Australian Dollar Outperformance Threatened by Removal of Government Fiscal Support: Credit Suisse

- AUD is one of 2020's top performers

- But, outperformance to be questioned into year-end

- Withdrawal of fiscal stimulus could be key to outlook

- All eyes on Oct. 06 budget

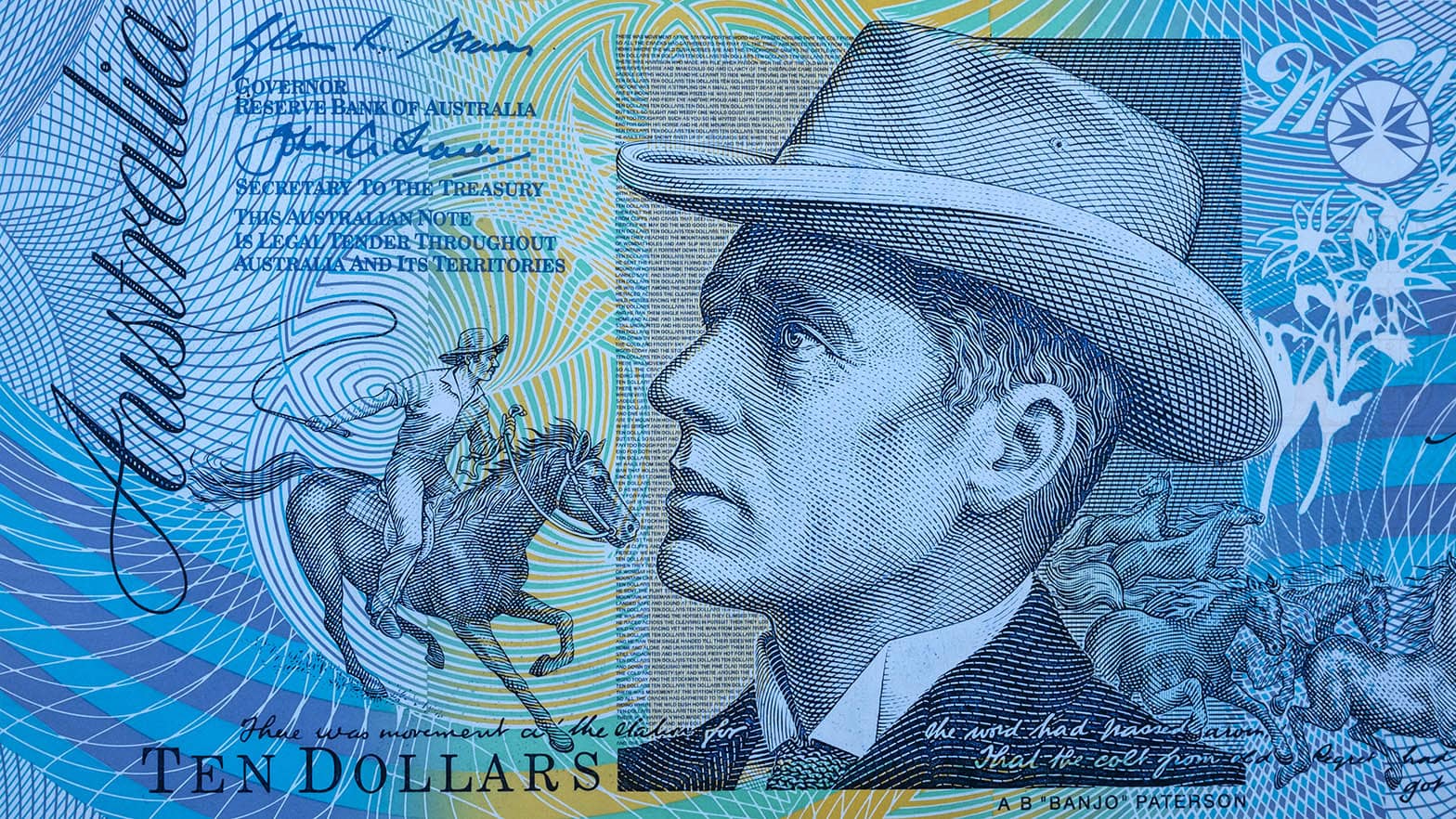

Image © Adobe Images

- GBP/AUD spot rate at time of publication: 1.7558

- Bank transfer rates (indicative guide): 1.6940-1.7066

- Transfer specialist rates (indicative guide): 1.7150-1.7400

- More information on specialist rates here

The Australian Dollar's period of outperformance could fade over coming months as the government withdraws the lion's share of financial support it has provided to its citizens, according to analysts at a Swiss multinational bank.

"The risk of a less generous fiscal stance emerging from the 6 October budget is notable," says Alvise Marino, an analyst at Credit Suisse.

The Australian Dollar has been one of 2020's better performing currencies, benefiting from a rapid recovery in commodity prices and global equity prices since the lows of March, when the covid-19 market meltdown was in full swing.

"Australia’s growth outlook is likely to remain aligned with global momentum, via commodities exports and high exposure to Chinese demand," says Marino.

However it is not just the Aussie Dollar's linkage with commodity and equity prices that might explain its outperformance: the Morrison Government's hefty financial support packages are seen to have provided support for the economy at a time it has been under substantial pressure from the effects of global and domestic lockdowns.

"AUD’s outperformance throughout the Covid crisis has at least to some extent been a product of the Morrison government’s willingness to stimulate growth, and of the ability to do so granted by Australia’s low debt levels," says Marino.

The Australian Dollar is now up by a percent against the U.S. Dollar in 2020, up 4.0% against the Pound and up 1.50% against the Euro. In fact, it is the leading performer in the G10 space for the year.

The mainstay of the Australian government's covid-19 fiscal support package are the Jobkeeper and Jobseeker programmes, both are due to be wound down in October and ended in early 2021.

The JobKeeper Payment will remain in place at AUD1500 every 2 weeks until 27 September 2020, when it is reduced to AUD1200. The programme is set to be reduced again on January 03 and end on March 31, 2021.

The Jobseeker unemployment supplement is set to ease from AUD550 every two weeks to AUD250 starting on September 25, with the programme ending on December 31.

"The coincident timing of the extension of the Victoria lockdown and of the decline in wage supplements remains nonetheless problematic from a growth momentum standpoint," says Marino.

For the Credit Suisse analyst, much rests with the October 06 budget where markets will get a sense of just how fast the federal government will withdraw support, or perhaps extend it.

"The risk we see is that budget talks leading into the Oct 6 budget announcement might reveal more fiscally conservative prospects. So far the narrative around the budget update has been focused on bringing forward tax cuts that were scheduled for Jun 2022 to Jun 2021 rather than on additional spending measures, as per comments by finance minister Frydenberg on 2 Sep. With no risk premium priced in around the event, this strikes us as a development worth monitoring closely," says Marino.

The withdrawal of stimulus from the government could in turn shift the onus of keeping the Australian economy moving forward onto the Reserve Bank of Australia (RBA), potentially encouraging the implementation of a more supportive monetary policy.

It has been noted by analysts that the RBA is one of the less agressive central banks in terms of offering support, which in turn is supportive of the Aussie Dollar. The most obvious contrast is made with the Reserve Bank of New Zealand, which has been one of the more agressive central banks and where the AUD is one of the better performers of 2020, the NZD is one of the laggards.

But, the outperformance would be questioned if the RBA adopted a more 'dovish' tilt in the event of the Government withdrawing fiscal support.

"In view of the economic slack in the economy, it is possible that policy makers will want to shake off the reputation of being the least dovish central bank in the G10 in the coming months," says Jane Foley, Senior FX Strategist at Rabobank.

The RBA is currently engaged in a quantitative easing programme that sees it target a yield of 0.25% on Australia's three-year government bond. By creating money and buying government bonds on the open market the RBA is able to ensure the yield paid on three-year bonds does not exceed 0.25%, thereby keeping lending costs right across the economy contained.

This strategy differs to that of central banks where an absolute value of quantitative easing is targeted, such as at the Reserve Bank of New Zealand. The net result is that the RBA is seen to be far less aggressive than some peers, and when it comes to foreign exchange, the less aggressive a central bank the better supported its currency.

It is this view of RBA policy that has been cited as one key reason for the Aussie Dollar's outperformance in 2020.

The RBA might accept the need to become more aggressive and increase the money it pumps into the economy if it deems the Australian Dollar is becoming too expensive, the recovery is lagging their expectations and inflation remains subdued.