South African Rand Forecasts Upgraded but Debt and Infrastructure Still Mar Outlook

- Written by: James Skinner

-

- ZAR softens with global stocks ahead of current account figures.

- But new Commerzbank forecasts suggest limited ZAR downside.

- ZAR seen holding near current levels, advancing further in 2021.

Image © Government of South Africa, reproduced under CC licensing. © Lefteris Papaulakis, Adobe Images

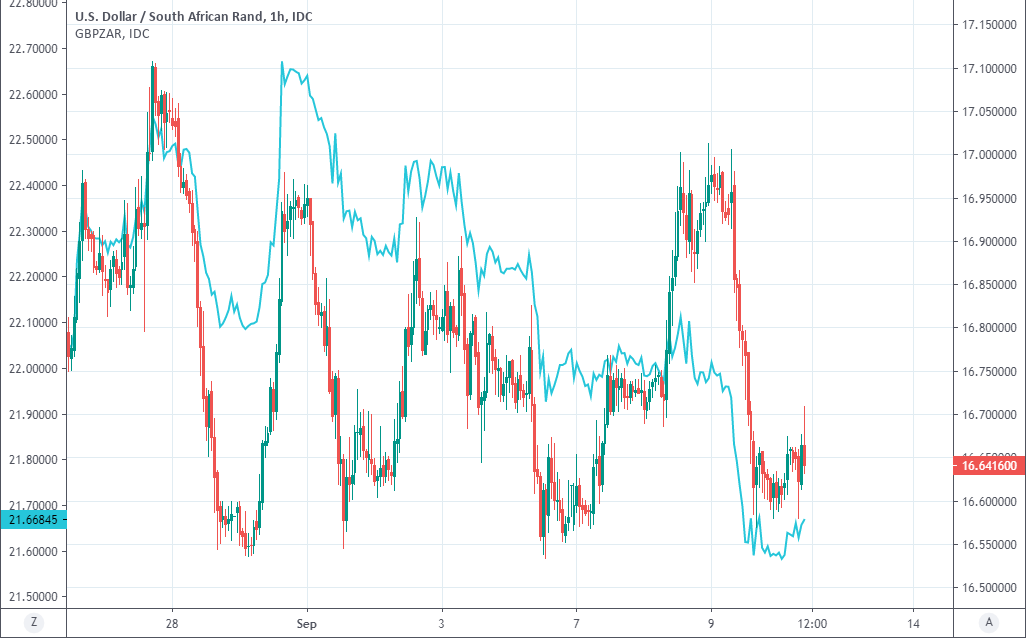

- GBP/ZAR spot rate at time of writing: 21.64

- Bank transfer rate (indicative guide): 20.88-21.03

- FX specialist providers (indicative guide): 21.32-21.45

- More information on FX specialist rates here

The Rand softened on Thursday but newly upgraded forecasts from Commerzbank suggest it can hold on near to its current one-month highs through year-end, although crumbling infrastructure and long established concerns about debt levels still mar the medium-term outlook.

South Africa’s Rand was on the back foot alongside some international stock markets and as investors awaited Statistics South Africa’s estimate of the second-quarter current account balance, which consensus estimates suggest will have swung back into a deficit after registering its first surplus for 17 years in the opening months of 2020.

But the latest forecasts from Commerzbank suggest the Rand won’t fall far from current levels in the short-term and that a further shallow recovery could be seen in the early months of next year, although the projections require ongoing weakness in the U.S. Dollar, healthy investor appetite for emerging market currencies and collegiate U.S.-China relations.

“Global risk sentiment remains a key driver for the rand. Disappointments and setbacks are expected to continue to characterize the rather sluggish global recovery. However, the prospect of a global long-term low interest rate environment in particular should help to further improve risk perception — measured by our ARPI — in the medium term as the pandemic ebbs,” says Elisabeth Andreae, an analyst at Commerzbank. "We see favorable conditions for a further recovery of the EM currencies and thus also of the rand."

Above: USD/ZAR rate shown at hourly intervals alongside Pound-to-Rand rate (blue line, left axis).

A rising global tide can lift South Africa’s Rand alongside other emerging market currencies but exacerbated debt levels and the economic constraints imposed by crumbling infrastructure are expected to act like an anchor beneath the waves that prevents the ship from drifting too far from current levels.

South Africa had already seen its credit rating downgraded to ‘junk’ at all three of the major ratings agencies before the coronavirus pandemic struck, although the pneumonia-inducing disease is expected to add at least the RS500 bn cost of pandemic-related grants, loans and debt guarantees to the balance sheet, bringing the country a step closer to a debt crisis.

Commerzbank says a debt crisis is a “a longer-term risk” but that in the short-term at least, the low level of interest rates elsewhere in the world will ensure that South African government bond yields remain attractive enough to investors for the state to be able to continue funding public services.

“In view of the ongoing problems in areas such as the electricity supply, we expect the economy to recover only slowly. Only with the implementation of urgently needed reforms should it be possible to boost investment and macroeconomic activity. Without sufficient growth, unemployment, poverty and national debt are likely to increase further,” Andreae says. "Given the fragile economy, the currency remains vulnerable, especially if global risk aversion increases again. The ZAR downside risks include not only an unfavorable course of the pandemic, but also renewed fears of an emerging market crisis or an escalation in US-Chinese (trade) relations."

Above: USD/ZAR rate shown at daily intervals alongside Pound-to-Rand rate (blue line, left axis).

South Africa’s economy shrank at an annualised pace of -51% in the second quarter amid the ‘lockdown’ used to combat the coronavirus, with manufacturing, international trade and transport industries hit the hardest.

But the path to recovery is expected to be slow in part because of crumbling infrastructure that includes a creaking and troublesome electricity grid which, after years of underinvestment and improper management, imposes limitations directly on the economy.

At the best of times South Africa’s electricity grid often proves unable to sustain prevailing levels of economy activity even when that level of activity is substantially below what economists and analysts consider to be the economy’s actual capacity for production.

“The economy continues to suffer from load shedding and the hoped-for acceleration of the reform process is lagging further behind. The number of new infections is slowing down and pandemic-related restrictions have been further relaxed. However, the strained public finances do not permit major economic stimulus,” Andreae says. “The restructuring and reorganization of highly indebted state-owned enterprises is high on the agenda — it is crucial for the country's economic recovery and creditworthiness. A major reason for the hesitant progress in reform is the ongoing power struggles in the ruling ANC (African National Congress) and in the cabinet, as supporters of former president Jacob Zuma continue to be represented in both. Political disputes — for example in the fight against corruption or over the possible use of further IMF aid — could make crisis management more difficult and jeopardize trust in the government. We assume, however, that president Cyril Ramaphosa will be able to gradually get the reform process underway.”

Commerzbank forecasts the Rand will weaken a touch into year-end, enabling USD/ZAR to lift from 16.66 on Thursday to 16.70, which is an upgrade from an earlier year-end USD/ZAR forecast of 17.0. The Pound-to-Rand rate on the other hand, is expected to rise from 21.66 to 22.07, which is a downgrade for Sterling and upgrade for the Rand from an earlier forecast of 22.44.

The Rand is expected to peak mid-2021 after pushing USD/ZAR down to 16.30 aalthough the Pound-to-Rand rate is seen rising further to 22.18 in that time.