South African Rand at Risk of Being Downgraded to a Developing Market Currency says Investec

- Written by: Gary Howes

-

Image © Adobe Images

- GBP/ZAR reference rates at publication:

- Spot: 19.87

- Bank transfer rates (indicative guide): 19.18-19.31

- Transfer specialist rates (indicative): 19.69-19.73

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The South African Rand is at risk of being downgraded from an Emerging Market to a Developing Market currency says a noted South African economist, offering a stark warning to the country's leaders that significant reform is now required.

Annabel Bishop, Chief Economist at Investec, says in a regular research briefing note that volatility in the currency could become increasingly elevated unless the government promotes significant private sector investment.

"The rand will likely always be a volatile currency, certainly as long as it remains an EM currency, and insufficient regulatory reform has occurred in SA in order to boost the economic growth outlook sufficiently to expect a positive change in the economy's trajectory," says Bishop.

An Emerging Market (EM) is one that is defined by its rapid economic growth and development that raises household incomes and deepens capital markets, eventually allowing the country to evolve into a developed nation.

This differs from a Developing Market (DM) which is loosely defined as one that has little market liquidity, marginally developed capital markets, and lower per capita incomes vis à vis the more developed emerging markets like Brazil and China.

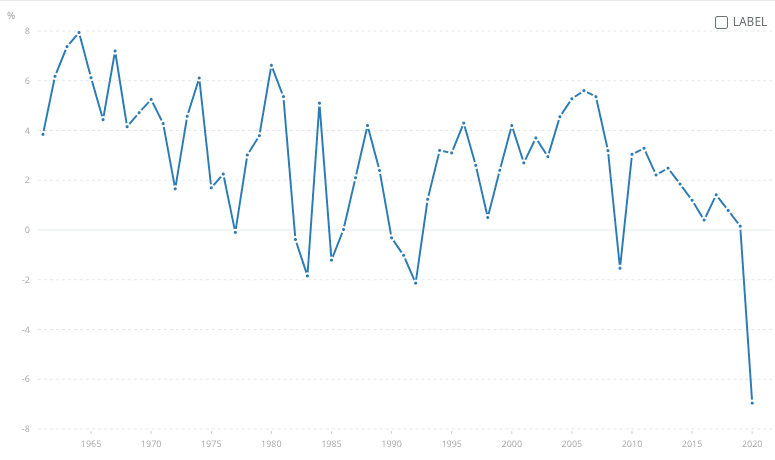

South African economic growth in the decade following the ending of apartheid was of a pace consistent with that of typical EM country:

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

However, since 2007 GDP growth has trended lower and has never recovered above 5.0%, falling steadily into the 2020 plummet caused by the Covid crisis.

As can be seen in the above chart, South Africa's economy was trending in the wrong direction beven efore the Covid shock and Bishop warns South Africa's status as an EM country is now in question.

"If anything, SA risks falling out of the EM market and also the middle-income economies categories, into developing markets and low income economies categories, which would then bring on even more volatility for the domestic currency," says Bishop.

Bishop says central to the Rand's outlook are trends in global commodity prices which have eased lower since May, but are still elevated relative to March 2020.

"South Africa is a commodity exporter, particularly metals, minerals and food commodities, and the higher prices benefitted SA’s trade balance, economic growth and SARS revenues, but more exploration of mines is desperately needed and so a change in state regulations," explains Bishop.

Owing to near-term support in industrial metals the Rand "could see further strength, with the rand to date the third strongest EM currency this year."

But the longer-term dynamics remain concerning.

"SA continues to lean heavily towards socialism in its policy making, including the newly proposed state pension fund which most of the employed reject as they fear the loss of their pension contributions through corruption and looting, among other malfeasance," says Bishop.

The economist says the ruling party and its allies in the tri-partite alliance need to abandon the disincentivising "prohibitive policies" holding back the mining sector.

The sector requires "rapid expansion" and this can only be driven by private investment says Bishop, "with much to be gained on the fiscal revenue side, as well as jobs".