Eurozone's Two-speed Economy Confirmed by PMIs

- Written by: Sam Coventry

Image © Adobe Images

It is a mixed bag for the Eurozone economy this March, as the region's services sector continues to recover, but manufacturing remains frozen in contraction territory.

At the same time, areas like Greece, Spain and Italy continue to outperform the big economies of Germany and France, underscoring an emergent two-speed economy.

The Eurozone's service sector moved further into expansion mode with a PMI of 51.1 for March, which exceeds Ferbuary's 50.2 and the consensus expectation for 50.5.

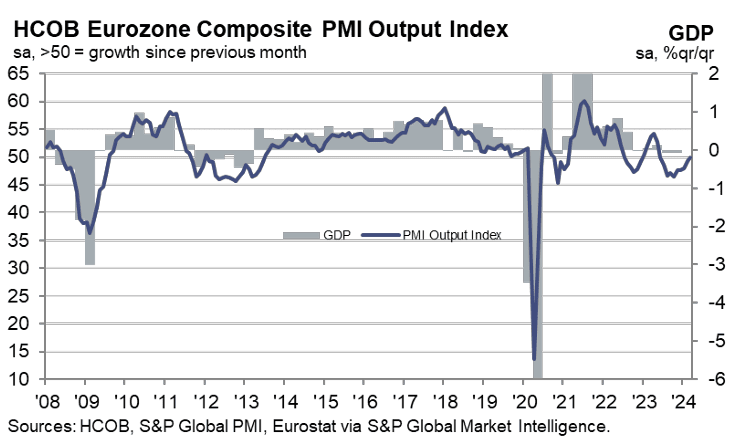

Above: The PMIs are consistent with a flatlining Eurozone economy and don't challenge market bets for a June ECB rate cut.

But, the manufacturing PMI disappoints with a fall from 46.5 in February to 45.7 (vs. exp. 47). The result is a composite PMI at 49.9, a shave below the key 50 level that marks the border between growth and contraction. This is nevertheless higher than February's 49.2 and the expected 49.7.

According to S&P Global, the composite reading confirms that business activity in the Eurozone came close to stabilising this month. "The composite PMI increased from 49.2 to 49.9 in March, the best reading since June last year. Green shoots are emerging for later this year, but expect continued economic stagnation for now," says Bert Colijn, Senior Economist for the Eurozone at ING.

The PMI figures again confirm one of the more extraordinary developments of recent times: the divergence in fortunes between the core Eurozone economies of Germany and France and the periphery.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The PMIs report ongoing falls in output in France and Germany, offset by "a gathering upturn" in the rest of the eurozone, which S&P Global says points to "an uneven economic picture".

Weighing Germany down is its subdued industrial sector, which has never really recovered from the gas price shock that followed Russia's invasion of Ukraine. The Germany manufacturing PMI read at 41.6, below February's 42.5 and below expectations for 43.1. Germany's most important sector remains locked in the deep freeze.

The rest of the eurozone (excluding France and Germany) collectively report growth of output for a third successive month, with the rate of expansion reaching an 11-month high.

The implications of this report for the European Central Bank (ECB) - and therefore Euro exchange rates - will be limited; there is nothing that will dispute market expectations for a June rate cut.

The slow output of France and Germany is hardly consistent with significant demand-lead risks to inflation that would delay a hike.

At the same time, the PMI report revealed service sector input cost and selling price inflation rates meanwhile remained elevated by historical standards due to higher wage costs. However, a cooling in the pace of increase in cost burdens was recorded to take some pressure off overall selling price inflation.