South African Rand Vulnerability Lingers after Market Sets High Bar for SARB

- Written by: James Skinner

-

- ZAR in tentative recovery as USD demand eases

- But remains July underperformer ahead of SARB

- Market pricing of SARB outlook a potential pitfall

- 0.75% step in July, 2% more in 2022 a tall order

- SA inflation data in focus before SARB decision

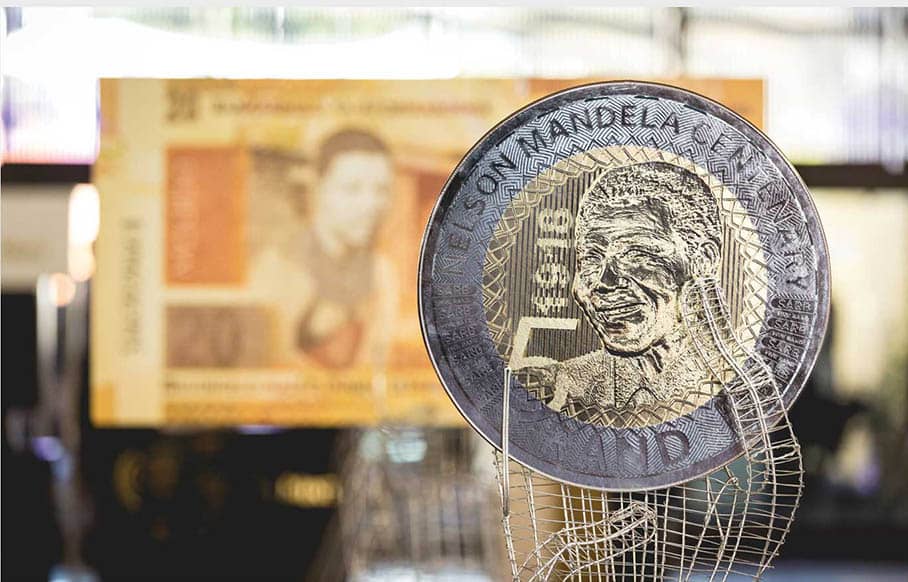

Image © SARB

The South African Rand benefited from a widespread retreat by the U.S. Dollar early in the new week but it remained an underperformer for the month of July and potentially faces risks associated with the high bar that financial markets have set for South African Reserve Bank (SARB) this Thursday.

South Africa’s Rand pushed a retreating Dollar back below the 17 handle on Tuesday but ceded ground to Pound Sterling and other European currencies, which rallied for a second session on the run amid market excitement over Thursday’s European Central Bank (ECB) policy decision.

But while international developments may have been a part of why the Rand lagged behind some other currencies on Tuesday, they don’t fully explain its continuing underperformance for July and there are now domestic event risks lurking on the immediate path ahead of the currency.

“The focus this week locally will be on the outcome of the SARB MPC on Thursday. The foreign exchange markets remain at the mercy of the USD,” says Walter de Wett, a fixed income and currency strategist at Nedbank.

| 5% | ... More Currency Achieved on Our Transfers Than a Typical Bank Delivers. |

| Get Your Quote |

“The short-term technicals suggest a possible extension to 16,8000 in this recovery phase, although the markets are likely to be exceptionally cautious ahead of the SARB event later in the week. Possible trading range for the rand today: 16,8000 to 17,3000,” de Wett and colleagues said on Tuesday.

The highlight of the week ahead for the Rand is Thursday’s interest rate decision from the SARB and one possible reason for the currency’s subdued state on Tuesday is the discrepancy between economist and financial market expectations for the decision.

Consensus among economists suggests the SARB is most likely to lift the cash rate by a further 50 basis points, taking it up to 5.25%, although financial markets have priced-in a larger 0.75% uplift since soon after the Federal Reserve (Fed) lifted U.S. rates in that increment back in June.

“We expect SARB (Thu) to hike policy rate by 75bp against Bloomberg consensus of 50bp, but broadly in line with rates market pricing. If our forecast materializes ZAR should remain broadly unchanged,” says Sheryl Dong, an FX and emerging market macro strategist at Barclays.

“We see, however, risks to our call with SARB opting for a smaller 50bp hike due to weak economic momentum, and decreasing global commodity prices. In that case, ZAR should weaken,” Dong wrote in a Monday research briefing.

| 5% | ... More Currency Achieved on Our Transfers Than a Typical Bank Delivers. |

| Get Your Quote |

Dong and the Barclays team flagged on Monday that markets are banking on the SARB lifting its cash rate by some 200 basis points more, or 2%, before the year is out, which may be a tall order for an economy where inflation has only just recently risen above the central bank’s target band.

The South African inflation picture could change, however, and as soon as this Wednesday when economists expect that figures for June will show the main inflation rate rising sharply while the core inflation rate remains below the midpoint of the three-to-six percent target band.

Consensus among economists suggests South Africa’s main inflation rate will rise from 6.5% to 7.2% for last month but that core inflation, which overlooks energy and food prices, will merely edge higher from 4.1% to 4.2%.

“Large upside surprises would increase the probability of a more aggressive tightening,” Barclays’ Dong said of the inflation data on Monday.

The South African Reserve Bank got ahead of the Fed when lifting its cash rate by 0.5% to 4.75% back in May but since then financial markets have leapfrogged the SARB by pricing-in a much steeper interest rate cycle than prior SARB forecasts had suggested was likely.

May’s economic forecasts and underlying assumptions suggested the SARB would likely need to lift its cash rate by 150 basis points over the 18 months out until the end of 2023, although financial market pricing implies an expectation that more than this be delivered in 2022 alone.

This sets a high bar for the Rand to avoid further depreciation and especially as the ECB is reported to be toying with the idea of a 50 basis point increase in its interest rate this month and given that the Fed is widely expected to go on lifting its cash rate in increments of 0.75%.

That leaves a lot riding on Wednesday’s inflation figures and especially the core inflation number, which is widely seen as a better measure of domestic price pressure and will be a key determinant for the SARB’s judgement of the extent to which rates might need to rise further up ahead.

"Core goods inflation is forecast higher throughout the horizon, while core services inflation is unchanged in 2023 and 2024. The risks to the inflation outlook are assessed to the upside," the SARB said in May.

"The implied policy rate path of the [Quarterly Projection Model], given the inflation forecast, indicates gradual normalisation through to 2024. As usual, the repo rate projection from the QPM remains a broad policy guide, changing from meeting to meeting in response to new data and risks," the bank also said.