Australian Dollar: Iron Ore Price Stabilisation Prompts Recovery

Image © Adobe Stock

- GBP/AUD spot at publication: 1.7818

- Bank transfer rates (indicative guide): 1.7194-1.7319

- FX transfer specialist rates (indicative): 1.7397-1.7600

- More information on accessing specialist rates, here

The Pound, U.S. Dollar and Euro all fell back from their recent highs against the Australian Dollar on Thursday as a recovery in global iron ore prices shored up demand for the antipodean currency.

The Australian Dollar has shown a strong correlation with iron ore price dynamics over recent months given Australia's position as the world's largest exporter of iron ore, making the raw material a key pillar of support in the country's strong balance of trade account.

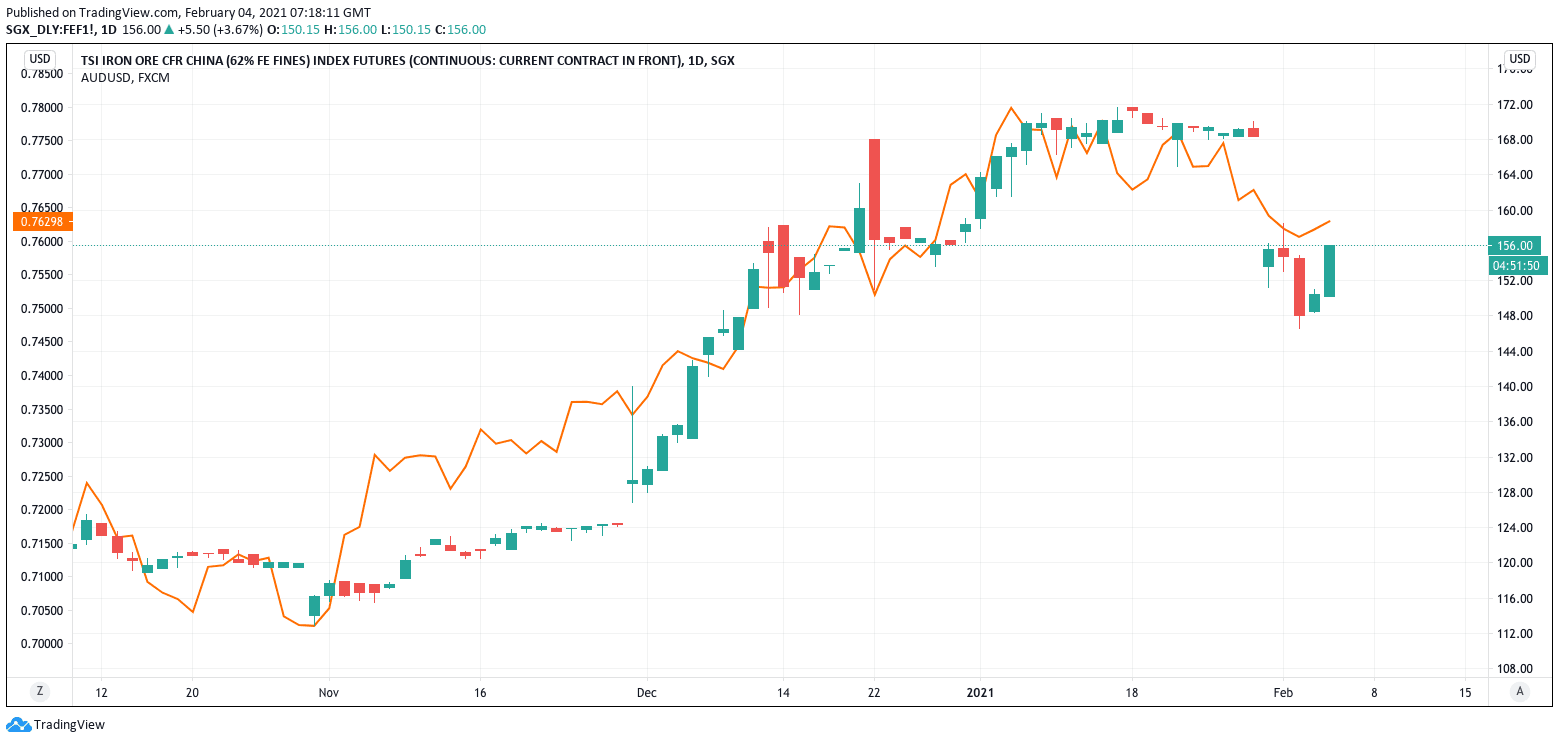

Iron ore prices had fallen sharply in late January and early February, taking the Aussie Dollar down alongside, but a stabilisation in iron prices over the past 24 hours are aiding a recovery in the currency:

Above: The Australian Dollar is responding to iron ore price dynamics.

The developments come as Australia on Thursday reported a sharp rise in its trade surplus for December, up to AUD6.8BN from AUD5.0BN in November, driven by a AUD1.0BN rise in exports and AUD800m fall in imports.

Resource exports increased 2.5% month-on-month, with rises in iron ore (up 3.2% m/m), coal (up 3.7% m/m) and Liquified Natural Gas (up 4.2% m/m).

While the December data is arguably 'old news' in terms of the iron ore-Aussie Dollar dynamics we are seeing at present, it does provide the fundamental justification for the Australian Dollar's outperformance in 2020.

The outlook for the Australian Dollar will therefore likely depend on whether iron ore prices are undergoing a short-term consolidation ahead of further declines, or whether the recent pullback is a pause in the broader uptrend that has been in place since mid-2020.

"The move in iron ore prices is from remarkably high levels, following a large acceleration to the topside, which makes the possibility of a correction ahead of the Chinese Lunar New Year holiday not an unreasonable outcome," says Shahab Jalinoos, a trading strategist at Credit Suisse.

Credit Suisse commodity analysts highlight how increasingly endemic supply constraints however cast a steadily bullish outlook on iron ore, "which suggests the terms of trade aspect will remain supportive," adds Jalinoos.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

The iron-fuelled rebound in the Aussie means the Pound-to-Australian Dollar exchange rate has fallen half a percent to reach 1.7815 at the time of writing on February 04, the Euro-to-Australian Dollar exchange rate is 0.20% lower at 1.5738 and the Australian Dollar-to-U.S. Dollar rate is 0.15% higher at 0.7626.

The pullback in iron ore prices on January 28 was said to be driven by a material decline in Chinese steel mill margins and expectations for lower steel demand from China, which is the world's largest import of the raw material and Australia's premier trade partner.

China’s Ministry of Industry and Information Technology vowed to cut crude steel output in 2021 compared to 2020.

The moves come amidst demands for a broader policy 'normalisation' in China, with the former chief economist of the People's Bank of China, Ma Jun, saying last week that policy should be tightened to stop bubbles forming in the stock and property markets.

"USD and concerns over the veracity of ongoing strong Chinese iron ore demand is weighing on AUD. Bloomberg reported that China’s Ministry of Industry and Information Technology reconfirmed numerous measures to help reduce steel output in China. The proposals include a medium‑term plan to reduce reliance on imported iron ore. Over 80% of Australia’s iron ore exports are sent to China," says Kim Mundy at Commonwealth Bank of Australia.

Industrial metals and other raw materials prices have come off the boil and aided an ongoing stabilisation of the U.S. Dollar, which is doubly problematic for the Aussie because gains in commodities have lifted the currency's valuation sharply in the last year.

Richard Franulovich, Head of FX strategy at Westpac says near-term headwinds to commodity prices are growing, and this could ensure the Australian Dollar stays under pressure short-term.

However, Westpac continues to bet on a higher AUD/USD rate in the months ahead but has set a tight stop-loss around 0.7680 on its current trade, with one eye on a steadying U.S. Dollar, which has benefited from global growth concerns but could also be supported in the weeks ahead by a quickening vaccine rollout.