Australian Dollar Pushes Higher in Risk-on Markets, RBA Decision Looms

- AUD in strong bounce as new week starts

- Fading fears on coronavirus, BPoC action cited

- RBA decision looms

- "times are likely to remain difficult for AUD" says Commerzbank

Image © Adobe Images

- Spot GBP/AUD rate: 1.9595, -0.51%

- Retail bank rate for transfers (indicative): 1.8909-1.9040

- Specialist money transfer providers (indicative): 1.9390-1.9419 >> More details

The Australian Dollar is trading higher against many of its peers in line with a strong start to the week for global stock markets and commodity prices linked to weekend developments in China.

The supportive global backdrop for the Australian Dollar is further reinforced by domestic conditions where expectations dominate that no interest rate cut will be forthcoming from the Reserve Bank of Australia (RBA) this week, although expectations for a cut later on in 2020 will likely keep upside limited.

The main driver of Australian Dollar strength on Monday is however ultimately the broad-based improvement in global investor sentiment, driven largely by a view that the neo coronavirus outbreak in China is ultimately under control. Markets appear to be making an early bet that the coronavirus outbreak is starting to peak given the latest data. If the outbreak were to be headed into crisis levels we would expect the rate of infection to be similar to levels seen at the early point of the previous week.

However, this is clearly not the case:

Image courtesy of Johns Hopkins University Center For Systems Science and Engineering.

China's pre-eminent respiratory scientist Zhong Nanshan on Sunday said, "we believe the epidemic will peak in the next 10 to 14 days, but we still need to enhance preventive measures and not lower our guard."

The coronavirus scare is particularly relevant to the Australian Dollar as Australia's economy is highly reliant on the Chinese market: a slowdown in China means a slowdown in Australia which would typically exert downside pressure on the Aussie Dollar. Exports to China hit a record of 38% of total Australian exports in 2019, more than any other country, and emphasising why the Australian Dollar is often seen as a financial market proxy for investors wishing to exercise exposure to China.

While the Aussie is higher at the start of the new week, the currency still has a great deal of distance to go before it starts reclaiming lost ground in a meaningful manner: the Pound-to-Australian Dollar exchange rate is quoted at 1.9608, down from last week's high at 1.9753 which was a new three-year high and the pair's highest rate of exchange since the week leading up to the Brexit referendum of June 2016. The U.S. / Australian Dollar exchange rate is meanwhile quoted at 0.6693 and we would warn that AUD/USD continues to look heavy and intent on going lower.

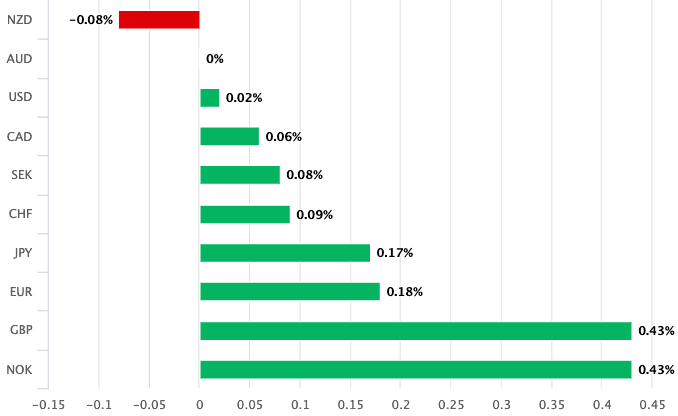

Above: AUD is outperforming the majority of its peers on Monday, February 03.

Markets also appear to have reacted in positive fashion to the Peoples' Bank of China (PBOC) decision at the weekend to inject 1.2 trillion yuan (£130 billion) of cash into the financial system via reverse-repurchase operations in a bid to ease any 'liquidity' or cash shortages.

This support is expected to provide a cushion against any significant slowdown in China caused by the coronavirus outbreak and is therefore deemed to be positive for global markets and the Australian Dollar by extension.

The Australian Dollar has been trading as a proxy for the Chineses Yuan and has over recent days been falling in sympathy with the offshore Yuan (CHF), which has been trading through the Chinese New Year holiday. Monday sees CHF strength as USD/CHF is up by 0.37%, which is correlating into the broader pickup seen in the Australian Dollar.

Expect the Australian Dollar to remain sensitive to headlines surrounding the coronavirus outbreak, as well as any further measures taken by market and financial authorities in China to minimise the economic impact of the outbreak.

RBA to Sit on Rates, Analysts Expect Further AUD Weakness

The RBA delivers their February decision on interest rates on Tuesday at 03:30 GMT, and markets are currently expecting policy makers to keep interest rates unchanged at 0.75%.

"The RBA meeting on Tuesday occurs at a critical moment and in a critical market picture. Yet, after three rate cuts halving the policy rate to the current record low of 0.75%, we expect the RBA to be cautious about more easing right now," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

Given the market's expectation for no rate change to be delivered, any decision to cut interest rates would come as a surprise and we would expect it to exert downside pressure on the Australian Dollar.

Be aware too that the tone of the guidance offered by the RBA will be important: if the RBA communicates a cautious approach to coming months then market expectations for a rate cut at a later point in 2020 will rise. This too could exercise some downside pressure on the Aussie Dollar.

"We think that the RBA may bide its time for now, but, due to the potential impact on the Australian economy of both the recent bushfires and the coronavirus in China, further easing may be required soon," says Mialich.

Antje Praefcke, FX & EM Analyst at Commerzbank, says there is in fact a good chance that the RBA will go ahead and cut interest rates.

"Following its last meeting in December the RBA signalled its willingness to ease monetary policy further, should the outlook for growth, inflation and employment deteriorate. The corona virus pandemic could have negative economic effects for China, Australia’s most important trade partner," says Praefcke.

The analyst also cites the recent bush fires as likely to have left their marks on economic growth, as activity in the sectors of tourism and mining are likely to have been affected.

"We therefore consider it likely that the rise in uncertainty might cause the RBA to act now, in particular as this would constitute a sign of support for the areas worst affected by the fires at the same time. The development of inflation remains satisfactory and also provides scope for a rate cut," says Praefcke.

Commerzbank is expecting the depreciation trend in the Australian Dollar to likely continue "regardless of whether the RBA cuts interest rates or not".

"The RBA is likely to sound concerned about the economic outlook and therefore sound more dovish," says Praefcke, adding "there is high uncertainty as to how the corona virus epidemic develops and the effects for China are currently impossible to gauge. That means times are likely to remain difficult for AUD."