Last Gasps of the Australian Dollar Bull Trend

Does the Australian Dollar’s idiosyncratic rally of the last few days represent the last gasp of the bull trend?

That is what Blackwell Global’s market analysts Stephen Knight seems to think.

“Hopes of the pair bursting through the long-term trendline are beginning to circulate and the bulls are gearing up for yet another push higher. However, this may all be a set up for a major slump that could erase the entirety of the rally seen over the prior two months,” says Knight in a recent analysis of the Australian Dollar.

Against the US Dolar, Knight sees resistance from the major trendline capping gains in the 0.77s holding and pushing the exchange rate back down to the 0.73s.

The pair could also be forming an as yet incomplete double top or head and shoulders pattern at the highs.

“More precisely, a messy double top/head and shoulders structure seems to be taking shape which indicates that the bears may be about to stage a comeback in a big way. Indeed, selling pressure could drag the pair as low as the 0.7376 handle by late August,” says Knight.

A double top pattern looks like this and is formed of two peaks at roughly the same level:

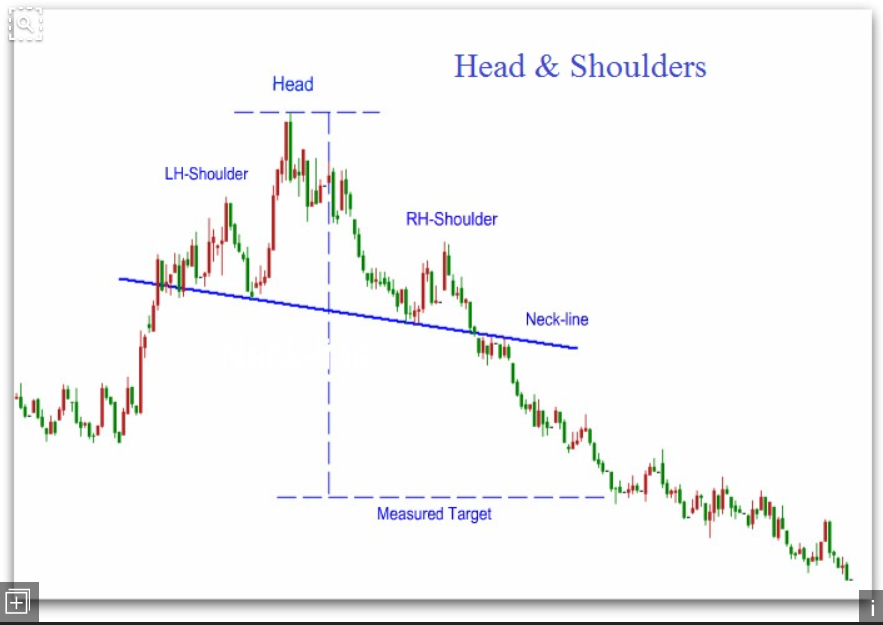

A head and shoulders looks like this and is formed of three peaks, the middle one of which is the tallest ie the ‘head’, and the two either side shorter and of a similar height, ie the ‘shoulders’:

Other indicators are also supplying evidence of a “confirmatory retreat”.

The stochastics momentum indicator has reached overbought levels and the Parabolic Sar – a stop-start ‘always in the market’ trading system – is still bearish and has not confirmed the closure of its short trade and opening of a new long trade.

The position of the 100-day moving average at 0.7551 just below the neckline of the potential reversal patterns at 0.7600, however, could be a major obstacle to more downside.

Despite the 100-day Knight remains bearish, however, suggesting a battle between bulls and bears at the moving average will probably eventually result in a victory for the bears, although the topping structure could elongate in the process.

“However, once the pair has broken through that 100-day EMA, the plunge could be rather rapid so keep a close eye on the AUD moving forward,” said Knight.

Fundamentals are also favouring more Aussie weakness, according to analysts at Credit Suisse.

The Australian economy has certain vulnerabilities which make it unlikely the Reserve Bank of Australia (RBA) will raise interest rates any time soon, and interest rates are a major driver of currency appreciation, as investors funnel money to jurisdictions which pay higher interest.

For one thing wages in Australia remain too low and this inhibits consumption, inflation and growth.

Secondly, the average indebtedness of households in Australia is higher than that of other G10 countries – another incentive for the RBA to keep interest rates low.

As such given these conditions it is unlikely the Aussie will have the fundamental conditions in place for a major rally.