Australian Dollar and RBA Outlook: Analyst and Economist Views

- Written by: James Skinner

Image © RBA.

The Australian Dollar outperformed all major currencies in the final session of the week after the Reserve Bank of Australia cuts its growth and inflation forecasts while signalling an uncertain outlook for interest rates in the months ahead, one that is dividing analysts and economists in their forecast views.

Australian Dollars were bought widely on Friday with its largest gains coming in relation to the Swiss Franc, U.S. Dollar, and Japanese Yen in the G10 bucket while outperformance was most marked in relation to the South African Rand, Renminbi, and Turkish Lira when measured against G20 couterparts.

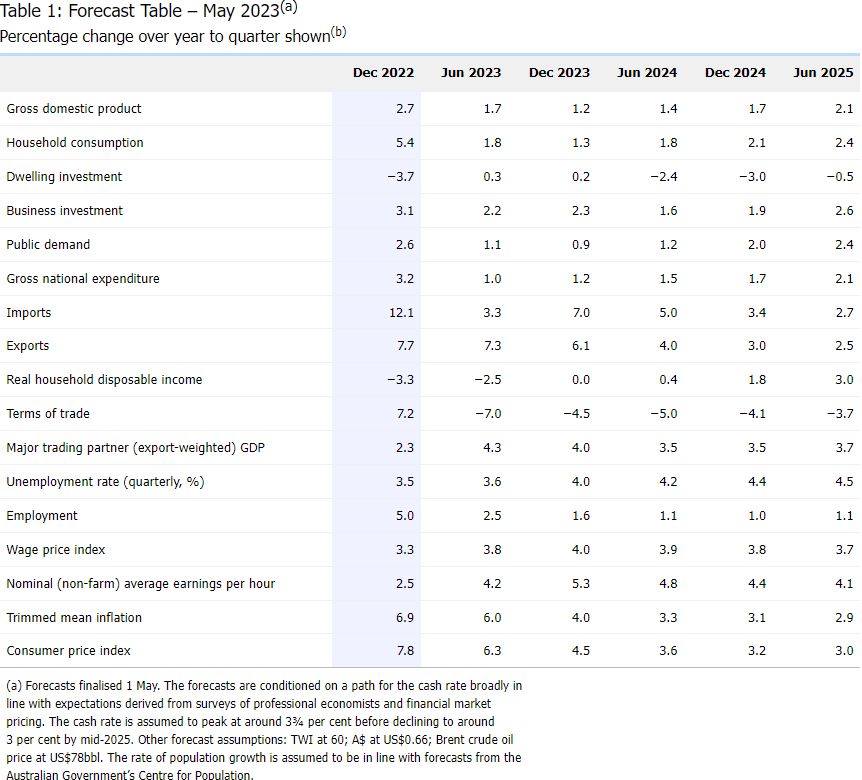

This is after the Reserve Bank of Australia cut its forecasts for economic growth, inflation and wage increases this year while projecting lower inflation and pay growth for the years ahead in a May Monetary Policy Statement suggesting that directional risk is potentially on the downside across all measures.

Downside risks stem from earlier increases in the cash rate and in part because the RBA raised it to 3.85% on Tuesday while its latest forecasts were produced on Monday when the benchmark for borrowing costs was assumed to be no higher than 3.75% this year.

Above: Summary of forecasts from May Monetary Policy Statement. Click image for closer inspection.

Above: Summary of forecasts from May Monetary Policy Statement. Click image for closer inspection.

Governor Lowe also warned following Tuesday's decision that "some further tightening in monetary policy" may be required but caveated this by saying that any further increases "would depend on how the economy and inflation evolve," over the coming months while flagging divergent risks for both.

The combined effects of rising interest rates and higher inflation are downside risk to the economy but they come at a time when inflation risk is still potentially on the upside due to a confluence of factors including recent falls in energy prices and the risk of services prices continuing to climb across the domestic economy.

None of this kept the market from buying Australian Dollars across the board on Friday, leading to a rally in AUD/USD and sharp decline in GBP/AUD as well as some other pairs.

But it has led to some divergence in the views and forecasts of analysts and economists, some of which are set out below.

Pat Bustamante, senior economist, St George Bank

"While the growth outlook remains broadly unchanged, there is a change in the composition. Some of the near-term softness we are seeing in partial economic indicators (such as retail trade) is expected to be partly offset by stronger expected growth in population."

"As a result, the Reserve Bank (RBA) is implicitly forecasting per capita consumption and per capita GDP to go backwards, implying a per capita recession. In fact, per capita consumption and per capita GDP are both expected to be lower through 2023 and 2024, compared to the December quarter of 2022."

"In other words, the RBA expects individuals to spend less per period over the next two years, compared to the December quarter 2022."

"This is significant. It highlights the tension in the RBA’s deliberation. The economy is slowing and slowing quickly. This is because households faced with mounting cost of living pressures, elevated rents and higher interest rates are cutting back. However, the record influx of migrants has offset this drag and is adding to short run inflationary pressures."

"At some point the drag from households cutting back on spending will to a large extent offset the boost to demand coming from migrants. Based on the RBA’s forecasts, this is likely to occur in the second half of 2023, where activity is expected to slow significantly."

"Inflation has been downgraded in 2023, but unchanged in later years. The CPI is expected to return to the top of the 2-3% band by mid 2025. The composition of inflation is expected to shift as rent inflation strengthens, while non-housing inflation is expected to be weaker."

Brad Bechtel, global head of FX, Jefferies

"AUD/USD is through the 200dma and opening NY around 0.6729 currently. Definitely better bid this week in that pair after it's look through 0.6600 recently, but we are still in the multi month range between 0.6800 and 0.6600."

"China Caixin PMI figures came out lower than expected but that didn't hurt the AUD's chances last night. The prints are still."

Bill Evans, chief economist, Westpac

"The forecasts in the May Statement assume the cash rate peaks at 3.75%, which is in line with the assumption used in the February SOMP, while the AUD assumption is around 4% lower on a TWI basis."

"The weaker growth outlook is also putting some further downward pressure on inflation through, “retailers have increasingly cited weaker demand as a constraint on their ability to increase prices.”

"We were given a “flavour” of the Bank’s concerns for the risks to the inflation outlook in the Governor’s statement following the May Board decision to raise the cash rate by 25 basis points. He emphasised his concerns with the resilience of services inflation – consistent with observations overseas."

"In turn those services pressures that are largely linked to wages growth are exacerbated if productivity growth in the services sectors remains weak."

"So, the key theme in the SOMP is the risks around the inflation outlook given the evidence both domestically and offshore that services inflation is slow to fall. That can be explained by the ongoing tightness of the labour market holding up wages growth and poor productivity in the market services sector which is boosting unit labour costs."

"This dilemma appears to have recently become a source of considerable frustration for the Board."

"Their policy instrument – interest rates - is doing its job in restraining demand as demonstrated by the significant downward revisions (from the already modest forecast pace) to household spending and investment growth but has had no real success in easing pressures in the labour market or, as is to be expected, boosting productivity."

Andrew Boak, chief economist for Australia & New Zealand, Goldman Sachs

"Overall we continue to view additional tightening as needed in Australia to bring inflation back to target in a reasonable timeframe."

"Our base case remains for one more 25bp hike in July to a terminal rate of 4.1% - following key updates in June on the national accounts, unit labour costs, and the annual resetting of the minimum wage."

"We continue to see the balance of risks as skewed to a higher terminal rate, with a material risk of a back-to-back rate increase in June."

Kristina Clifton, senior economist and currency strategist, Commonwealth Bank of Australia

"We still consider it will be a matter of time before AUD/USD breaks below its recent support near 0.66 because of what we think is mispricing of FOMC rate cuts and a potentially weaker Chinese economic recovery."

Alvin Tan, head of Asia FX strategy, RBC Capital Markets

"The RBA monetary policy statement and updated macro forecasts are largely what one would expect after the latest surprise hike."

"The emphasis is on elevated inflation, and risk of further pressure ahead from specific factors such as rents and utilities, sticky services inflation, and a very tight labour market. Moderating domestic demand is acknowledged, but more is needed."

"The downward revision to GDP (mostly HCONS), upward to unemployment (4% from 3.8%) and downward to inflation (4% trimmed from 4.3%) by end-23 likely reflect the tighter setting with the 2024/25 forecasts only tweaked marginally. In the end, it doesn't really explain why the board paused in April but hiked in May."

·