Pound-to-Australian Dollar Forecast to Recover this Week

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar could come under pressure against Pound Sterling in the coming week.

This is because we are looking at another week of tariff developments that are likely to be of greater concern to the Aussie Dollar than to its British counterpart.

AUD gapped lower at the start of Monday trade in Asia as investors reacted to Sunday comments from U.S. President Donald Trump that he would impose a 25% import tariff on aluminium and steel. He also said he would announce further tariffs later in the week.

However, markets soon found composure and AUD recovered, pushing the Pound-to-Australian Dollar exchange rate (GBPAUD) back to Friday's closing level at 1.9775.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Trump's latest tariff salvo is a reminder of the evolving global trade backdrop from one that is open to one that is increasingly restricted. As Trump moves, so other countries retaliate, and a global trade war is the result.

There is an open-ended question on the additional tariffs he seeks to impose, with the President saying on Sunday they would be imposed on those countries with existing U.S. import tariffs. The uncertainty around this should ensure market confidence stays muted.

Currency analysts say the steady ratcheting up of trade restrictions is particularly unsupportive of major exporters, such as Australia and New Zealand.

"Dollar bloc currencies including CAD, AUD and NZD, and the EUR are in the firing line, following the decline in short term bond yields vs the US as investors pare back growth expectations," says Kit Juckes, an analyst at Société Générale.

"The Yen and GBP outperform in G10," says Juckes.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The tariff backdrop is, therefore, one that fundamentally supports GBPAUD appreciation and is why we think the pair can eke out some gains in the coming days.

"China remains Australia's largest trading partner. As such, Australia is significantly exposed to Chinese domestic demand," says Carol Kong, an FX strategist at Commonwealth Bank of Australia. "The US‑China trade conflict will have indirect impacts on the Australian economy."

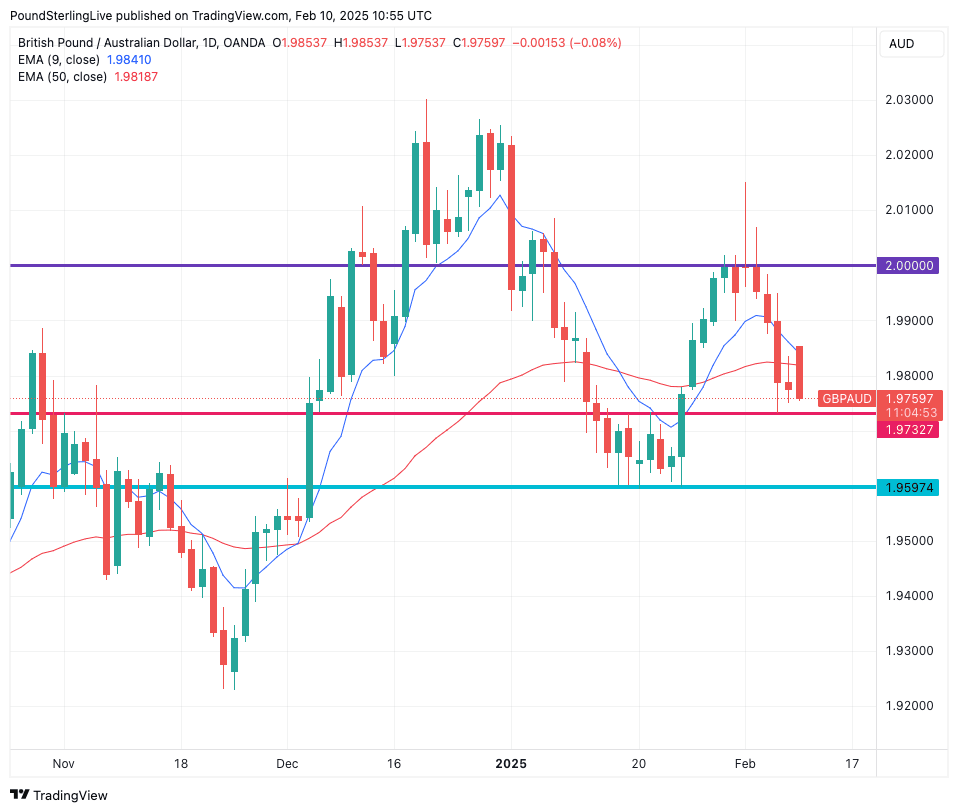

Although the tariff backdrop is supportive of GBPAUD, we note the technical picture is more challenging and, if anything, the exchange rate looks as though it wants to go lower.

Although the fundamental backdrop is supportive of GBPAUD upside, the view is challenged by poor technical signals etched into the daily chart.

The pair is below both the 50- and 9-day exponential moving averages (EMA), which speaks of some near-term pressures that put a test of 1.9764 ahead of 1.9597.

So, although the fundamental backdrop supports GBPAUD upside, the poor technical setup suggests this should be a low-conviction call at this point.

Before turning outright bullish on GBPAUD we would want to see the charts better reflect global tariff developments.

Sterling's recent setback has a lot to do with last week's Bank of England decision to cut interest rates by 25 basis points and signal it was not yet done.

The weakness in GBPAUD reflects expectations in some corners of the market that the Bank could, in fact, be inclined to accelerate the pace it cuts.

However, we wrote at the time that the weakness would be temporary as the Bank would be severely curtailed by the UK's inflation dynamics, which saw the Bank aggressively raise its inflation forecasts to a peak of 3.7% later in the year.

The realisation that the Bank is severely curtailed in its ambitions should ultimately bolster GBP.

Risks to the currency come in the form of a slew of speeches from Bank of England policy setters Andrew Bailey, Catherine Mann and Megan Green, who should shed further light on last week's decision. We will be watching for any market-moving soundbites.

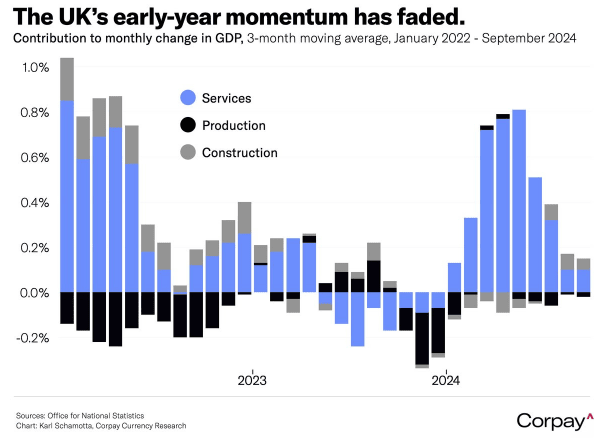

The bigger risk to GBP comes on Thursday when Q4 GDP data is released, and a -0.1% q/q reading is confirmed.

This would mean the economy has shrunk since Labour took office, posing difficult decisions for the UK's Chancellor Rachel Reeves who might need to raise taxes again later this year to ensure she meets her goal of shrinking debt as a percentage of GDP by the end of the parliament.

An unexpectedly larger fall would result in a weaker Pound that could put GBPAUD under renewed pressure.

There is nothing to note on the Australian front this week, with all eyes fixed on next week's Reserve Bank of Australia decision. Expectations for a rate cut are high, but the central bank will also be curtailed at the speed at which it can cut rates owing to the robust economy.

This should offer AUD a decent floor of support in the context of global trade fears.