Pound-to-Canadian Dollar Rate Forecast to Fall Inside it's Range

Image © Stockyme, Adobe Images

- GBP/CAD to complete descent within range

- Medium-term trend still sideways, however

- Brexit headlines to drive Sterling; Canadian Dollar moved by growth data

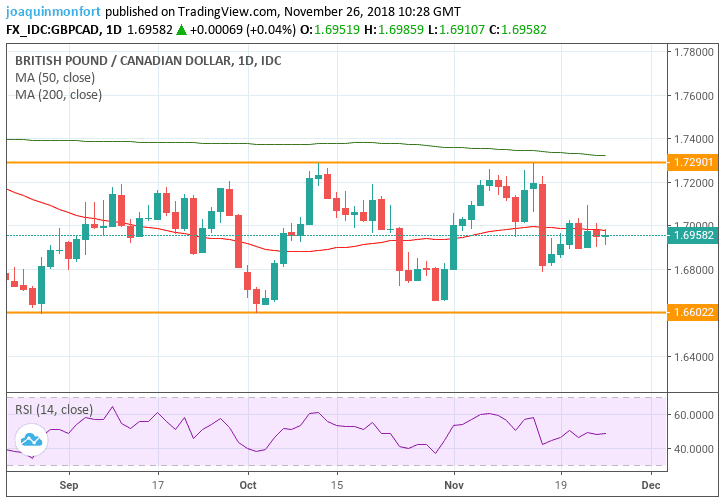

The Pound-to-Canadian Dollar rate continues trading in the middle of a range between roughly 1.73 and 1.66.

Of late it has been moving towards the lower end of the range and we see a strong probability of a continuation of that short-term downtrend to the 1.66 range lows in the week ahead.

The pair has lost ground on further uncertainty surrounding Brexit. Despite the UK and EU officially approving a withdrawal agreement the deal still needs to be voted through Parliament and the likelihood of this remains difficult to assess, with the evidence suggesting that, as things stand, it probably won't get the necessary votes.

From a technical perspective, more upside is also likely to be limited by the 50-day moving average (MA) located just above the exchange beat and providing a ceiling for the exchange rate after its most recent pull-back higher. This corroborates the fundamental constraints on the pair.

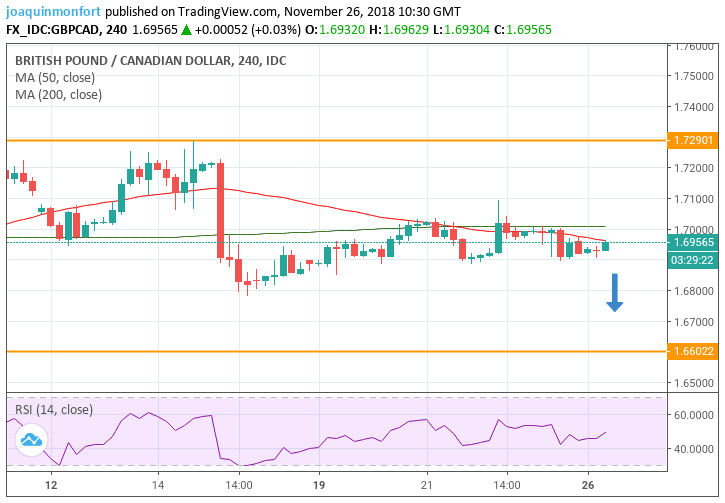

The four-hour chart below, shows that after touching the range highs at 1.73, on November 15, the exchange rate fell to 1.68 and then recovered marginally, before consolidating in a narrow range which it has been moving in for over a week now.

It looks more 'right’, from our perspective, that after this sideways move the next leg will be lower rather than higher, and we forecast that a break below 1.68 will probably confirm a new leg down to a target at 1.66.

Factors to Watch

The Canadian Dollar is highly correlated to the state of the oil market since crude oil is one of the country's most important export.

The recent fall in global oil prices is therefore likely to put downward pressure on Canada's foreign currency earnings.

Whilst the particular variety of oil prevalent in Canada, Western Canada Select, is much cheaper than other varieties and has its own idiosyncratic fundamental drivers, the overarching global climate, nevertheless, still impacts, and has brought the price down from a peak of $58 per barrel in May 2018 to the current $13 per barrel price - a much deeper decline than that of benchmark WTI oil, which has fallen from a peak of $76 in October to $52.

There are no signs yet that the sell-off has ended even if the downtrend has got a little ‘long in the tooth’.

The main hard data release in the week ahead is Canadian GDP data, which is forecast to show a 0.1% rise in September compared to the month before, when it is released at 13.00 GMT on Friday, November 30. GDP showed a growth rate of 0.7% in Q2 and 0.1% in August.

A higher-than-expected rise would support the Loonie whilst vice versa for a lower result. This is because higher growth attracts more foreign investment which contributes to demand for the currency.

The other key release for the Loonie is the current account balance for Q3 out on Thursday at 14.30. This is the broadest measure of the balance of payments and aggregate cross-border flows.

The current account is forecast to show a deficit of -11.5bn in Q3 compared to -16bn in Q2. If the deficit shrinks as much or more than expected it will be a positive sign for CAD. If the deficit widens, however, CAD will probably weaken.

Advertisement

Bank-beating GBP/CAD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here