Pound-to-Australian Dollar Rate Forecast for the Week Ahead: Surge Higher Reinvigorates Uptrend

Image © Adobe Stock

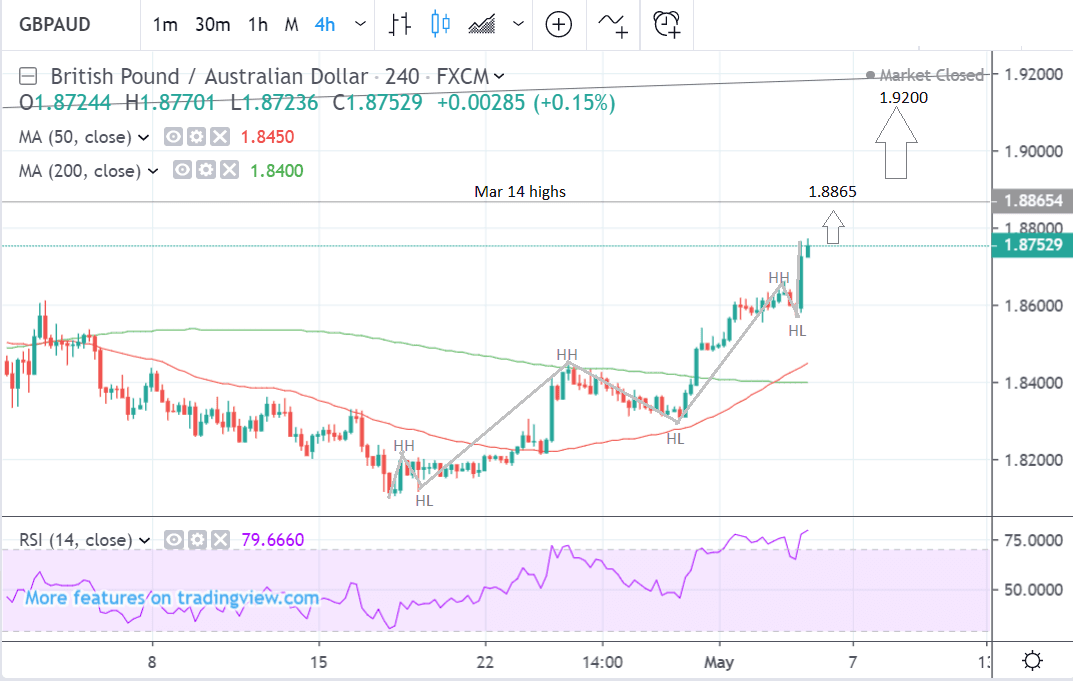

- GBP/AUD’s short-term trend rotates higher

- Bearish long-term chart pattern hypothesis fades

- Pound to be driven by Brexit debate; Aussie by RBA

The Pound-to-Australian Dollar rate is trading at 1.8758 at the start of the new week, virtually unchanged on Friday's close but the pair is still 2.2% higher than a week ago suggesting that while the Pound has seen a lacklustre start to the new week, it does enjoy an advantage short-term.

From a technical point of view, our studies believe the positive price action over recent days might have in fact altered the longer-term outlook.

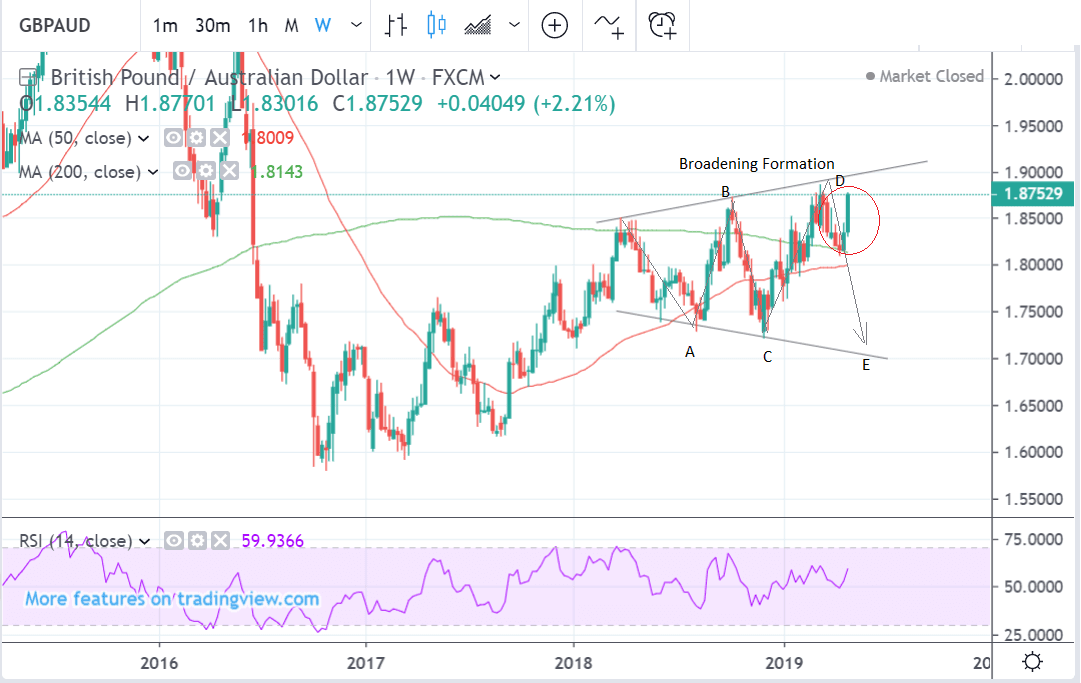

Previously we saw a possibility it could be forming a bearish broadening formation on the weekly chart, but since the strong recovery last week, that hypothesis seems less likely.

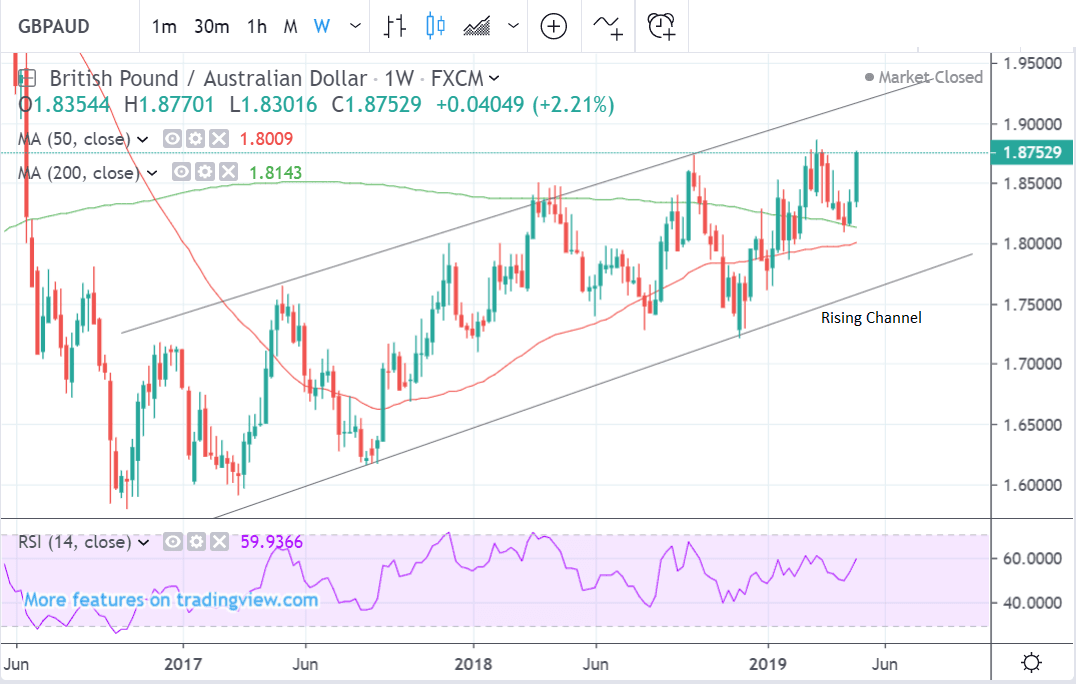

It now looks more likely that the pair is rising in a long-term ascending channel, instead.

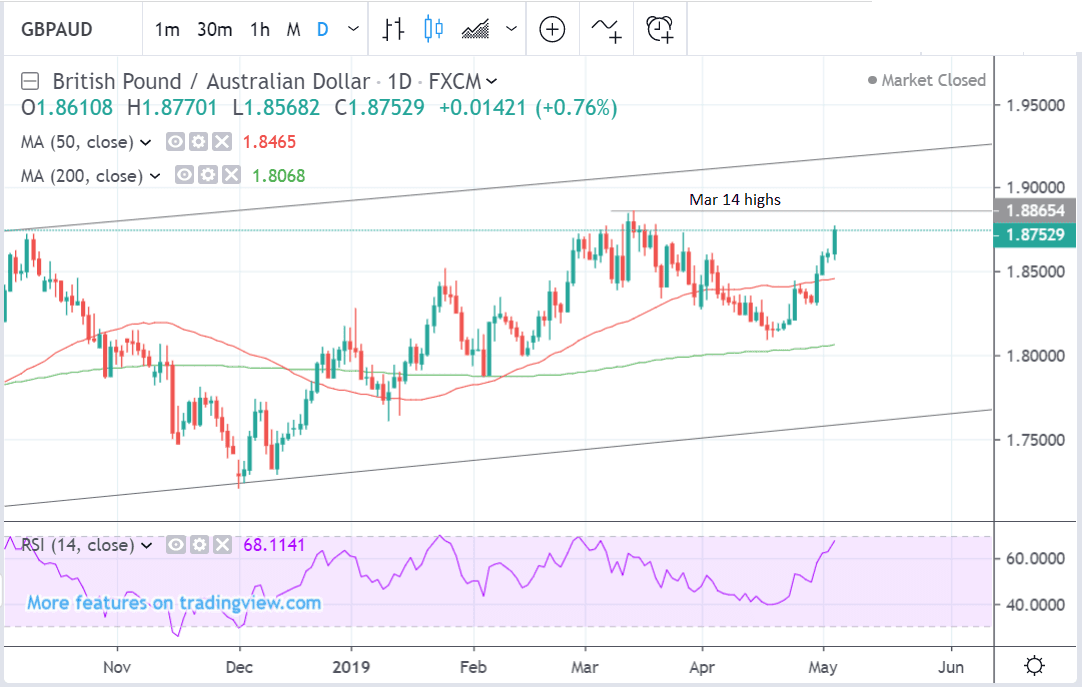

The next key level for the markets is at 1.8862, and the March 14 highs.

There is a strong chance the pair will continue rising up to these highs, especially if it can break above last week’s highs at 1.8770.

Further gains are then also possible, all the way up to the top of the ascending channel at roughly 1.9200, conditional on a break and daily close above the Mar 14 highs - or alternatively a move above 1.8900.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Australian Dollar: U.S.-China Trade Talks, RBA in Focus this Week

The Australian Dollar is actually not looking too bad at the start of the new week despite a decidedly negative start for global stock markets which would typically be met with sharp declines in the Aussie currency.

Global markets have fallen into the red on concerns that the U.S.‑China trade war may re‑escalate.

Until now, the mood on trade talks had been positive with growing expectations for a deal to be struck within days. However, U.S. President Donald Trump criticised China for dragging out the trade negotiations and that the U.S. will increase the tariff rate on $US 200 billion of imports from China from 10% to 25% on Friday.

President Trump’s announcement could be a negotiating tactic to speed up sealing a trade deal with the Chinese government, nevertheless markets must now contemplate seriously the imposition of tariffs.

Chinese and Asian markets fell on the news and it appears there has been contagion to western markets which are trading over a percent down.

The Aussie Dollar tends to fall in such 'risk off' conditions, while safe-havens such as the Yen tend to benefit.

But looking at the currency markets, the Australian and New Zealand Dollar's appear to be holding out suggesting the response function of these two currencies to global sentiment might have faded.

How long this robust response to global conditions lasts is hard to say, but we remain wary.

The main domestic event on the horizon for the Australian Dollar is the Reserve Bank of Australia (RBA) rate meeting at 5.30 BST on Tuesday, May 7.

The market consensus suggest an interest rate cut of 0.25%, taking the official cash rate (OCR) down to 1.25%, is a possibility.

But, on balance we would not expect such a move so close to Federal elections.

Therefore, a rate cut would come as a surprise that would have a notably negative impact on the Aussie Dollar.

The steep decline in inflation witnessed in recent first quarter CPI figures caused a deep sell-off in the Australian Dollar, as market expectations of an interest rate cut by the RBA increased.

Lower central bank interest rates usually weaken currencies as they attract less foreign capital inflows.

Recent labour market data has improved, however, offsetting some of the fears about low inflation, and this could result in the RBA maintaining a more upbeat a neutral bias on interest rates.

The main thing is that the market will be able to gauge the RBA’s updated view of the situation and its guidance on future moves. If there is discussion of a possible interest rate cut it could result in substantial weakness for the Aussie.

“The latest data on prices and the labour market have been mixed; inflation fell more than expected in the first quarter, but employment rose sharply in March,” says Raffi Boyadijian, an economist at FX broker XM.com. “However, markets clearly think the weakening inflation picture will be significant enough to force the RBA to slash rates over the coming months even if employment continues to rise at healthy levels. Interest rate futures imply a full 25 basis point rate reduction by July.”

“A weaker-than-expected inflation print will likely result in additional dovish statements from the RBA, while we will be focused on any indications that downside risks to the outlook are increasing. A rate cut at next week’s meeting is viewed as likely, with markets currently pricing in two policy rate cuts over the next 24 months,” say Wells Fargo in an economic briefing.

The other main data release for the Aussie in the coming week is retail sales and balance of trade data on Tuesday at 2.30.

The trade balance is forecast to show a A$4.25bn surplus in March from 4.8bn in the previous month. A smaller surplus is usually a negative sign for a currency.

Retail sales is set to rise 0.2% compared to the 0.8% rise in the previous month of February.

The Pound: May's Concessions to Corbyn, GDP

We expect Brexit to remain the major mover of the Pound over coming days as this week has been set as the deadline by Prime Minister Theresa May for a deal between Labour and the Conservatives to be agreed.

Reports over the weekend suggest May is prepared to offer Labour fresh concessions to allow the two sides to come together.

According to Tim Shipman, political editor at The Sunday Times, "Theresa May will take a final desperate gamble to deliver Brexit this week by offering Jeremy Corbyn three major concessions in a bid to force MPs to back a new deal."

On Tuesday, May is being tipped to make a “big, bold” offer to Labour.

This could well be the point at which we find out whether a cross-party compromise is possible.

However, there are fears the PM's offer "could split the Conservative Party down the middle," says Shipman.

Labour are demanding the UK enters into a customs union with the EU following Brexit, which would mean the country is unable to strike independent trade deals which has been a key test of Brexit for many in the Conservative Party.

Labour and the Conservatives might well strike a deal but both parties are deeply divided over the issue and therefore even a deal does not necessarily a majority in the House of Commons can be secured.

So while the news pulse has turned positive for Sterling over recent days, there are clear limits as the risk that no deal is done and the Prime Minister resigns remains substantial we believe.

The main economic release for the Pound is preliminary GDP data for the first quarter, out at 9.30 BST on Friday, May 10.

This is expected to show a 0.5% rise compared to 0.2% of Q4 which would suggest the economy remains robust in the face of the ongoing Brexit saga. On an annualised basis i.e extrapolated to provide a yearly estimate, GDP is expected to have rise 1.8% compared to the 1.4% previously.

Other key releases out at the same time are the trade balance for March, manufacturing production for March, industrial production for March and business investment (Q1).

Business investment is expected to remain especially subdued as it is one of the facets of the economy hardest hit by Brexit.

Another important release is Halifax house prices out at 8.30 on Wednesday, and speeches from the Bank of England's Cunliffe and Haldane on Tuesday evening.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement