GBP/USD Week Ahead Forecast: Constructive

- Written by: Gary Howes

Image © Adobe Images

What is the Pound to Dollar forecast for the week ahead? We expect the Pound to potentially test the $1.28 level thanks to strong technical momentum and a potential undershoot in the all-important U.S. job report.

The Pound to Dollar exchange rate is in a short-term uptrend and a test of 1.28 and above is possible in the coming days.

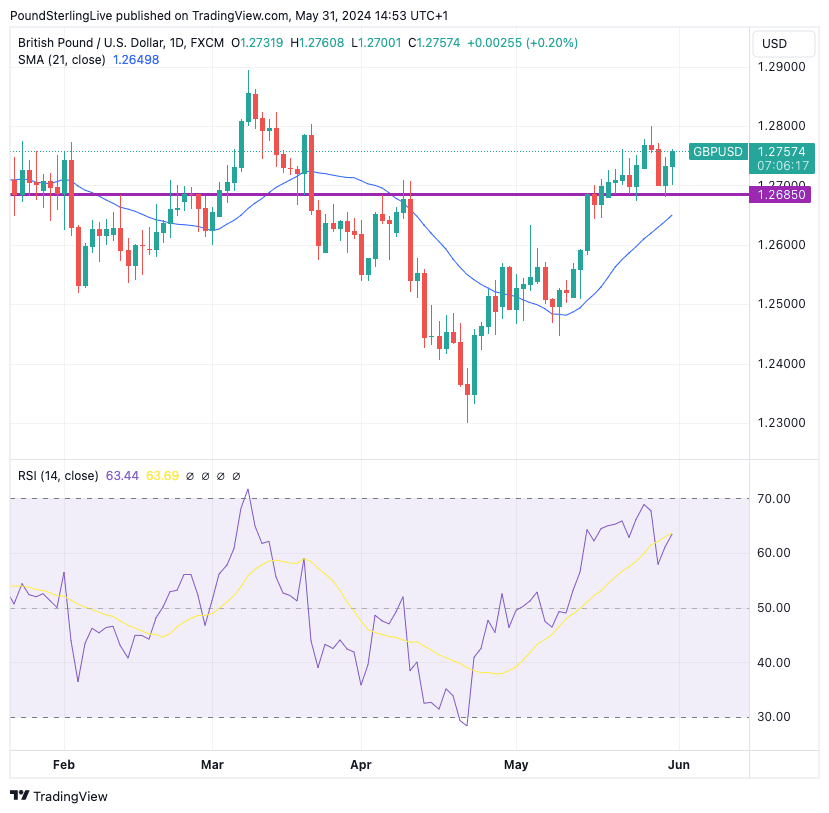

Momentum is firm with the RSI at 63 and pointing higher once again, while the exchange rate remains above its key moving averages.

Above: GBP/USD at daily intervals. Track GBP/USD with your own custom rate alerts. Set Up Here

1.28 is the prize for dollar buyers but should this week's data move in favour of the Dollar and the important level to the downside is 1.2685. As the above shows, it has been consistently bought into over the past two weeks and we see this as the nut that must be cracked if the exchange rate is to turn lower.

Nothing significant is due out of the UK this week, which in itself is a supportive development for Pound Sterling, which tends to do better when it is not being bothered by data and Bank of England policymakers who appear eager to cut interest rates at the first possible opportunity.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Monday's U.S. PMI print should generate some interest, although we would not place too much weight on any market movements ahead of Friday's all-important job report.

"Last month, U.S. nonfarm payrolls came in below 200,000 for the first time since 4Q23. All eyes are on this month’s release to gauge whether this was just a one-off or if new employment is actually cooling down. This is critical for the US dollar," says Dominic Schnider, a strategist with UBS' Chief Investment Office.

The market is looking for a headline non-farm payroll reading of 180K and an unemployment rate of 3.9%. Average hourly earnings are expected to have risen 3.9% year-on-year.

"If US labour market data are on the soft side, markets may upgrade the likelihood of a first rate cut in July, which would weaken the USD even more," says Schnider.

The Federal Reserve is in no rush to cut interest rates, leaving markets pricing in one full rate cut by December, with September being a 50/50 shot.

"This jobs report and wages data should provide further clues on that front. In recent weeks, we have seen bond yields rise, with investors growing increasingly worried about the possibility of interest rates staying elevated for a longer period," says Fawad Razaqzada, an analyst at City Index.

"If that sentiment changes, say because of a run of below-forecast U.S. data, then the US dollar may finally break down more decisively and start a clean trend. However, if data remains super-hot, then this may, paradoxically, weigh on risk sentiment as rate cut expectations are pushed further out," he adds.