Pound Sterling Falls After Bank of England Takes a Step Towards a Rate Cut

- Written by: Gary Howes

-

Image © Adobe Images

The British Pound fell after the Bank of England took a step closer to cutting interest rates, however, weakness will be limited as the Bank continues to warn of inflationary risks and a need to be patient.

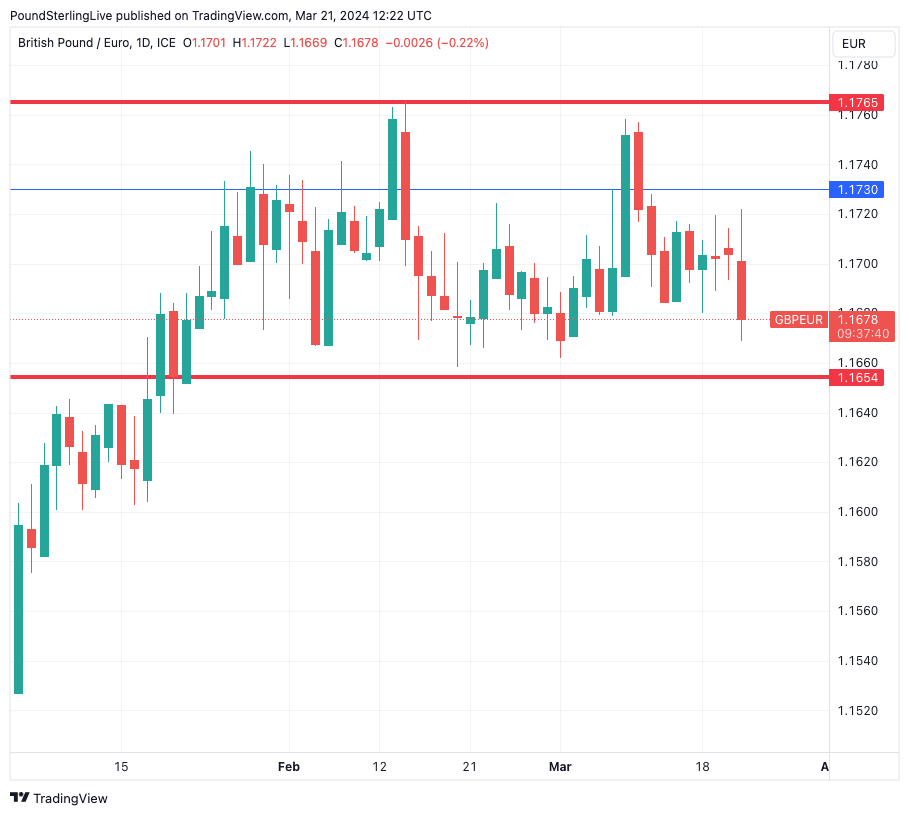

The Pound to Euro exchange rate fell 0.40%t to 1.1658 after the Monetary Policy Committee (MPC) voted by a majority 8-1 to keep interest rates unchanged at 5.25%, with one member voting for a cut.

Two members voted for a hike at the February decision, meaning their vote switch represents progress towards a rate cut in the coming months and explains the Pound's weakness. "This is the dovish pivot the market has been waiting for. No one voting for a hike opens the door to rate cuts in June," says Kathleen Brooks, an analyst at XTB.

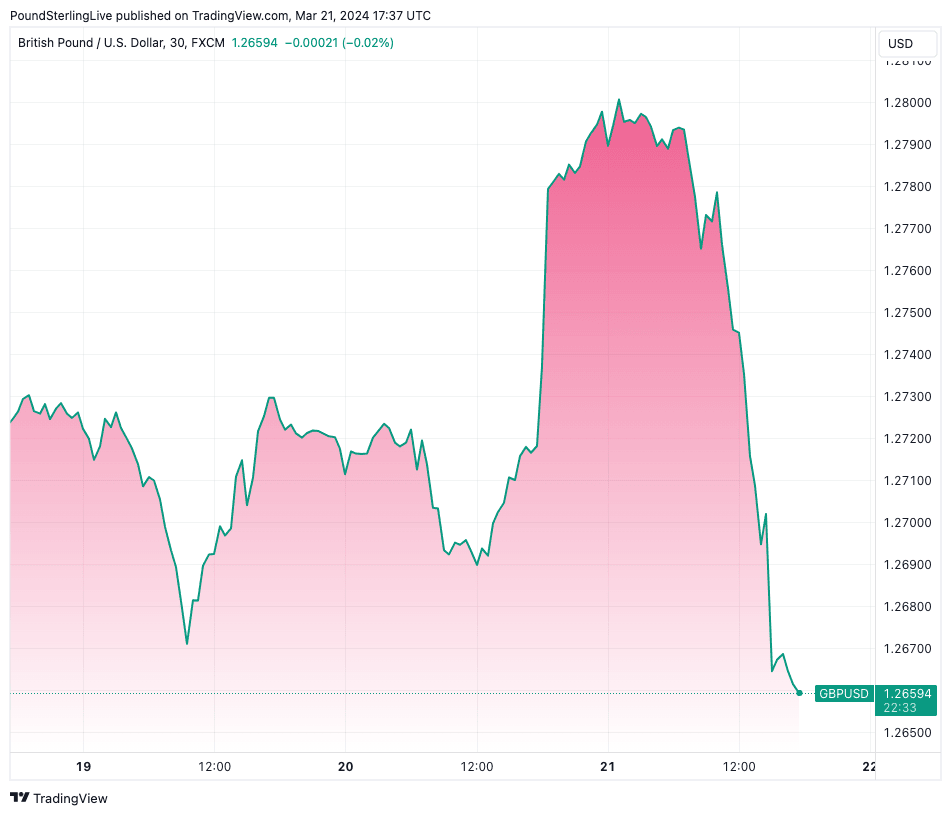

The Pound to Dollar exchange rate gave up more post-Fed gains to trade lower by 0.43% at 1.2730.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

In its statement, the Bank said, "the stance of monetary policy could remain restrictive even if Bank Rate were to be reduced, given that it was starting from an already restrictive level".

This suggests the Bank believes it can cut interest rates without running the risk of reawakening inflation.

Konstantinos Venetis, an analyst at TS Lombard, says, "this is a tell-tale sign that the bar for rate cuts is shifting somewhat lower".

The market implied odds of a June rate cut rose to approximately 80% following the developments.

"We maintain our call that the first rate cut will come in June, with two further 25bps cuts lowering Bank Rate to 4.5% at the end of this year," says Andrew Goodwin, Chief UK Economist at Oxford Economics. "The inflation trajectory now looks well set and the need to maintain a very tight policy stance to guard against second-round effects looks less convincing."

Above: GBP/USD at 30-minute intervals showing the post-Federal Reserve rally followed by the post-Bank of England selloff. Track GBP rates with your own custom rate alerts. Set Up Here

Pound Sterling downside will nevertheless be limited by ongoing signs of caution that point to the first rate cut only landing in June or August.

The Bank said, "inflationary pressures have continued to abate, though by slightly less than expected... Material risks remain, notably from developments in the Middle East, including disruption to shipping through the Red Sea."

The decision comes just hours after the March PMI report revealed building inflationary pressures at UK private sector businesses, something the Bank will be keen not to stoke by cutting interest rates.

The PMIs also confirmed an economic recovery extended into March, which the Bank reflected on, noting "business surveys remain consistent with an improving outlook for activity."

The accompanying statement was relatively unchanged, confirming the Bank is keen to ensure markets don't radically alter expectations for the amount of rate cuts to come. In particular, it noted, "key indicators of inflation persistence remain elevated. Monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target."

While Pound exchange rates have fallen as an initial reaction to the Bank's March decision, weakness will likely be limited as the Bank remains on course to cut alongside the ECB and Federal Reserve mid-year, meaning we would anticipate recent ranges to remain intact.

Above: The GBP/EUR range is likely to hold. Track GBP rates with your own custom rate alerts. Set Up Here

The Bank's latest decision follows the release of inflation midweek that showed a faster-than-expected fall in the headline rate. However, the all-important services inflation rate stood at 6.1%, which is far too high for the Bank's liking.

If anything, the Bank could still cut interest rates after the Fed and ECB, according to some analysts.

"The slowdown in CPI revealed on Tuesday did not sway the Bank of England. Service inflation remains too strong for comfort and the recent rebound in real estate activity data raises the specter of a second wave of inflation. As a result, the MPC remains on track to be the last major central bank to cut rates. It could even start doing so later than the August meeting anticipated by the SONIA curve," says Mathieu Savary, Chief Strategist for the European Investment Strategy at BCA Research.

If this call is correct, the Pound can maintain its outperformer status for a while yet.

"Overall the required caution on monetary easing will continue to support the pound, which remains the top performing G10 currency year-to-date along with the US dollar," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank Ltd.