Pound vs. Australian Dollar Rate in the Week Ahead: Target at 1.80 Dependent on RBA's Move

Image © Adobe Stock

- GBP/AUD starts declining suggesting more weakness

- Potential for move down to channel trendline

- Pound to be moved by Brexit news

- Aussie to be moved by RBA decision

The Pound-to-Australian Dollar exchange rate is trading at around 1.8220 on Monday, after falling 1.42% in the week before, and the immediate concern for markets will be whether or not the Reserve Bank of Australia (RBA) cuts interest rates tomorrow.

If it does, it will be business as usual for the Aussie Dollar, however if the RBA opts to keep the interest rate unchanged the currency might rally and push the GBP/AUD exchange rate lower.

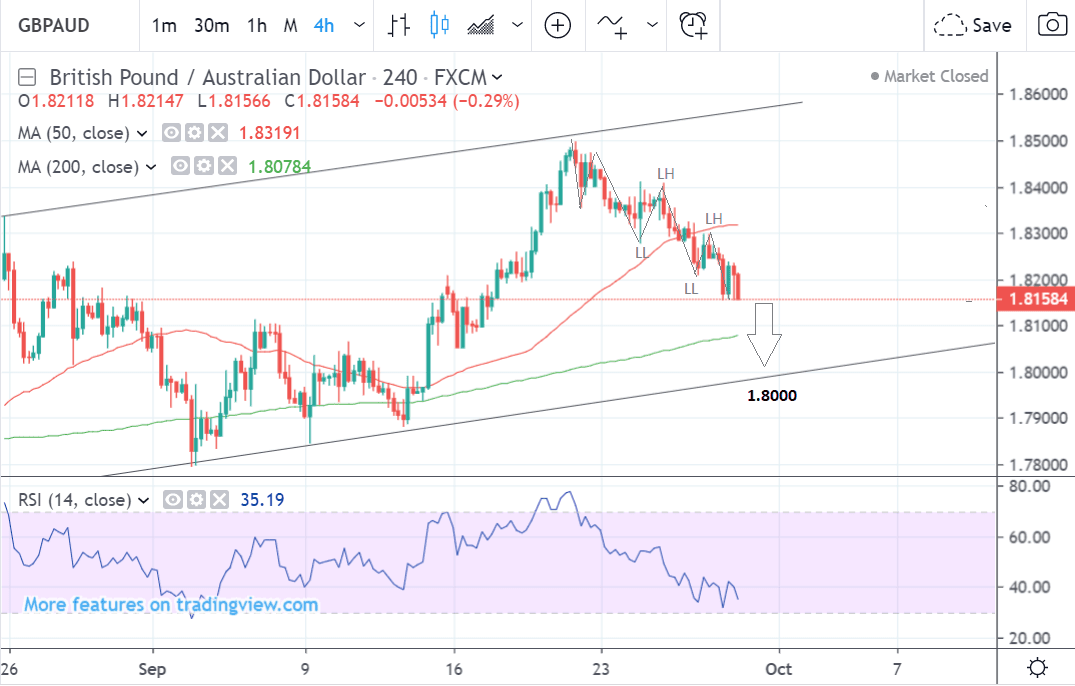

The GBP/AUD's 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair falling in a step sequence of declining peaks and troughs.

This could suggest the onset of a new short-term downtrend which - subject to confirmation - might run down to support from the lower channel line at 1.8000.

A break below the 1.8150 lows would provide the confirmation required to open the way to more downside down to the aforesaid target.

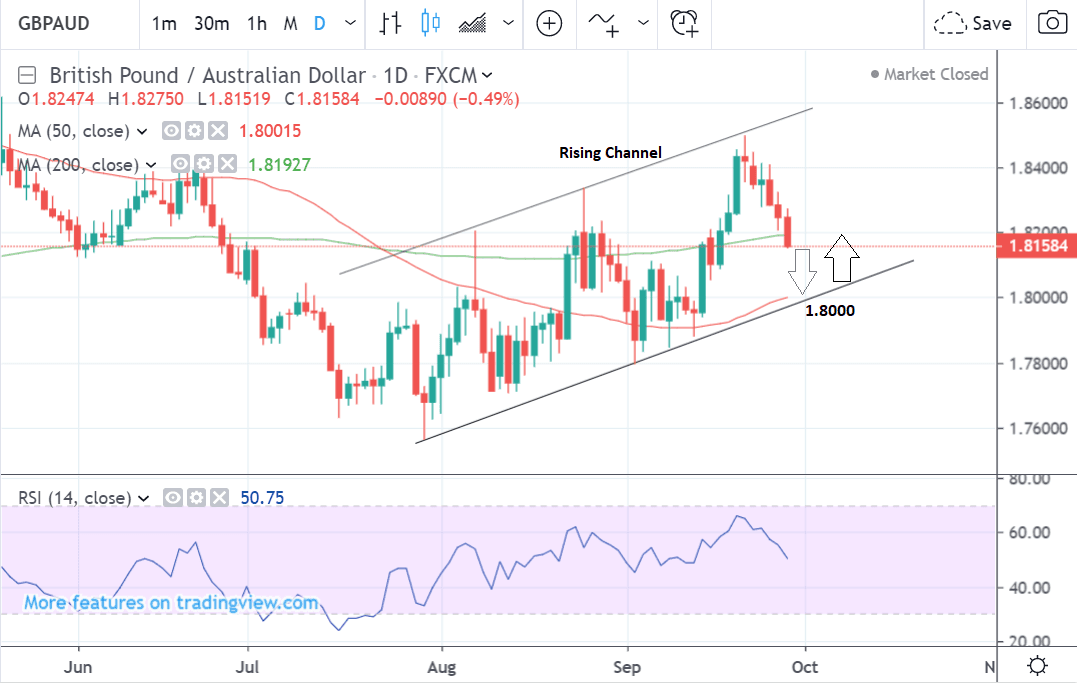

The daily chart meanwhile reinforces the bearish outlook conveyed by the 4hr chart and increases confidence in the 1.8000 target which happens to be at the same level as the 50-day moving average (MA).

Major MAs often provide strong support, reinforcing that provided by the lower trend channel line, and making it more likely to be a potential stopping point.

After that, there is a strong chance of a reversal higher: the pair has been in a rising channel and given ‘the trend is your friend’ this will probably continue.

If this is the case, one possible upside target might be the 200-day MA at 1.8200.

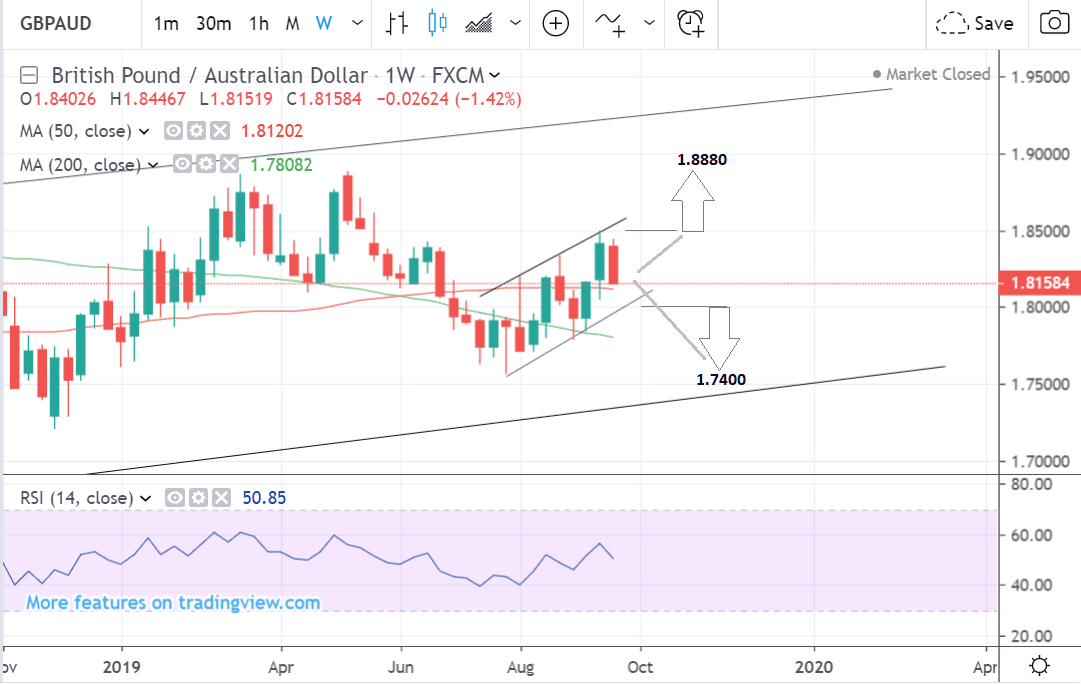

The weekly chart shows a more mixed picture.

Although the longer-term trend is bullish the pair has been oscillating greatly within that trend with extended periods when it fell as well as went up.

There is probably potential for a move either higher or lower depending on how the medium-term time horizon evolves.

A break above the 1.8500 level, however, would provide a strong bullish signal suggesting a continuation higher to a target at 1.8880.

A break below 1.8000 on the other hand would bring into focus the 1.7400 level near the lower trend channel line.

The weekly chart is used to give us an idea of the longer-term outlook, which includes the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Australian Dollar: What to Watch

The main event for the Australian Dollar in the week ahead is RBA policy meeting on October 1.

The consensus expectation is for a 0.25% rate cut from the RBA to help stimulate the flagging economy.

Normally negative - this has already been priced into the Aussie, suggesting more emphasis may be placed by traders on the contents of the accompanying statement and what that means for the outlook.

“As far as the Aussie is concerned a rate cut is more or less already priced in,” says Raffi Boyadijian, an economist at FX broker XM.com. “So what the RBA says in its statement will be more important for whether or not the Aussie goes higher or lower.”

In his most recent comments the governor of the RBA Philip Lowe sounded more optimistic about the outlook for the Australian economy, which might suggest the central bank statement could be more optimistic, lending the Australian Dollar support.

"The RBA announces rates tonight and our economists are in the minority looking for no change (20-7 for a cut in the Bloomberg survey), though they acknowledge it is a close call and note the RBA often delivers what is priced by the market, especially if a cut is likely at some point before year end so a move would probably not be surprising. Markets are about 80% priced for a cut at this meeting," says Adam Cole, a foreign exchange strategist with RBC Capital Markets.

However, in the same speech, Lowe also underlined the importance of keeping the Australian Dollar weak to aid exports and this could mean the RBA tempers any positivity of tone.

Another driver of the Aussie could be Chinese data out on Monday morning since Australia has close trade links with China leading some to have even dubbed it a ‘proxy Yuan’.

Chinese Manufacturing PMI is forecast to remain unchanged at 49.5 in September and non-Manufacturing to rise to 54.2 from 53.8, when data is released at 2.00 BST on Monday.

PMI’s are reliable leading indicators for the economy and the data could influence global risk appetite greatly if it comes out differently to what is expected.

A higher-than-expected reading should be taken as bullish for the Aussie, while a lower than expected reading should be taken as bearish for the Aussie.

The Pound: What to Watch

The main drivers for Sterling in the week ahead are the unfolding Brexit drama and PMI data.

The main risk to the Pound is that the government strengthens its position on taking the UK out of the EU on October 31 regardless of whether a deal is in place or not.

In reality, this would involve them finding a loop-hole around the so-called Benn Act - the law forcing it to seek an extension to the Brexit deadline if it does not have a deal by October 19.

The Observer on Sunday reports one law the government could invoke to get around the Benn Act is the Civil Contingencies Act 2004, which grants it special powers in the event of a national emergency to override parliament.

Another loophole would be that highlighted this week by John Major whereby the Government uses an ‘Order of Council’ to suspend the law, something which would not require the approval of either lawmakers of the Queen. Such a move, however, would be heavily criticised and almost surely challenged in the courts.

If either of these courses were taken in the week ahead they would have extremely negative knock-on effects for the Pound. However, we regard chatter of these methods as being highly speculative and therefore unlikely.

We feel the more pertinent story will come out of Parliament, which also has options which would impact on the Brexit saga in the coming week.

The first would be to bring a vote of no-confidence in the government, however, lawmakers are split on who should lead any possible care-taker government, with the Labour party and the SNP supporting a Corbyn-led government, but the Liberal Democrats and rebel Conservative MPs against the idea.

Another possibility is that a figure which is agreeable to everyone is appointed as caretaker PM instead.

A vote of no-confidence would bring a lot of uncertainty with unclear effects on the Pound, although initially, it might weaken it. It could raise the risk the UK could drop out of the EU anyway simply due to the clock ticking down in the midst of the political vacuum which would temporarily ensue during the wait for a general election.

One positive potential outcome for the Pound would be if the government managed to finally agree a deal with the EU and this is more possible given increased willingness on both sides to return to the table.

There is a possibility that the government’s recent proposals to solving the problem of the Irish backstop may be published in the coming week and these may also impact the Pound. If the proposals look workable Sterling could rise strongly.

"Sterling has room to recover if the Brexit situation moves towards a “deal outcome”, but a delay of the Brexit deadline to January or a snap election in the UK could push back the GBP rally into 2020," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan. "Caution still prevails regarding a possible agreement and at the same time the risk of a snap election in the UK remains."

On the data front, the main releases for the Pound are PMI data - survey-based leading indicators for the economy.

Manufacturing PMI for September is expected to show a decline to 47.0 from 47.4 when it is released on Tuesday, at 9.30 BST.

Services PMI for September is forecast to show a fall to 50.3 from 50.6 when it is released on Thursday, at 9.30 BST.

Construction PMI is estimated to show a show a decline to 44.9 from 45.0 when it is released on Wednesday, at 9.30 BST.

A lower-than-expected result would put pressure on the Pound and vice versa for a higher result.

This is especially true following recent comments from Micheal Sauders, an official at the Bank of England (BOE), who said the BOE may need to lower interest rates to help offset a slowdown in the economy.

Lower interest rates normally depreciate the local currency because they attract less money from foreign investors looking for somewhere to park their capital.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement