Japanese Yen is "Undervalued" and Likely to Rise says Queen's Banker, Coutts

- Yen likely to appreciate as demand increases amid bargain valuation.

- Technical studies suggest establishment of Yen uptrend in most pairs.

- USD/JPY story is more complicated as US Dollar strength to endure.

Image © Adobe Stock

The Japanese Yen is undervalued and especially sensitive to shifts in its central bank's monetary policy - or hints of them - which suggests it may rise in the months ahead, says Shanti Keleman, a director and investment adviser at Coutts and Co.

The currency has been a popular go-to for investors fleeing the Turkish currency and emerging market crises. This combined with other factors, such as its extreme undervaluation and that fact that interest rates (bond yields) only one way to go - which is up - make it an attractive play.

"If you look at the Yen it looks pretty undervalued, and I think the central bank rumblings earlier in the month are a reminder of the heft and global influence of the Japanese central bank, and any move forward on interest rates, or forward guidance, would boost the currency," Keleman says, in an interview with Bloomberg TV.

Last week, Pound Sterling Live noted how the currency is the most undervalued based on a combination of the REER (Real Effective Exchange Rate) valuation and the PPP (Purchasing Power Parity) models.

REER is a measure of how fairly a currency is priced against a basket of its most highly traded peers. PPP uses the difference in cost of a basket of similar goods - or universal item such as a McDonald's hamburger - in two different currencies to determine currency valuation.

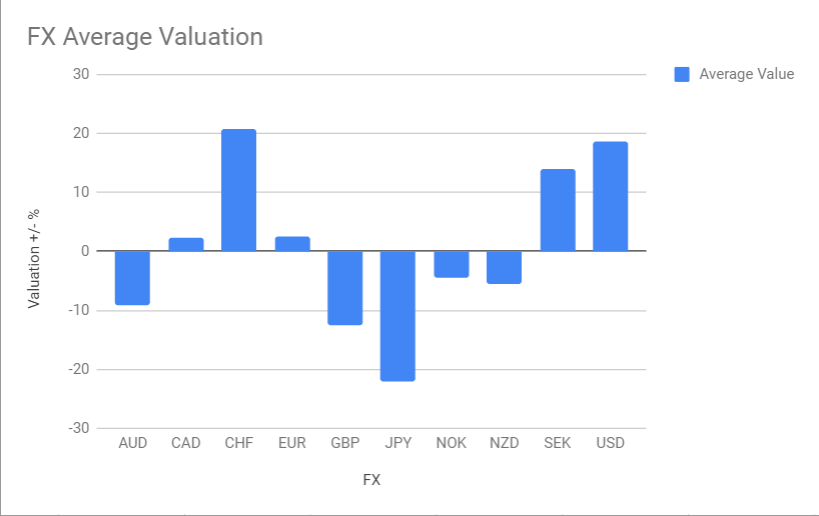

Above: FX Valuations. Source: Pound Sterling Live.

The valuation comparison above shows the Yen is the most undervalued G10 currency, followed by the Pound and the Canadian Dollar, while the Swiss Franc and US Dollar are the most overvalued.

Currencies that are grossly out of whack with their modelled value are normally expected to drift back towards that "fair value" over time, further suggesting the Yen could be due a period of strength.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

USD/JPY Outlook

It is a testament to the market's vaunted outlook for the Japanese currency that option traders appear to be bearish in their outlook for the USD/JPY rate at a time when the markets couldn't be more bullish on the US Dollar.

"USD/JPY may have rebounded from 110.11 to 111.43, but option flows suggest the market is still more concerned about a setback than an extension," says Richard Pace, a correspondent with Reuters. "it's pricing in heightened potential of a test toward 109.00 over coming sessions. Demand has been steady for 109.00 strike JPY calls, which would allow the holder to sell spot at 109.00 at expiry, mostly within a six-week horizon."

There is now markedly more demand for USD/JPY bearish 'calls', which are options entitling the bearer to sell the Yen at a spot (strike price) of 109 or lower, than bullish 'puts', which allow the option holder to buy Yen at a strike price above market.

Overall this suggests options traders are expecting USD/JPY to fall from its current 111.01. The options implied view matters because the market is comprised of highly experienced institutional operators who not only use options to protect themselves against losses, but also favour using them to speculate on the underlying instrument because of their risk-limiting characteristics.

"There have also been buyers of 108.00 and 107 strikes in the same period, but on much smaller volume and with more supply to meet the demand. By comparison, topside (JPY put) hedges have been limited to 113.00 strikes within a one-month expiry, and volumes for those trades are also much lighter than those to the downside," Pace adds.

Offsetting the bearish tenor of the option flows data is a report suggesting the Yen-US Dollar carry trade remains an extremely attractive play, which suggests increased demand for the Dollar and a higher USD/JPY over coming months.

"The dollar-yen carry trade just got more appealing for investors, thanks to the Bank of Japan," says Masaki Kondo, a reporter for Bloomberg News, in a recent report on the pair.

Kondo says the Bank of Japan's continued easing bias suggests interests rates will remain low in Japan for a long-time to come, whereas in the US the more hawkish central bank is believed to be on course to raise rates four times this year - or by 1.0%.

The carry trade is an interest rate arbitrage form of currency trade in which investors borrow a low-interest-bearing currency and invest the loaned funds in a jurisdiction where interest rates are higher. The difference between the rate they pay to borrow and the rate earned on the investment is the profit from the trade.

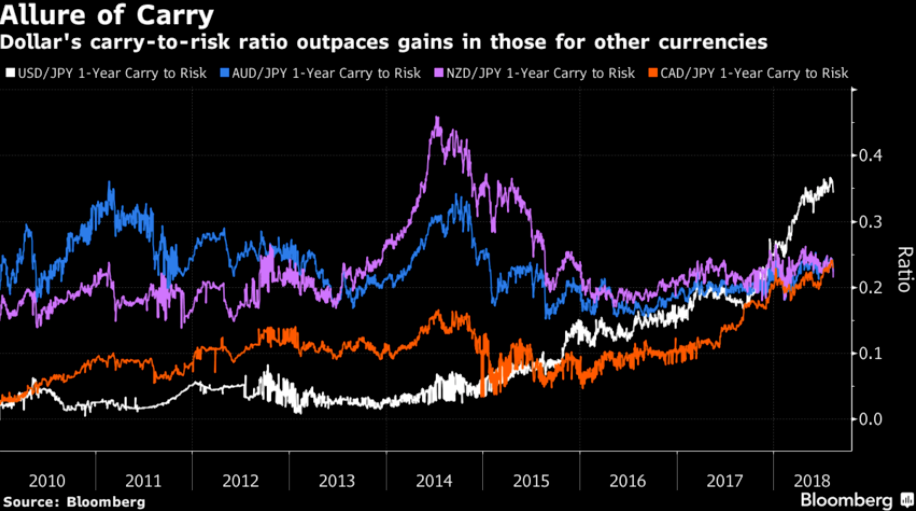

USD/JPY represents the best value carry trade for the yen relative to all G10 currencies from a risk-reward perspective, according to Kondo.

"The carry-to-risk ratio -- which compares interest-rate differentials with implied currency volatility to gauge attractiveness of a carry trade -- is the best for the dollar among G-10 exchange rates versus the yen," the reporter writes.

Above: Various JPY carry-risk ratios. Source: Bloomberg.

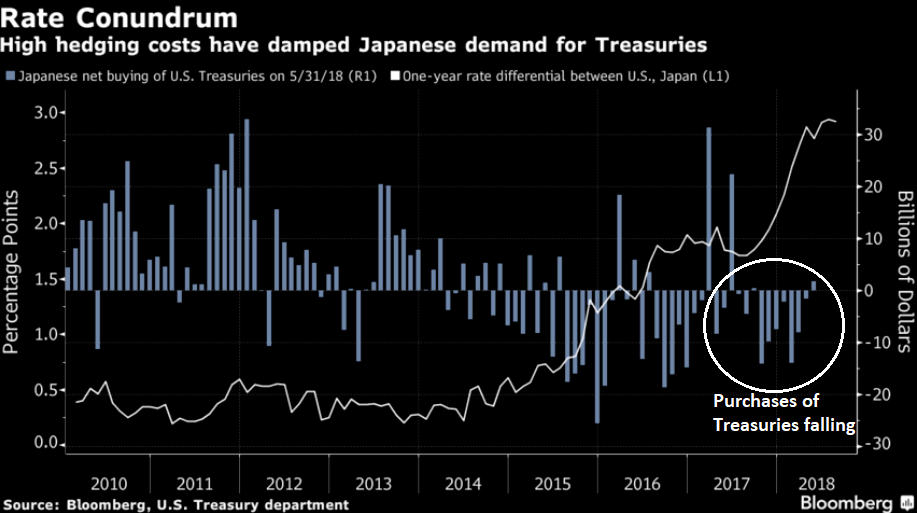

Carry trades come in many shapes and forms but one of the most popular for investors is to buy US Treasury Bonds using borrowed Yen, yet Kondo notes how the popularity of this particular carry trade has declined recently due to the rising cost of hedging the trade against Dollar weakness, which now costs as much as the potential profit from the carry.

Above: USD/JPY rate differential with US Treasury purchases overlay. Source: Bloomberg.

Ultimately the basis for USD/JPY carry profitability lies in the expectation that the interest rate differential between the US and Japan will remain extremely wide because the BoJ will keep interest rates low in Japan, yet this assumption may be flawed.

As Kelemen says, its easy to forget the 'heft and global influence of the Japanese central bank' and recent communiques from the bank have underscored how markets appear to be anticipating an adjustment toward a tighter, or less loose, monetary policy environment in Japan, with stimulus being withdrawn and rates eventually lifted.

The BOJ's most recent move to allow more flexibility in 10-year Japanese government bond yields was seen as a de facto tightening as it narrowed the gap between US and Japanese 10-year government bond yields. Previously the BOJ had sought to keep yields at o 0.0% by buying the bonds itself.

The relaxation came partly as a result of stronger economic data in Japan, especially wage data that indicated the likelihood of higher inflation pressures coming from rising wages.

If the data continues to improve, the BOJ will start to tighten its ultra-loose policy stance even further and eventually raise interest rates, with the potential for the carry trade profitability gap to narrow, not widen.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Chart and Technical View

From a technical perspective the long-term outlook for the Yen also favours further upside, in the case of most pairs.

The JPY/GBP monthly chart shows multiple pivots higher, starting from the February 2018 lows (circled), then again in May and now in August, which has seen especially strong gains for the Japanese currency.

A 'pivot' is when a currency reverses from an downtrend to an uptrend over a period of three months.

Above: JPY/GBP at monthly intervals.

JPY/EUR on a monthly timescale shows an almost identical pattern with a pivot higher in February 2018, followed confirmation pivots in May and August.

Above: JPY/EUR at monthly intervals.

The weekly JPY/AUD chart is showing a very bullish breakout from a range the pair has been stuck in since not long after the start of 2018. This suggests upside equivalent to the height of the range extrapolated higher.

Above: JPY/AUD rate shown at monthly intervals.

JPY/NZD on the monthly chart is currently showing great strength in the current month (as much as for NZD weakness as JPY strength) but the pair appears to have been in an uptrend since the pivot higher in 2017 (circled).

Above: JPY/NZD shown at monthly intervals.

The Yen even looks robust versus the relatively strong Canadian Dollar, which analysts also say will rise during the months ahead.

It pivoted higher strongly in February, and although action has been anticlimactic since then, the original pivot remains in force and the uptrend probably likely to resume eventually.

Above: JPY/CAD rate shown at monthly intervals.

Last but not least is JPY/USD which looks mixed after a pivot higher was cancelled out by a pivot lower (circled) before the market went higher anyway, ignoring it.

This reflects the contrary fundamentals expressed above, and the fact the Dollar remains one of then strongest of G10 currencies.

Above: JPY/USD rate shown at monthly intervals.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here