April a "Sweetspot" for Pound Sterling, Potential For Recovery Against Euro and Dollar

- Written by: Gary Howes

-

Image © Pound Sterling Live

April is typically favourable for the British Pound, and analysts say that the currency can appreciate against the Euro and Dollar.

Seasonal considerations can be an important catalyst in foreign exchange markets, and for Pound Sterling, no month is more supportive than April.

"April ranks among the best months of the year for the pound thanks to the repatriation by corporates of overseas FX for dividend payments. The average percentage monthly gain of the last ten years in April is 0.8%. The standard deviation is 2.2%," says Kenneth Broux, a foreign exchange analyst at Société Générale.

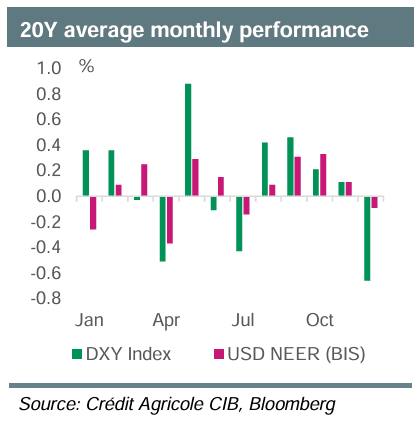

Image courtesy of Crédit Agricole.

Broux says gains are particularly noticeable in the Pound to Dollar exchange rate, but the Pound to Euro exchange rate also benefits.

"The pullback in GBP/USD attracted buyers right on the 200dma (1.2591). This could be the prelude to a rally back over 1.28 towards 1.30 if seasonality is a guide," he says. "Seasonality in April is also typically bearish EUR/GBP."

Kamal Sharma, FX Strategist at Bank of America, says "April is the sweet spot for GBP. If history is any guide, a test of $1.30 in GBP/USD is likely."

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

He cautions that positioning in the UK currency is looking stretched relative to the last ten years, which could hinder GBP's upside potential.

Sharma's analysis was printed ahead of the Bank of England's March policy decision, which prompted a 1.0% selloff in the Pound-Dollar exchange rate. We assume this would impact Sterling's upside reach.

However, the latest set of FX market positioning data reveals a significant reduction in overbought conditions since Sharma's research was published.

Analysts at Crédit Agricole say their suite of FX positioning models shows GBP positioning to have dropped from recent extremes following recent selling pressures. This means the positioning overhang will have faded ahead of April's favourable GBP flows.

"Our FX flow data points at banks, corporates, hedge funds and real money investors inflows. All in all, the GBP is no longer in overbought territory," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Bank of America continues to project a higher GBP through 2024, but the UK General Election and potential changes in economic policy complicate its 2025 forecasts.

"In addition, we remain concerned about structural underpinnings of the UK economy - the large current account deficit; ability to attract long-term investment inflows; large public sector deficit," says Sharma.