AUD Starting a Multi-year Uptrend says Westpac, Pound-to-Australian Dollar Might Have Peaked Back in March

- AUD tends to trend over multi-year timeframes

- Period of depreciation in AUD might be over

- GBP/AUD could be set to go lower as a result

Image © Desiree Caplas, Adobe Stock

- GBP/AUD spot rate at time of writing: 1.8310

- Bank transfer rates (indicative guide): 1.7670-1.7780

- FX specialist provider rates (indicative guide): 1.7880-1.8150

- For more information on market beating rates, please see here

The Australian Dollar could be at the at the start of a multi-year upswing that could last until through 2021, according to economists at Australian lender Westpac.

Studies show the Australian Dollar tends to engage in long-term cycles that last a matter of years and 2020 might have seen a turning point at which the currency exits a trend of decline and commences a trend of appreciation.

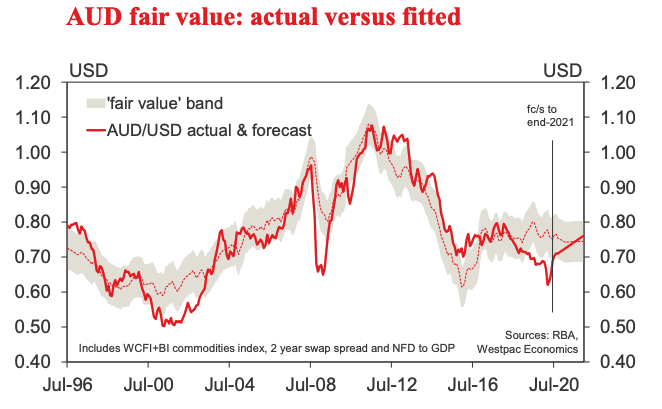

"The current period of AUD appreciation is likely to be measured in years rather than months. If we look back at the cycles of the AUD since mid-1990’s that there was one upswing (late 2001 to July 2008 (GFC)) that lasted around seven years. Of course ,that period coincided with the first 'industrialisation' burst in China. There was another five year period marking the 'pre China' fall in the AUD," says Bill Evans, Chief Economist at Westpac.

It is noted that since the financial crisis of 2008 the Aussie Dollar embarked on a three-year period of appreciation against the U.S. Dollar, followed by a four-year decline which was in turn followed by a two-year upswing.

"The only sustained “short” cycle was the nine month collapse in the AUD immediately following the GFC. The point is that once a clear trend has been established, the AUD has a solid history of sustaining the trend for a number of years," says Evans.

The Australian Dollar had been in a period of decline from the start of 2018 through to the early months of 2020 at which point the coronavirus outbreak appears to have pressed a reset button on the global economy and financial system, which could be the catalyst to another multi-year upswing in the Australian Dollar.

"With AUD now four months into what appears likely to be an established up swing history is clearly encouraging us to expect that upswing to be sustained through, at least, 2021 if not considerably further," says Evans.

Westpac forecast that AUD will lift consistently agains the U.S. Dollar through 2021 from 0.72 to USD 0.76.

Modelling by the bank estimates fair value for the AUD/USD exchange rate currently stands at 0.77, suggesting an undervaluation of around 5c from the current level of the exchange rate which is at around 0.72.

"We do see that gap with fair value closing significantly in 2021," says Evans.

The implications for the outlook of the Pound-to-Australian Dollar exchange rate are less clear, but as we can see from the multi-year GBP/AUD chart below this pair also tends to embark on sizeable multi-year trends:

What is striking in the above is that the GBP/AUD had been in a multi-year upswing from October 2016 when the pair fell into the 1.60s. However, since then the pair has been grinding higher to what could now be an ultimate peak of 2.0 reached in March.

Strikingly the trend of appreciation came at a time of well documented anxiety concerning Brexit that has seen Sterling decline against other majors, suggesting that perhaps for GBP/AUD it is the move in the Australian Dollar that ultimately matters.

If the observations and expectations expressed by Westpac on AUD/USD have a strong bearing on the GBP/AUD then it could be assumed that Sterling faces a protracted period of weakness ahead of it unless some idiosyncratic drivers emerge to send GBP higher.

While we cannot call the outlook for GBP/AUD, or AUD/USD with absolute certainty, we would suggest this research should provide readers with an interest in the Aussie Dollar with some important questions to consider. If you would like to lock in current, or future rates, we would suggest talking to foreign exchange specialists at our partners Global Reach for assistance.