Australian Dollar Extends February Rally thanks to Cheery RBA Assessment

- RBA optimism boosts AUD

- RBA sees limited threat of coronavirus

- However, analysts say RBA risks being to sanguine

- More rate cuts pencilled in for 2020

Above: File image of Governor Philip Lowe, left. Photo Source: RBA on Flickr, reproduced with permission from the RBA press office.

- Spot GBP/AUD rate at time of writing: 1.9305, -0.63%

- Bank rates for transfers (indicative): 1.8628-1.8763

- Specialist provider rates (indicative): ~1.9130 >> Find out more

Last week saw the British Pound power higher after the Bank of England opted to keep interest rates unchanged at 0.75%; this week it is the turn of the Australian Dollar to go higher after the Reserve Bank of Australia (RBA) also opted to keep interest rates unchanged at 0.75%

As was the case with the Bank of England decision, the RBA's call will have caught a portion of the FX market by surprise as there were some expecting a rate cut to be delivered in the wake of China's coronavirus outbreak and the brutal bushfire season.

However, it appears that the real engine of the Australian Dollar's jump is the guidance offered by the RBA which was more upbeat than many had been predicting, suggesting that any further cuts to the country's basic interest rate in 2020 is now no longer assured.

"The central scenario is for the Australian economy to grow by around 2¾ per cent this year and 3 per cent next year, which would be a step up from the growth rates over the past two years," said the RBA's Governor Philip Lowe when delivering the decision.

This assessment is a repeat of the RBA's November assessment and suggests the RBA has not so much as blinked at the devastating bushfire season and coronavirus outbreak in China.

The assessment by the RBA is that the cuts delivered in 2019 are having a positive effect on the local economy, and that the transmission of these cuts into economic activity are not yet fully realised. Therefore, in their opinion, no further action is necessary at this time.

Patience therefore appears to be a virtue the RBA is looking to lean on, noting that at 0.75% its space to cut interest rates is declining.

"The statement made the case that monetary policy easing to date has been working. It highlighted the positive effect of the lower exchange rate and pointed out the recent pick up in labour market outcomes," says Nelson Aston, Economist at St.George Bank in Sydney.

When a central bank cuts interest rates, the rule-of-thumb is that the currency it issues falls. The signal from the RBA that no further rate cuts are likely is therefore, on margin, supportive of the Aussie.

On the back of AUD strength, the Pound-to-Australian Dollar exchange rate is now adding to its sharp drop seen on Monday and is at 1.9343, it had been as high as 1.9747 at the start of the week.

The U.S.-Australian Dollar exchange rate is meanwhile over half a percent higher at 0.6725, while the AUD/USD is higher it is still looking fragile and is under the influence of a determined 2020 selloff.

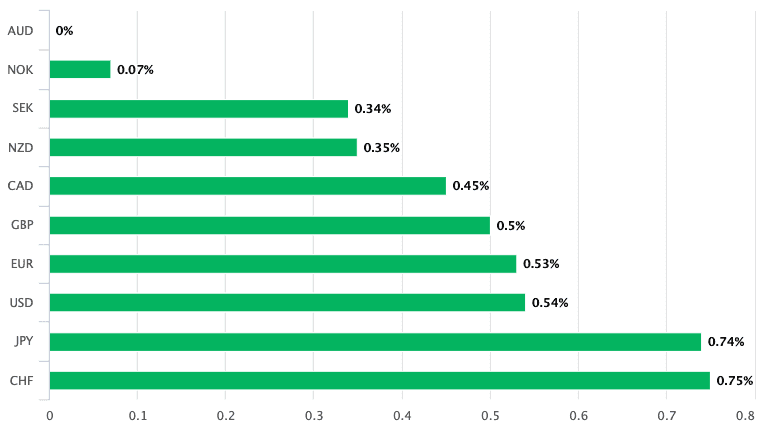

Looking at the broader market, the Aussie is the best performing major currency recording gains against all its peers in the G10 space:

The RBA has taken a relatively sanguine approach to the dual uncertainties of the bushfires and the coronavirus; "in the short term, the bushfires and the coronavirus outbreak will temporarily weigh on domestic growth," said Lowe.

On the coronavirus specifically, Lowe notes it to be "having a significant effect on the Chinese economy at present". However, he added "it is too early to determine how long-lasting the impact will be".

There is something of a contradiction here: the impact of the virus is said to be a temporary concern for Australia yet "significant" in its effect for China. Considering the sheer importance of China to the Australian economy, there is a chance that the RBA's apparent laid back approach unravels in coming weeks.

The Australian Dollar is often seen as a proxy for investor exposure to China, noting it tracks the Chinese Yuan. There is a strong link between the fates of the two economies and we wonder if the RBA is playing down that linkage.

If, the coronavirus outbreak does soon start to fade the Chinese economy can look forward to a relatively sharp comeback, and the RBA's stance will be justified. However, should the outbreak prove more persistent the RBA might find itself needing to reconsider the outlook for interest rates.

"It seems highly likely to us that the RBA’s perhaps understandably cautious assessment of these risks is about to be overtaken by “events, dear boy, events”, to steal a phrase attributed to the former British Prime Minister, Harold Macmillan. The question is when this will become clear," says David Plank, Economist at ANZ Bank.

ANZ says the Government’s understandable decision to close the border to travellers from China means the impact of the coronavirus is likely to considerably exceed earlier estimates, such as their own expectation for a negative 0.2% impact.

"The outlook is very uncertain," says Plank. "With the RBA clearly of the view that policy is very supportive it will need to see evidence to the contrary. At this stage, we think this will be apparent by late March, with an April rate cut following."

St. George Bank's Aston says "it would be a challenge to achieve the RBA’s forecasts of economic growth and underlying inflation this year without further easing. Economic growth is weak, and the outlook for consumer spending is soggy amid low wages growth and high household debt. We continue to expect two more cuts to the cash rate later this year."

However, economists at RBC Capital Markets meanwhile see the RBA stepping away from cutting interest rates and are consequently likely to push back their own expectations for another interest rate cut being delivered in 2020. RBC economists expect the RBA to cut again in June, but recognise the risks are it takes longer.

"A reluctance to head ever lower suggests that the hurdle to cut remains high and the case will need to be compelling," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

Australian Dollar Starts February on the Front Foot

The Australian Dollar traded higher against many of its peers at the start of February owing to the market's view that the coronavirus outbreak is starting to come under control.

Markets appear to be making an early bet that the coronavirus outbreak is starting to peak given the latest infection data.

If the outbreak were to be headed into crisis levels we would expect the rate of infection to be similar to levels seen at the early point of the previous week.

However, this is clearly not the case:

Image courtesy of Johns Hopkins University Center For Systems Science and Engineering.

China's pre-eminent respiratory scientist Zhong Nanshan on Sunday said, "we believe the epidemic will peak in the next 10 to 14 days, but we still need to enhance preventive measures and not lower our guard."

The coronavirus scare is particularly relevant to the Australian Dollar as Australia's economy is highly reliant on the Chinese market: a slowdown in China means a slowdown in Australia which would typically exert downside pressure on the Aussie Dollar. Exports to China hit a record of 38% of total Australian exports in 2019, more than any other country, and emphasising why the Australian Dollar is often seen as a financial market proxy for investors wishing to exercise exposure to China.

We believe that unless the infection rate starts to climb once more, markets will continue to look forward to the ultimate containment of the disease and an ensuing recovery in the Chinese economy.

"Unless the situation further escalates, expect investors to hunt for bargains at these lower prices for riskier assets. Market sentiment could quite quickly turn positive and turn this market upside down," says George Vessey, Currency Strategist at Western Union.

Research by Asia-focussed DBS Bank suggests the shock to China’s economy from the coronavirus will likely be 2 to 3 times larger than SARS in 2003.

DBS say growth may fall to 4.7% in 1Q before recovering to 5% in 2Q and they are lowering China’s full-year growth forecast to 5.3% (from 5.8%).

However, Chinese authorities are being tipped to rely on fiscal and monetary policy easing to cushion the economy. At the weekend the Peoples' Bank of China (PBOC) made the decision to inject 1.2 trillion yuan (£130 billion) of cash into the financial system via reverse-repurchase operations in a bid to ease any 'liquidity' or cash shortages.

While the full negative impact to Chinese growth might still be some weeks away, it must be stressed that it is the nature of the recovery that markets are primarily interested in.

"A typical pandemic can also pave the way for a V-shaped recovery for both the economy and the markets," says Chris Leung, Economist at DBS, but Leung warns, "keeping liquidity ample and ensuring regular functioning of the

financial system are now the chief priorities."

If the coronavirus outbreak fades as a threat, expect those currencies, commodities and stocks exposed to China to make a notable recovery.

"We think the market is reacting to nervousness around the coronavirus and concerns about its impact on the Chinese economy. While this global health worry is far from over, currently our expectation is that the economic fallout will be without significant long-lasting effects on the global economy," says David Absolon, Investment Director at Heartwood Investment Management. "Noise surrounding the coronavirus may have led investors to return to the relative safety of bonds of late, but we don’t expect this to be a sustained trend."

The Australian Dollar's rebound this week, contrasted to the decline in the Yen and Franc, is testament to how the market will likely react if coronavirus fears evaporate further.