Pound Forecast to Rise against Canadian Dollar by Westpac

- Written by: James Skinner

Image © Adobe Stock

- GBP/CAD rate is headed for more gains, buy, says Westpac.

- Boris Johnson premiership offers hope of negotiated EU exit.

- Electoral considerations could also see fiscal stimulus unveiled.

- But Scotiabank looks for continued defensive trading from GBP.

- Nomura says more information about Johnson's strategy needed.

The Pound could win back even more ground previously lost to the Canadian Dollar in the coming weeks, according to analysts at Westpac, who've told clients to buy Sterling and sell the Loonie amid renewed hopes of a Brexit breakthrough following the inauguration of Boris Johnson as Prime Minister.

Sterling began to creep higher this week after Boris Johnson won the Conservative Party leadership election, setting him up to replace outgoing Prime Minister Theresa May in 10 Downing Street late Wednesday. That's almost the opposite to what was forecast by some pundits.

"There is a buy the rumour sell the fact bit of price action taking place here," explains Jordan Rochester, a strategist at Nomura, referring to the GBP/USD rate. "We’d need to see some actual “new” bad news to drive it lower. Plus Boris has not been adding to the Brexit hardness, he is still talking about getting a deal and now will be in the mood to boost his polling numbers by talking up the positives. Election risks will come around again, but not on day one!"

Above: Pound-to-Canadian-Dollar rate at hourly intervals alongside GBP/USD (orange line, left axis).

The sheer scale of the losses that blighted Sterling during the leadership election mean that quite some level of bad news is already in the price, at a time when there's still a chance that an ammicable EU exit can be negotiated.

This is why investors are buying back currency they previously sold. The Pound fell 6.1% against the Loonie in the last three months as fears over a 'no deal' Brexit and possible general election rose, but markets now face a period in which new-news about the exit process is could be thin on the ground.

Some of those sellers are now taking profits off the table, giving rise to a rebound that's taking place at a time when Canadian economic outperformance relative to its G10 rivals appears to be waning. Until last week the vast majority of economic numbers emerging from Canada suggested the country has avoided a slowdown that is gripping the entire global economy.

"Buy GBP/CAD. The selection of Boris Johnson resolves one UK uncertainty, with a likely “honeymoon” as his Cabinet forms. Newly elected EU officials and Brexit negotiators may be more open to discussions," says Richard Franulovich, head of FX strategy at Westpac. "Johnson may initiate tax and policy changes to bolster a market friendly profile. A lift in sentiment could trigger recently absent investment and property activity."

The most pressing task for Boris Johnson as Prime Minister will be renegotiating the EU withdrawal agreement struck by outgoing PM Theresa May with a view to removing the controversial and so-called Northern Irish backstop from it, which the EU has said it won't do.

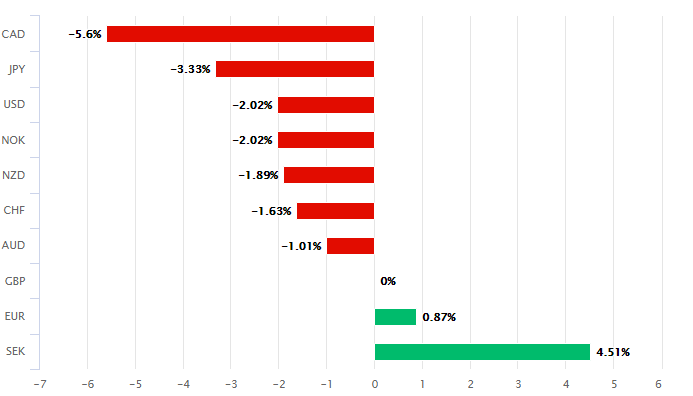

Above: Pound Sterling performance Vs G10 rivals in 2019.

Johnson said on the campaign trail that he'll take the UK out of the EU on October 31, which is when the current Article 50 extension period ends, with or without the necessary changes to the agreement. That could mean a 'no deal' Brexit in a few months time.

The backstop was once described by Johnson as entrapping the UK in a form of "vassalage" although on one occasion he did vote in favour of the EU withdrawal agreement. Investors might now see that as meaning Johnson is open to compromise with the EU.

Franulovich has told clients to buy the Pound at 1.6355 against the Canadian Dollar and to hold out for a move up to 1.6755 over the coming weeks and months. However, analysts at Canada's Scotiabank have recently been sceptical of whether Sterling can avoid further significant losses for very long.

"We still rather look to fade short-term GBP gains from a technical point of view and feel risks remain tilted towards a push to the 1.20/1.22 region," says Eric Theoret, a technical analyst, referring to the GBP/USD rate.

Theoret said last week there's a risk the Pound-to-Canadian-Dollar rate falls to 1.57/1.58 over the coming months because the downtrend in the exchange rate has been so strong and although he's yet to provide an update on the outlook for Sterling relative to the Loonie, he is looking for the British currency to cede more ground to its U.S. rival.

"We have reached the bear target for the GBP we outlined in June, following the break lower in the GBP below the base of the late May consolidation but we continue to feel that the risk of an overshoot to the 1.57/1.58 area, tested in 2016/18, remains very real," Theoret wrote last week.

Above: Pound-to-Canadian-Dollar rate at daily intervals alongside GBP/USD (orange line, left axis).

This is while Shaun Osborne, chief FX strategist at Scotiabank, says the Pound should "retain a broadly defensive undertone while Brexit risks remain elevated."

Markets initially feared a Johnson premiership because he played a key role in one of the two major referendum campaigns to leave the EU and has been seen as likely to simply withdraw the UK from the bloc without any formal agreement if a palatable deal cannot be struck with Brussels by October 31.

Outgoing Prime Minister Theresa May announced her resignation in May after three failed attempts to pass her EU withdrawal agreement through the House of Commons culminated in a disastrous and divisive offer to MPs to include the possibility of a second Brexit referendum in the relevant legislation.

The idea behind the move was to lure opposition MPs into backing the EU treaty but it backfired because the decision lost the then-PM more votes from her own MPs than she was ever seen as likely to gain from the opposition. Her resignation followed shortly after.

Political parties in Westminster had their own motivations for voting against the EU deal, but the Conservatives were divided over the backstop and split mostly along leave-remain lines. Future customs policy was also a concern for some Brexit-backing MPs.

This 'no deal' Brexit would see the UK default to doing business with the EU on World Trade Organization (WTO) terms, which would mean exports to the bloc face being hit with tariffs and vice versa. Economists say this would be bad for UK economic growth in the short as well as long-term.

"We need to see what it is that the new team will bring to the table. Is it dressing up the Political declaration then selling it better than before? He’s planning to see Trump within the next month or at the U.N. assembly in September. Either way the G7 on August 24th could prove more interesting than usual given we’ll also have FX intervention concerns after a round of potentially both ECB and Fed easing plans," says Nomura's Rochester.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement