Australian Dollar on Top Following RBA Rate Hike

- Written by: Gary Howes

- AUD leads the pack

- Following RBA rate hike

- 25 basis point hike bigger than expected

- Hike at each upcoming meeting expected

- Leaves AUD at risk to disappointment

Above: File image. Governor Philip Lowe. Photo: O'Neill Photographics/Goldman Sachs. Source: RBA on Flickr, reproduced with permission from the RBA press office.

The Reserve Bank of Australia raised the key interest rate by 25 basis points and signalled a number of further hikes are expected, offering near-term support to the Australian Dollar.

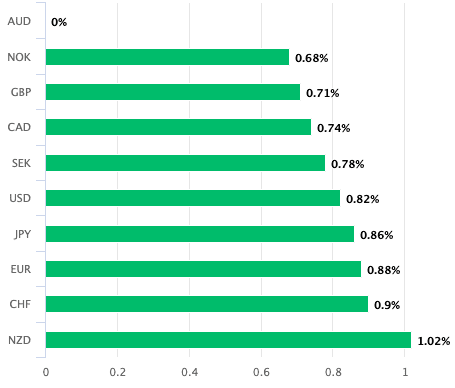

The Australian Dollar rose by nearly two-thirds of a percent against the Pound and 0.82% against the U.S. Dollar after the RBA raised rates for the first time in a decade.

In fact the Australian currency was the best performing major G10 currency in the wake of the RBA policy meeting, suggesting it was more 'hawkish' than anticipated.

Markets had been anticipating a more cautious 15 basis point liftoff.

"The increment of the rate hike was a total surprise to markets," says strategist Carol Kong at Commonwealth Bank of Australia.

Above: AUD performance relative to other G10 majors on May 03.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Pound to Australian Dollar exchange rate is at 1.7589, the Euro to Australian Dollar rate at 1.4768 and the Australian to U.S. Dollar rate at 0.7115. (Set your FX rate alert here).

The decision to raise interest rates was largely a recognition of rising Australian inflation rates and an improving labour market, ensuring further rate hikes are expected at upcoming meetings.

The RBA also said it would end extraordinary pandemic support and will no longer repurchase bonds that fall due under its quantitative easing programme.

"Futures are now pricing in a very aggressive hike cycle for RBA and the AUD has gotten support," says Karl Steiner, Chief Quantitative Strategist at SEB.

Justifying the larger than expected hike, RBA Governor Philip Lowe said in a statement "the more timely evidence from liaison and business surveys" showed wages have picked up enough to justify raising hikes now.

The official Australia wage report is due next week, which some analysts had believed would provide cover for the RBA to wait a little longer before hiking.

The market is now expecting a rate hike at each of the coming meetings.

"A lot seems to have been priced in already," says You-Na Park-Heger, FX and EM Analyst at Commerzbank.

"That means there is likely to be limited scope for further AUD gains in the current rather difficult financial market environment unless further hawkish RBA comments confirm the market view," she says.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Should the RBA disappoint and not raise rates at each remaining meeting of 2022 the Aussie Dollar would likely come under pressure as investors are forced to recalibrate expectations.

"Markets are pricing in another 11 rate hikes for this year - it will be a miracle if the RBA can deliver anything close to that with the Chinese economy losing power," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

The RBA nevertheless looks set to be one of the most agressive of the major central banks given a combination of rising inflation and a strong domestic economy: this contrasts to some developed economies that are facing both high inflation but stalling growth prospects.

The RBA raised their inflation forecast to 4.75% for the end of 2022, (inflation is at 3.7% currently), up from the previous forecast of 2.75%.

Underlying inflation is then forecast to fall back to 3% by mid-2024 compared to 2.75% expected previously.

"This observation explains why the Board surprised today by lifting the cash rate a little further than the 15 basis points expected by the market and many analysts," says economist Bill Evans at Westpac.

Evens says the RBA should be prepared to "front load" its tightening cycle to convince households and business that it is committed to "achieving that formidable goal of returning inflation back to the target band".

Westpac say the RBA will hike in June by 40 basis points, more than the 25 basis point hike they had previously expected.