Pound / Australian Dollar Rate Could Attempt Retest of 1.92

- Written by: James Skinner

- GBP/AUD recovery places 22-month highs in sight

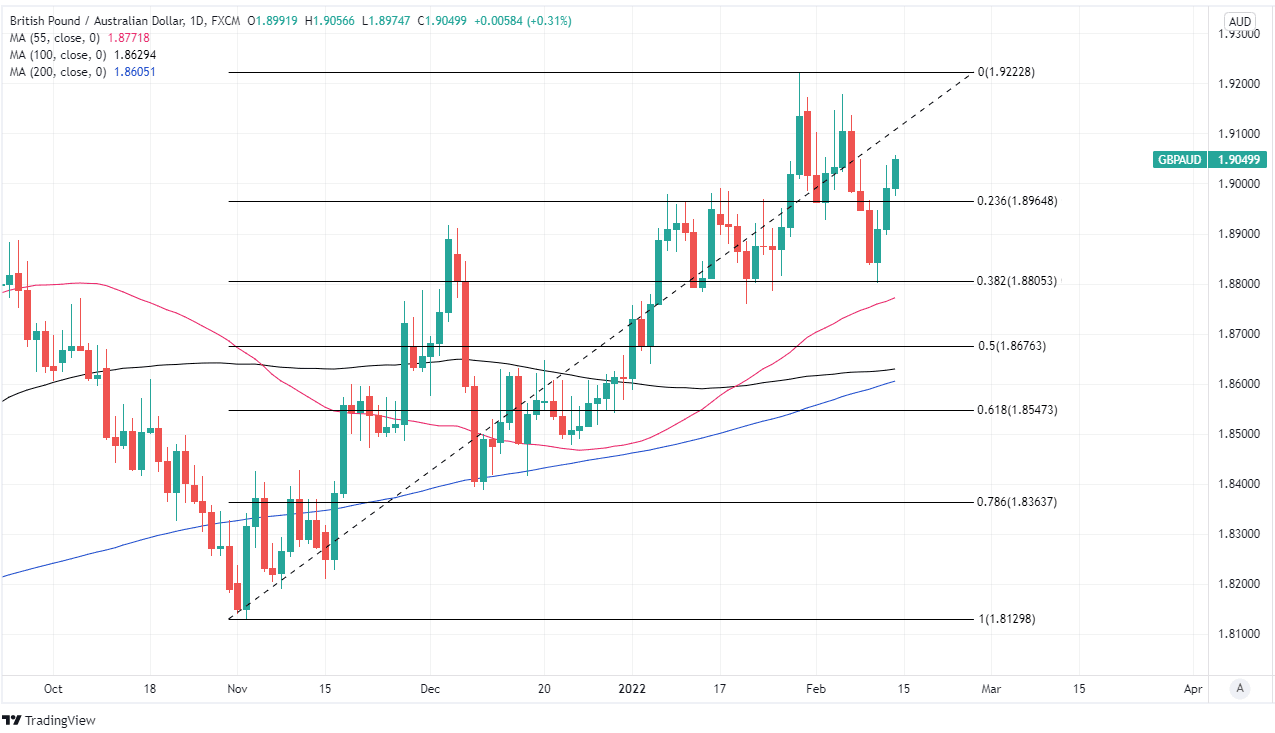

- Supported at 1.8805, could retest 1.92 short-term

- As AUD/USD struggles on RBA, Fed & risk aversion

- RBA minutes, AU job data & Ukraine risks in focus

Image © Adobe Images

The Pound to Australian Dollar rate entered the new week on the front foot and would likely have scope to retest 20-month highs around 1.92 over the coming days if a recent and ongoing retreat by AUD/USD extends through the week ahead.

Australia’s Dollar was on course for a hat-trick of declines on Monday when beating a further retreat from the U.S. Dollar, Sterling and other currencies that are typically less sensitive to episodes of risk aversion among investors like that seen at the opening of the new week.

“Fears of a Russian invasion into the Ukraine are weighing on risk appetite across the globe. European and Asian markets were largely down to start the week and that weakness looks to be extending into the North American session as well. Core rates are largely bid. In FX, the havens are outperforming while risk proxies are under a lot of pressure,” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

GBP/AUD extended its recovery on Monday from last week’s low near 1.8805 - also an important level of technical support for Sterling - just as the highly influential AUD/USD pair fell back toward the almost two-year nadir established during late January.

AUD/USD declines have been compounded and GBP/AUD gains boosted since Friday when global markets were upended by suggestions from Washington that an extension of Russia’s 2014 invasion into Ukrainian could be likely this week.

Above: GBP/AUD shown at daily intervals with Fibonacci retracements of November rally indicating possible areas of support for Sterling and shown along with selected moving-averages.

- GBP/AUD reference rates at publication:

Spot: 1.8817 - High street bank rates (indicative band): 1.8158-1.8290

- Payment specialist rates (indicative band): 1.8650-1.8723

- Find out about specialist rates, here

- Set up an exchange rate alert, here

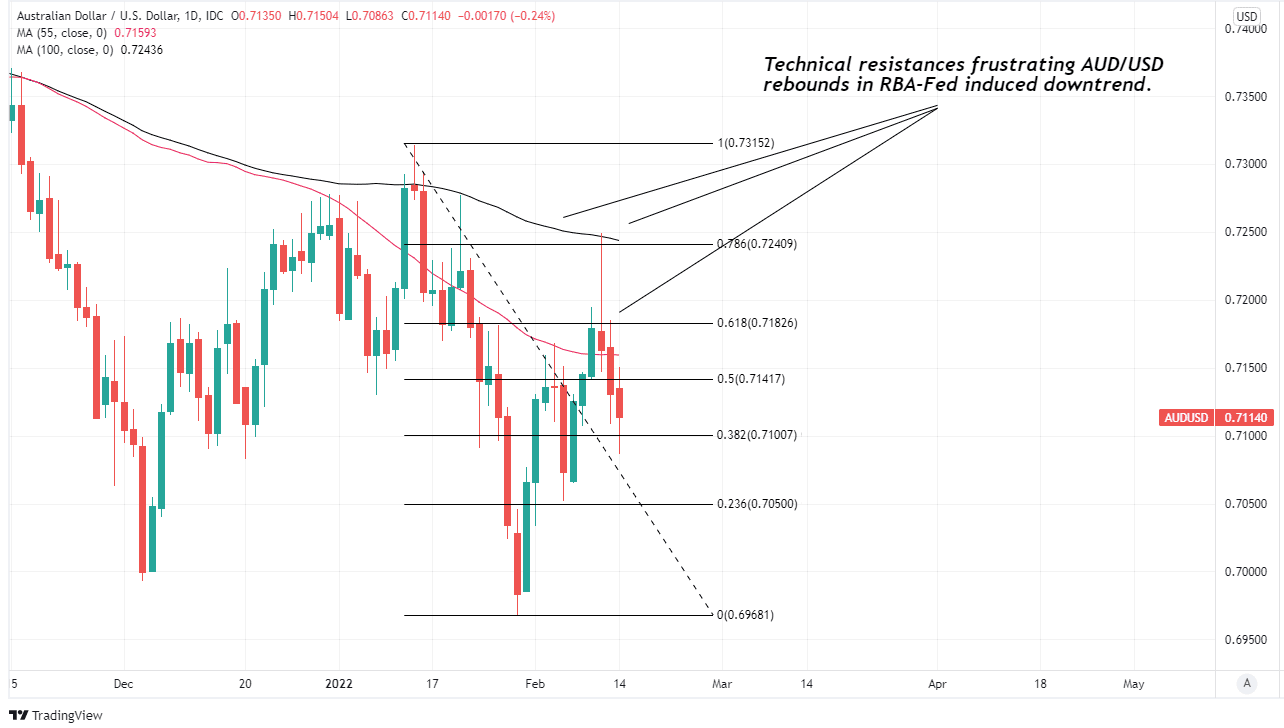

The Aussie was already on the back foot previously, however, due to the widening gulf between monetary policy outlooks of the Reserve Bank of Australia (RBA) and international peers, which could potentially remain a headwind for AUD/USD in the short-term.

“AUD/USD can ease modestly this week because of the divergent near-term outlook between the RBA and the FOMC. The RBA is unwavering in its determination to remain ‘patient’ about policy tightening. However, we doubt AUD will dip far below 0.7000 unless equity markets fall again and Australian bond yields decrease,” says Carol Kong, a currency strategist and economist at Commonwealth Bank of Australia.

This is a favourable outlook for GBP/AUD, also given that it tends to closely reflect the relative performance of AUD/USD and its Sterling equivalent GBP/USD, but with a negative correlation often evident between GBP/AUD and AUD/USD.

GBP/AUD would be likely to remain on an upward trajectory this week if pressure on AUD/USD persists, and could even come close to 22-month highs just above 1.92 if AUD/USD’s losses extend as far down as the 0.70 handle.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

“If AUD/USD retests the 0.7000 area again in the week ahead, it is more likely to be due to offshore events than to Australia's jobs data,” says Sean Callow, a senior currency strategist at Westpac.

While minutes of the RBA’s February meeting are due for release this Tuesday, the main event in the local calendar is Thursday’s publication of employment figures for January, which the market will scrutinise closely for signs of a pickup in employee pay growth.

This is because the RBA has stipulated that pay packets would need to grow by around three percent per year in order for it to feel that Australia’s 2.5% inflation target will be met on a sustainable basis over the medium-term, which is a prerequisite for an eventual increase in Aussie interest rates.

“The AUD remains unable to shake off the overhang of the dovish RBA, the widening gap between the RBA and market expectations, and the Fed-RBA divergence. These factors are oft-cited for the extended AUD-short position among the investment community, which has risen again in the latest week, and is at historical high levels,” says Terence Wu, a currency strategist at OCBC Bank in Singapore.

Above: AUD/USD shown at daily intervals with Fibonacci retracements of January 2022 decline and selected moving-averages indicating likely areas of technical resistance to any Aussie Dollar recovery.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

RBA forecasts and guidance have continued to suggest it will be among the last of the major central banks within the G10 contingent to begin lifting its interest rate coming out of the pandemic, and this prospect has weighed heavily on the Australian Dollar through much of the last year.

Governor Philip Lowe underlined this risk when he told the House of Representatives Standing Committee on Economics last week that the RBA could choose to wait until it receives a further two quarterly inflation reports before lifting its benchmark cash rate.

“Importantly, he said that while there was clearly a risk this approach could see inflation “above 3% for a period of time”, this risk is “acceptable”given the opportunity to test how far the unemployment rate can fall. In terms of timing of the first rate hike, he indicated “a couple more CPIs would be good to see” before,” says David Plank, head of Australian economics at ANZ.

Governor Lowe’s testimony followed in the wake of the revelation that U.S. inflation hit a four-decade high of 7.5% in January, which prompted one Federal Reserve policymaker to suggest an accelerated pace of interest rate rises may be appropriate as a result.

The data and subsequent remarks from the Federal Reserve Bank of St. Louis President James Bullard lifted the U.S. Dollar and sent AUD/USD tumbling, which helped GBP/AUD to recover from last week's low around 1.8805.