Buy European Pharmaceutical Stocks on Strong Dollar Expectations, Sell Miners

A Stronger Dollar is Likely to Support European Pharmaceuticals Due to the Sector's 38% Exposure to the US Market, whilst the Mining Sector Should Underperform say Deutsche Bank.

Buying Pharmaceutical stocks and selling mining stocks is a good way to play a stronger US Dollar, says Deutsche Bank’s Equity Analyst Sebastian Raedler.

“We think a long position in European pharma relative to mining looks attractive,” says Raedler in a strategy note to clients.

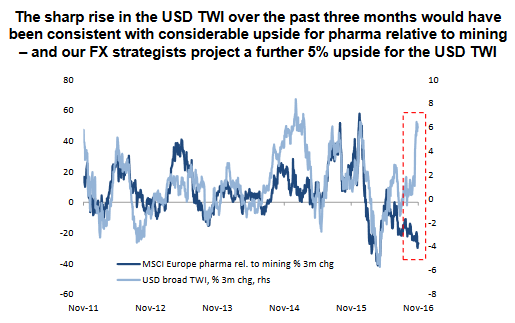

What’s more, though Pharma has outperformed Mining since the Dollar’s most recent rally it started from an extremely undervalued level relative to the Mining Stocks and therefore has ground still to make up (see chart below).

“Pharma has underperformed mining by 25% over the past three months. The more the USD strengthens the more likely this performance picture is to reverse,” added Raedler.

Deutsche’s FX Strategists, meanwhile, expect the dollar to rise by at least another 5% on the back of a mixture of, “a more aggressive Fed, the prospect of fiscal stimulus and the potential $1tn repatriation of corporate cash),”says Raedler.

This strengthening of the Dollar will provide the catalyst for higher Pharma stock valuations and lower Mining stock prices, as commodities which are priced in Dollars come under pressure.

Fundamental Backdrop to the Trade

Deutsche outline several catalysts to support their trade recommendation.

These include an expected Fed rate hike in December, which will push up the Dollar even further, supporting Pharma stocks.

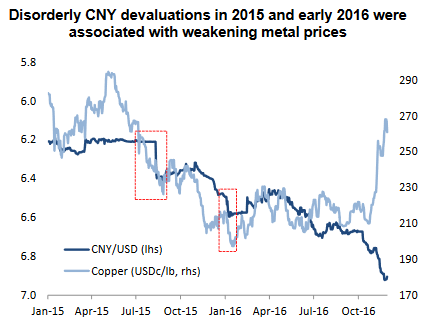

They see a risk of further devaluations of the Chinese Yuan as weighing on the outlook for commodities and therefore mining stocks, as China is one of the largest importers of commodities (see chart showing correlation below).

Recently the correlation between the weaker Yuan and Commodities has diverged, but they are now so far apart that they look overstretched and a return to a closer relationship is expected.

They see the current trend for European investors buying riskier assets, and therefore not Pharma, as vulnerable to change as a result of a “No” vote in the Italian Referendum, or some other political event.

Increasing political risk in Europe would probably make investors more defensive again, leading them back to Pharma stocks.

Finally, Raedler argues that Mining stocks may be hit by the rising Dollar as it will probably favour Pharma-linked Developing Markets, rather than Mining-linked Emerging Markets.