Australian Dollar: Bracing for a Hike

- Written by: Gary Howes

Image © Adobe Images

Australian financial conditions are tightening as markets brace for another interest rate hike at the Reserve Bank of Australia (RBA).

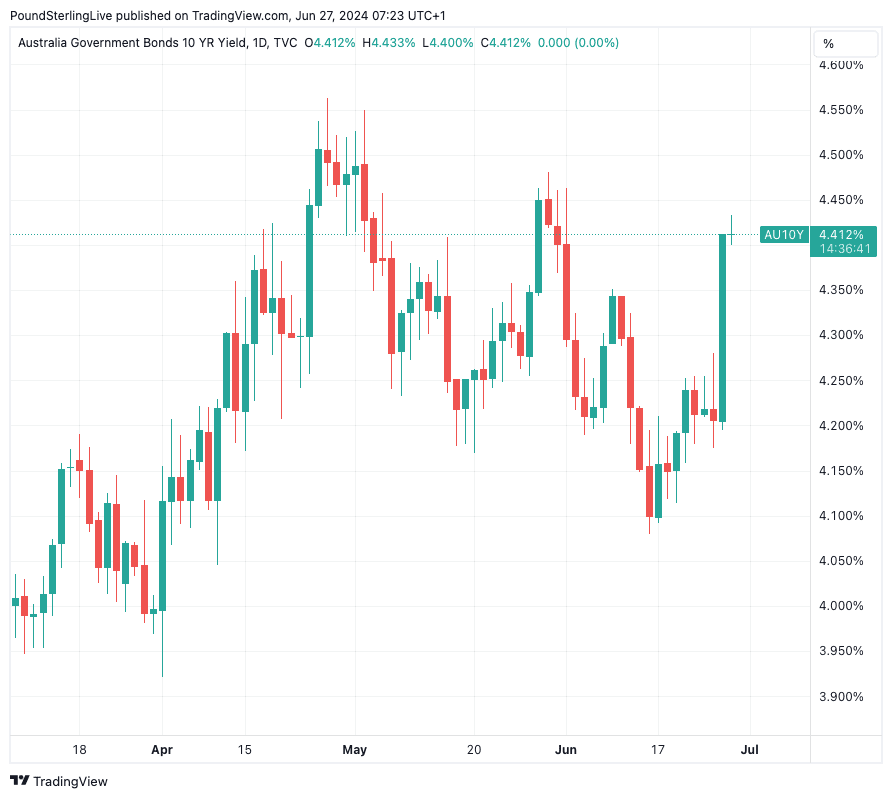

The Australian Dollar has rallied against all its G10 peers amidst a surge in Australian bond yields, which indicates markets are preparing for higher central bank policy rates.

This is after Australia's monthly inflation indicator rose for a third consecutive month at 4.0% year-on-year in May, confirming price pressures are heating up once more. Cash futures suggest that the probability of a hike by the RBA's September meeting has risen to nearly 60% from less than 15% in the day preceding the inflation report.

The 'trimmed mean' measure of core inflation hit 4.4%, jumping from 4.1%, and underlining the relatively broad-based nature of the surprise increase. This is a particularly important reading as RBA keeps a close eye on this figure which gives a better understanding of genuine domestic inflationary developments.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"Australian price growth accelerated to its fastest in six months in May, knocking markets off balance and raising the likelihood of another rate hike this year," says Karl Schamotta, Chief Market Strategist at Corpay.

A concern for the RBA is that Australians earning less than A$150K are set to benefit from changes to the stage-three tax cuts package from July, which can further stoke demand in the economy.

Above: The yield on Australia's ten-year bond saw its biggest daily rise since May 2023. Track GBP/AUD with your own alerts, find out more here.

With the RBA potentially raising interest rates again, analysts say the Aussie Dollar can remain supported.

"With the RBA expected to be the last to ease financial conditions among its peers, AUD’s resilience continues to show with a solid floor above the 0.65 level versus USD, targeting the 0.68-0.69 area in the pair," says a note from Citi. Strategists at the bank are positioned for an ongoing rebound in the AUD.

However, if the RBA opts to push back on interest rate hike expectations and plays down the recent trends in inflation, the Aussie could give back some of its recent gains.

"In our view, the RBA is unlikely to actually follow through on another rate hike. For one thing, the economy is just barely muddling along, meaning demand should soon start to fall short of supply. For another, inflationary pressures coming out of the labour market are set to cool further," says Marcel Thieliant, Head of Asia-Pacific at Capital Economics.

Capital Economics nevertheless pushes back its forecast for the first RBA rate hike from Q1 to Q2 next year.

This would be in keeping with a consensus view that the RBA will be amongst the last central banks to cut interest rates. This can provide AUD with ongoing support via the interest rate expectations channel.