Australian Dollar Forecast Higher on a Six Month View at Rabobank

- Written by: Gary Howes

Above: LNG tanker. Image © Adobe Images.

The Australian Dollar is "catching its breath" before it pushes higher, according to a new analysis from Rabobank.

The Dutch based global financial services provider says although the Australian economy is currently facing headwinds, it should grow in 2023 and 2024, a time when other major economies are expected to slide into recession.

This in turn informs their updated forecasts for the currency to outperform the likes of the Dollar, Euro and Pound over coming months.

However Rabobank's Senior FX Strategist, Jane Foley, says it will take some time for the Aussie Dollar to launch, given domestic economic headwinds.

The Aussie economy has faced setbacks over recent weeks with PMI data for August confirming a sharp slowdown. This is on top of recent employment data that showed a drop in full time jobs of 86.9K.

Furthermore, ongoing signs of a Chinese economic slowdown amidst the country's failure to move on from its zero-Covid policy are also weighing.

"Headwinds should be increasing," says Foley, "firms and households are having to content with 175 bps of rate hikes from the RBA over just four months and a slower backdrop of global growth."

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

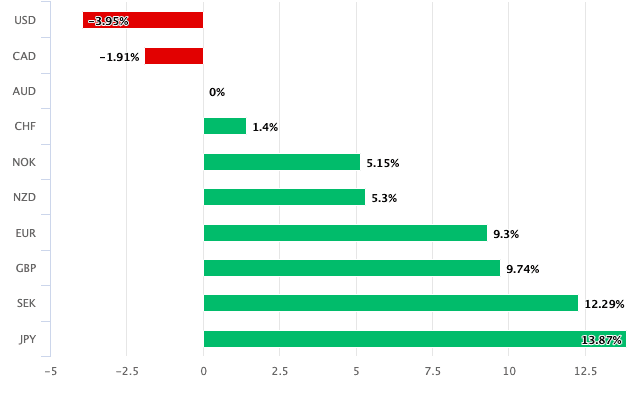

The Australian Dollar is nevertheless one of the best performing major currencies of 2022 with only the Canadian Dollar and U.S. Dollar outperforming it.

This outperformance is almost certainly linked to Australia's rich resource base that allows it to export commodities at a time of exceptionally high commodity prices.

Foley says the price of coal and natural gas are particularly relevant here, given the scramble for energy in the Northern Hemisphere following Russia's invasion of Ukraine.

Above: Australian Dollar relative performance in 2022.

Coal and Liquified Natural Gas (LNG) are Australia's second and third most valuable exports after iron ore.

Signifying just how valuable sea-borne Australian gas is, this week saw a tanker carrying Aussie LNG dock in the UK for the first time in six years.

"The RBA has predicted that Australia’s terms of trade are likely to have reached a new historical high in the June quarter, they are then likely to decline but are still expected to follow a higher trajectory than has previously been forecast," says Foley.

The ABS reported in August that Australia's seasonally adjusted balance on goods and services surplus increased $2,654m to $17,670m in June.

The record trade surplus was driven by a surge in the value of commodity exports, such as gas, iron ore and gold.

Above: Australia's trade surplus continues to surge.

"The drop in the prices of iron ore and coking coal have negative connotations for Australia’s terms of trade and the AUD. However, Australia is also an exporter of energy linked commodities such as thermal coal and LNG and these should continue to provide a positive impetus," says Foley.

Research from JP Morgan finds that broader foreign exchange performance has become materially more aligned with the direction of trade flows, i.e., currencies tend to appreciate alongside surpluses, and vice-versa, relative to their long-term averages.

They find the divergence in trade flows between G10 surplus and deficit currencies has never been this stark. Surplus countries are considered those that are running significant trade surpluses, including Australia, Canada and Switzerland.

Net importers like the Eurozone, the UK and Japan are meanwhile seeing their currencies underperform.

"Terms of trade gains that should be AUD-positive, particularly in energy exports," says Patrick Locke, FX Strategist at JP Morgan.

"We remain constructive on AUD, particularly on the crosses, as the economy’s strong supply-side performance through the pandemic should mitigate the risk of the RBA having to overtighten, and its commodity exporter status also provides natural insulation from stagflationary forces," he adds.

Rabobank forecasts show an expectations for further weakness against the U.S. Dollar over the next three months ahead of a recovery over the six month horizon.

And, given the Aussie economy looks set to avoid recession, unlike those of the Eurozone and UK, strength against the Euro and Pound is also likely.

"Going forward Australian growth is set to slow. The central bank forecasts growth at 3¼ per cent over 2022, underpinned by growth in consumption and a recovery in investment and service exports. Growth is then expected to slow to around 1¾ per cent over both 2023 and 2024. This outlook compares favourably with the Eurozone, UK and the US all of which are at risk of recession next year," says Foley.

AUD/USD is forecast to fall back to 0.69 on the back of dollar strength near-term but Rabobank sees scope for "AUD/USD to clamber back to 0.71 on a 6-month view".

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes