GBP/EUR Week Ahead Forecast: Wounded, Dip Buyers On the Ready

- Written by: Gary Howes

Image © Adobe Images

The Pound to Euro exchange rate is forecast to recover some of last Friday's losses over the course of the coming week, but much will depend on the release of UK and Eurozone PMI figures for April.

Pound Sterling fell in the final session of the last week following a speech by the Bank of England's Dave Ramsden, in which he boosted the odds of a June interest rate cut.

Speaking in Washington, Ramsden said he believes risks to the Bank's inflation forecasts are now tilted to the downside, suggesting he will lend his vote to a mid-year rate cut alongside Governor Andrew Bailey.

Money market pricing shows investor expectations for a rate cut coming as soon as May also rose, with two rate cuts for the totality of 2024 now being expected. In short, there has been a massive repricing in favour of UK rate cuts while expectations remain steady elsewhere, creating a sizeable selloff in the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

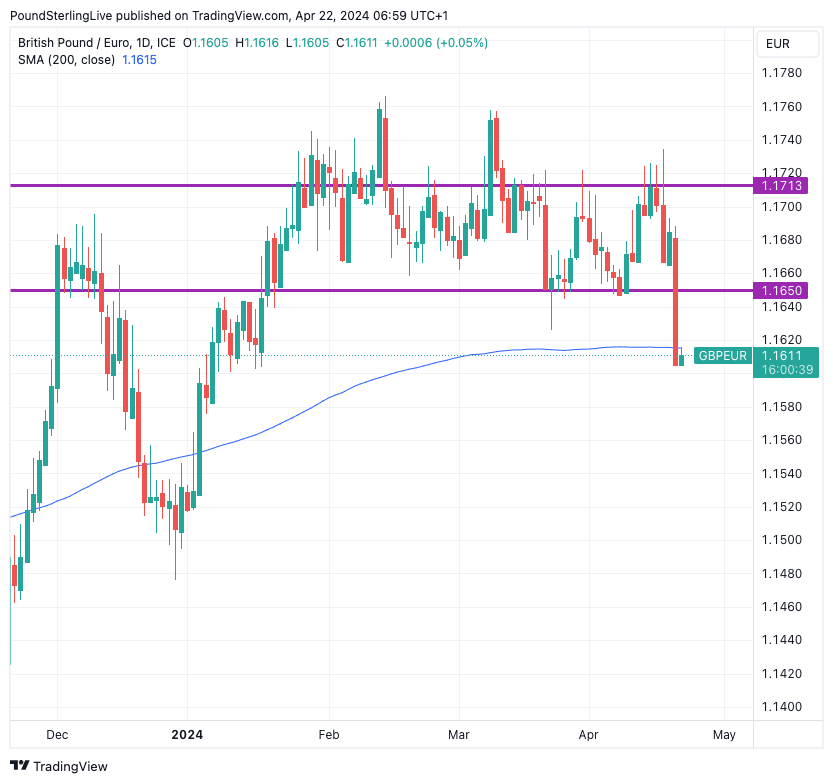

Technically, the outlook now turns negative, with Pound-Euro piercing the 200-day moving average (currently at 1.1615). Our Week Ahead Forecast rules rely heavily on this technical indicator to tell us where a trend lies; if the market is below the 200 DMA we judge a financial asset to be in a downtrend.

We note that the exchange rate is up slightly in Monday trade but is tapping against the 200 DMA. Unless a quick break back above this line transpires soon, it will become the new resistance level.

Above: GBP/EUR at daily intervals with the 200 Day Moving Average and the outlines of the previous 2024 range. Downside pressures are building from a technical perspective.

But, fundamentally, we question the move. Ramsden's comments only confirm that a synchronised rate cut path between the ECB and the Bank of England lies ahead. This has been a long-standing assumption in global FX and explains why the Pound to Euro conversion rate has been stuck in a tight range centred around 1.17 for much of 2024.

It is why we reckon Friday's selloff will be reversed in the coming days; we have not seen anything to suggest the established range should break and look for the exchange rate to turn back into its comfort zone.

We imagine there will be numerous market participants who view Sterling as a buy on dips against the Euro in current circumstances.

"We forecast there will be more downward pressure on EUR/GBP from a monetary policy-divergence perspective. Furthermore, the rise in crude oil prices have affected the terms of trade less in the UK than that of the euro area. Overall, we maintain a relatively positive bias on GBP vs. EUR," says Yusuke Miyairi, a foreign exchange strategist at Nomura.

Track GBP/EUR with your own custom rate alerts. Set Up Here

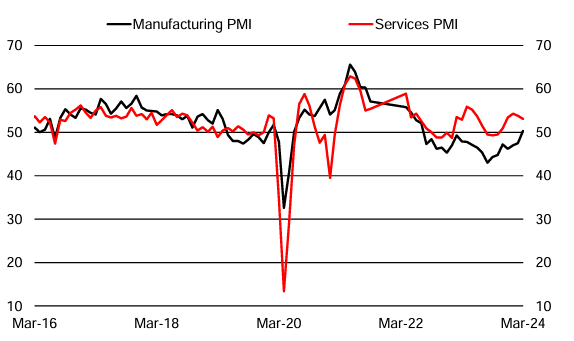

The Pound could prove volatile on Tuesday, as the PMI survey for April is released. This is the most timely of the major economic data releases that will give a steer as to how the economy started the first quarter.

The number to watch is the services PMI, where consensus looks for a reading of 53. Anything below this could extend the recent sombre tone in Pound Sterling.

"The flash services PMI likely eased to 52.5 in April. The pick-up in 1Q24, which was presumably related to the improvement in real incomes, is likely to prove short-lived as the labour market is now clearly weakening," says an economic preview note from UniCredit.

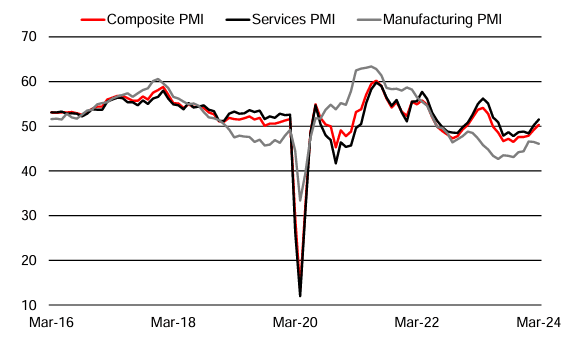

From a fundamental perspective, Pound-Euro direction will depend on how the UK print contrasts with the Eurozone release, out just half an hour earlier at 09:00. Markets look for the services PMI to read at 51.9 and the manufacturing PMI (this is important for the Eurozone owing to the centrality of German manufacturing) at 46.5.

Expect a weaker Pound to Euro conversion if the Eurozone figures surprise and the UK figures disappoint, and vice versa.

Image: UK PMI trends. Source: UniCredit.

Wednesday's German business climate findings will also be in focus, with the Euro potentially reacting to any surprises here. The market looks for the expectations index to read at 88.5 and the current assessment to read at 88.9.

Image: Eurozone PMI trends. Source: UniCredit.