.

To the extent that it is a risk, it would be supportive of the Pound-to-Canadian Dollar exchange rate over the coming weeks, potentially also helping to ensure that dips toward or below the 1.69 handle remain short-lived.

“The Bank of Canada will be reminding markets what they seem to have forgotten. Canadian GDP fell in Q2, and its Q3 rebound will be in the range of 4% annualized. At annual rates, these two quarters will each be about 3% below the last Bank of Canada forecast,” CIBC’s Shenfeld says.

“The result is that, as the Governor also hinted, the timetable for closing the output gap will likely be pushed a bit further away, not closer,” he added.