GBP/AUD Week Ahead Forecast: Looking for a Decisive Break

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar exchange rate is rising at the start of the new month and could end the week above a key resistance area if U.S. labour market data beats expectations.

Indeed, this week will be dominated by global factors for both the Pound and Australian Dollar owing to a lack of interest in the UK and Australian calendars.

GBP/AUD had been under pressure over the course of April/May amidst a broad-based bout of AUD outperformance, linked to expectations that the Reserve Bank of Australia would be the last of the major central banks to cut interest rates.

Late May saw the Pound stage a comeback against most of its G10 peers and the result is an improved near-term technical picture in GBP/AUD, and we see potential for further consolidation of the recent gains.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

But, chatter of a potential rate hike at the RBA remains a feature in global FX owing to resilient Australian inflation data, which is proving supportive for AUD and stymying GBP's attempts to advance further.

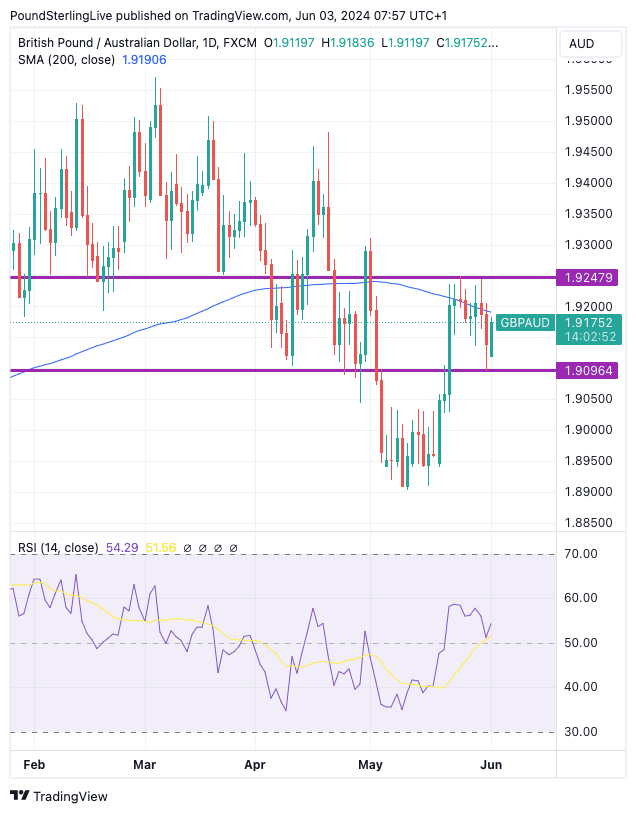

GBP/AUD has returned above the 21-day moving average, suggesting near-term momentum has improved, which is underscored by the RSI which is at 54.7 and is pointing higher.

Gains to the 100-day moving average at 1.9253 are possible in the coming week. But as the below shows, it is the 200-day moving average (1.9190) that is proving to be the most important technical level to watch:

Above: GBP/AUD at daily intervals with the 200 DMA annotated and RSI (lower panel). Track GBP/AUD with your own custom rate alerts. Set Up Here

As can be seen, rallies above the 200 DMA tend to be very short-lived and ultimately, GBP/AUD has not been able to close above this line on a daily basis. Because it is pointed lower, it is weighing on GBP/AUD.

Our previous GBP/AUD Week Ahead Forecast drew attention to this level as potential source of resistance, and the call was correct.

A break above ~1.9190 on a multi-day / weekly basis would therefore prove decisive for those looking for a stronger Pound with which to purchase Australian Dollars.

To the downside, support is located at 1.9096, a level that is close at hand and forms the lower end of a potential consolidation zone for the coming week.

Failure here could see a return to levels close to 1.89. We favour trading between 1.9253 and 1.9096 in the coming days. If U.S. non-farm payroll numbers surprise, a breakout of this area on Friday is possible.

The market is looking for a headline non-farm payroll reading of 180K and an unemployment rate of 3.9%. Average hourly earnings are expected to have risen 3.9% year-on-year.

If the data comes in at softer-than-expected levels, the Australian Dollar would potentially be a leading beneficiary.

This is because a soft print would suggest to the market that U.S. interest rates will be cut sooner than previously expected, which can boost global investor sentiment and stock markets.

The AUD is a 'high beta' currency, meaning it tends to benefit when stock markets are rising and investors are confident. A breakdown in GBP/AUD and a resumption of the April-May selloff might ensue under such a scenario.

"If US labour market data are on the soft side, markets may upgrade the likelihood of a first rate cut in July, which would weaken the USD even more," says Dominic Schnider, a strategist with UBS' Chief Investment Office.

An above-consensus job report would have the opposite effect, as markets would be resigned to a belief the Fed will struggle to get away with a rate cut before year-end.

Indeed, the risks would grow that it won't be until 2025 before the Fed cuts rates, putting the Fed in line with the RBA and diminishing any yield advantage the Aussie Dollar has recently gained.

Falling stocks and souring investor sentiment can lead to notable AUD underperformance and a potential break by GBP/AUD above 1.9253 and into a more constructive technical setup.