Canadian Dollar is Month's Best Performer, Aided by GDP Surprise

- Written by: James Skinner

Image © COSPV, Adobe Stock

- CAD advances after GDP surprise, ahead of BoC survey result.

- BoC outlook survey and G20 trade talks to set direction for July.

- CAD interest rate expectations steady on strong growth, oil outlook.

- CAD best positioned to lead further riposte to the USD says MUFG.

The Canadian Dollar remained the best-performing major currency Friday after growth data surprised on the upside ahead of the latest Bank of Canada's (BoC) survey of the business outlook, vindicating analysts for speculating the Loonie can go on ruling the G10 roost for a while yet.

Canadian GDP growth was 0.3% in April, which is down from 0.5% but ahead of the market consensus for an expansion of only 0.2%. This pushed the three-month rolling average pace of expansion up from 0.1% in March to 0.3%.

Gains and losses were evenly split across the 20 different business sectors, Statistics Canada says, although output increased faster in the goods producing industries than it did in the services sector. That being said, retailers did poorly in April after building materials and gardening equipment retailers saw sales fall alongside those of their clothing and accessories counterparts.

"April's flowers came in resources (mining oil gas) wholesaling and various services, against weakness in factory output and retailing. Goods production is down 1% from a year ago reflecting the retreat in resources and construction," says Avery Shenfeld, chief economist at CIBC Capital Markets. "Q2 looks headed for a solid GDP gain on its own, enough to keep the Bank of Canada on its stand-pat message for now."

The economy grew at an annualised pace of 0.4% in the first quarter overall, in line with market expectations but above the Bank of Canada forecast of 0.3%. That's a low growth rate compared to those seen in Canada as recently as the first half of 2018.

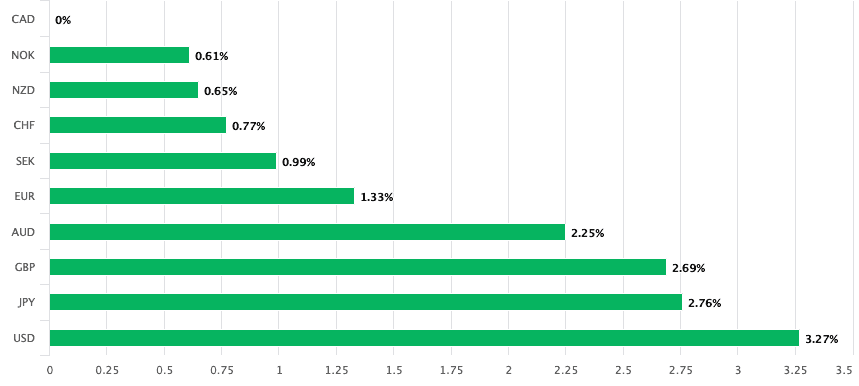

Above: The Canadian Dollar is the best-performing major currency of the past month.

Canadian GDP growth nearly halved in 2018, falling from 3% previously to just 1.8% last year, after an economic slowdown took hold in the second-half. But the BoC has since said that growth should pick up in the second quarter. The BoC will provide its latest asssesment of the outlook at 15:30 with its third-quarter outlook survey.

"Today’s GDP report showed further easing in some of the key headwinds that weighed on Canada’s economy in the last two quarters—namely a slowdown in the energy sector and housing," says Josh Nye at RBC Capital Markets. "The key question is whether rising trade tensions and a softer global outlook will result in downward revisions to domestic growth over the second half."

Currency markets care about the GDP data because it reflects rising and falling demand within an economy, which has a direct bearing on consumer price inflation, which is itself important for questions around interest rates. And interest rates themselves are a raison d'être for most moves in exchange rates.

Changes in interest rates, or hints of them being in the cards, are only normally made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

"The Business Outlook Survey indicator is currently consistent with soft Canadian economic activity. Another disappointing Business Outlook Survey will bring forward the probability of a BoC interest rate cut and weigh on CAD. BAX futures have a full 25bps rate cut priced‑in for Q2 2020. Our base case scenario is for the BoC to leave rates at 1.75% over the forecast horizon," says Elias Haddad, a strategist at Commonwealth Bank of Australia.

Above: USD/CAD rate shown at daily intervals, alongside U.S.-Canada 2-year bond yield differential.

"While the BOS may contain a more cautious tone, the CAD looks poised to sustain a bid. Its beta to rates has risen sharply relative to its peers recently. With the Fed expected to ease more deeply than the BOC, there is more room for US/CA front-end spreads to compress. As a result, USDCAD will remain under pressure and we think a break of 1.30 could be inevitable," says Mark McCormick, head of North American FX strategy at TD Securities.

The USD/CAD rate was quoted 0.07% lower at 1.3086 following the release and is now down 3.78% for 2019 after dropping steeply through May and June.

The Pound-to-Canadian-Dollar rate was 0.19% higher at 1.6610 but is now down 4.4% for 2019 after falling steeply in May and June.

"GBPCAD is weaker and nearing major support at 1.6595/00," says Eric Theoret at Scotiabank. "Trend dynamics are bearish, with DMI oscillators aligned and strongly bearish for the GBP across a range of timeframes. Below 1.6595/00, there no obvious support for the GBP until the mid-1.57s (early 2017 low). We think the cross can retest the 1.60/1.61 area at least."

Above: Pound-to-Canadian-Dollar rate shown at daily intervals.

Canada's Dollar has strengthened this month and the U.S. currency weakened, driving a steep decline in the USD/CAD rate, in part because markets have become increasingly convinced the Federal Reserve will cut its interest rate from a post-crisis high of 2.5% to just 2% or less before year-end.

Meanwhile, investors are looking for the BoC cash rate to remain at 1.75% until mid-2020. Strong domestic economic data is making it difficult for the BoC to justify any possible future decision to cut its own interest rate.

The bank's guidance is that future decisions will depend on developments in the economy and that it will pay close attention to "household spending, oil markets and the global trade environment" when deciding what to do next.

"USD/CAD has broken below key technical support levels sending a strong signal that a bearish trend is now underway. The upward trend line joining the lows from February 2018, October 2018, February 2019, and March 2019 came in at around 1.3370. In addition, USD/CAD is attempting to sustain levels below the 200-day moving at around 1.3290 for the longest period since the start of 2018," says Lee Hardman at MUFG.

The BoC appeared to suggest in May that it could be quite some time before it lifts interest rates again, even if the domestic economic outlook has improved notably of late, but neither it nor any of its policymakers have said anything about Canadian interest rate cuts being on the horizon.

And even if Canadian rate setters did want to lower borrowing costs for companies and households the bank might still find it difficult to justify doing so because all of the BoC's preferred measures of inflation of inflation are either testing the 2% target, or are now already well above it.

"The stronger data flow reinforces the BoC’s view that the economic slowdown in late 2018 and early 2019 was “temporary”, and is being followed by a “pick-up in the second quarter”," Hardman writes, in a note to clients. "For those looking to position for a weaker US dollar in the near-term, the Canadian dollar appears well positioned to continue leading the advance. USD/CAD is on track to break back below the 1.3000-level earlier than we had anticipated."

This could mean the narrowing gap between U.S. and Canadian bond yields continues to support the currency for a while to come, particularly if the economy and jobs market remain in rude health.

Those yield differentials are influenced most by the outlook for relative central bank interest rate policies because capital flows, which drive exchange rates, tend to move in the direction of the most advantageous or improving returns. Lower rates and yields normally drive investors out of a currency and vice versa.

"The Canadian rate market is currently pricing in a less than 50:50 chance of just one 25 basis point rate cut from the BoC by [year-end]. It has resulted in yield spreads moving sharply in favour of a lower USD/CAD," Hardman says.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement