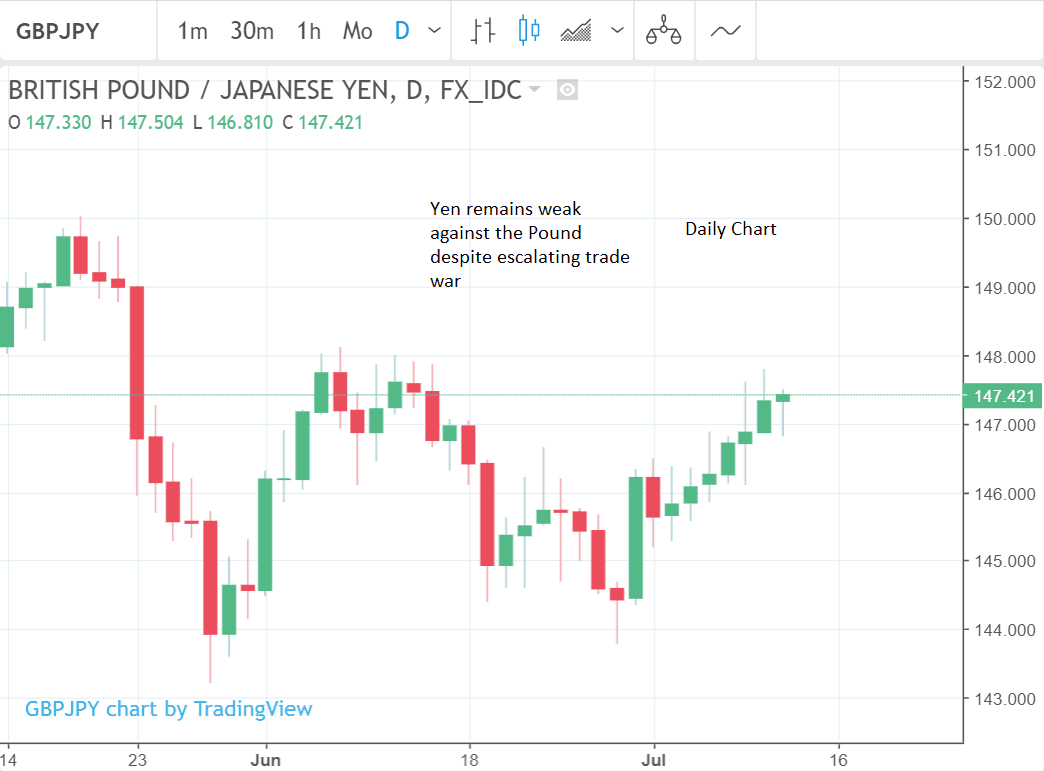

GBP/JPY Hits a Monthly High Despite Trade War Fears, Bullish Signs Accumulate

- The 'safe haven' Yen is falling vs the Pound despite an escalation in the US-Sino trade war

- GBP/JPY has just made a new high for July

- Signs accumulating which point to the possibility of further gains

Image © kasto, Adobe Stock

The Yen has steadily fallen versus the Pound regardless of fluctuations in other pairs linked to the ongoing trade Trump trade war saga which has today seen the announcement by the United States of a fresh $200BN tranche of tariffs on Chinese imports.

Usually the Yen, which is viewed by investors as a 'safe haven', follows global risk trends very closely, albeit inversely: moving higher on bad news and lower on good news.

Yet versus the Pound the Yen has shown a more consistent period of weakness recently, dismissing the wide pendulum swings in global risk sentiment.

"I really really don't know why the yen isn't stronger," says Kit Juckes, an analyst with Société Générale. "My default position is to believe that it will be, in due course."

On Tuesday the Yen fell as markets grew bolder; whilst on Wednesday it mostly rose as markets grew fearful after the US announced a further $200bn in trade tariffs on Chinese goods.

Yet over the last 48 hours, it has been more consistent against the Pound, with GBP/JPY continuing to maintain the 147s.

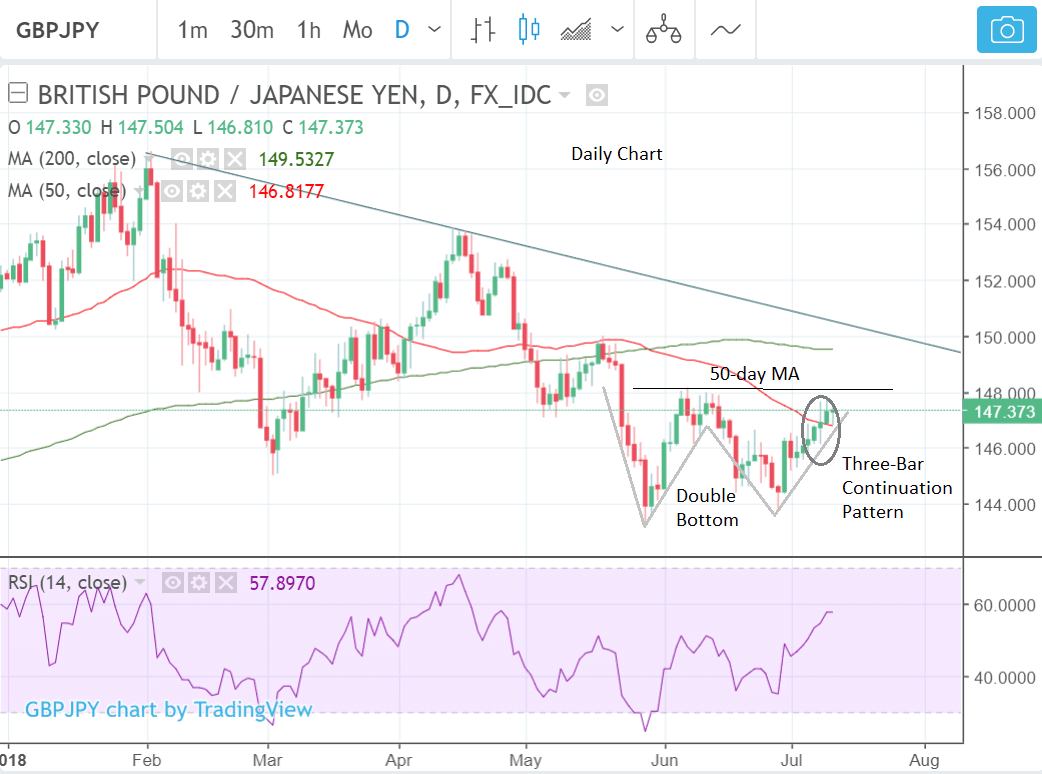

We now note the formation of several technical chart patterns which suggest the possibility of further upside for GBP/JPY, in the medium-term, even though some are imperfect and immature.

The pair has now broken clearly above the 50-day moving average (MA) at 146.84 and this is a very bullish sign for the outlook. The 50-day MA is perhaps the most important indicator on any financial market price chart. It is followed by both private and institutional investors alike and many make important buy and sell decisions based purely on whether prices are above or below the MA, so a break above is usually a major game-changer for the pair.

But it is not the only signal worth mentioning on the chart.

Tuesday's strong up day completed a three-bar continuation pattern (circled below) which is composed of a long green up day, then a day with a small body and then another long green up day, and this is also a compelling bullish sign. Whilst this particular set-up is not a perfect 'A-grade' example of the pattern, it nevertheless lends some credence to a bullish outlook.

Further evidence suggesting a bullish bias comes from the RSI momentum indicator in the bottom panel. This has moved sharply higher along with the market over the last few days and has now reached a higher level than when the market topped at 148 at the start of June one month ago. This suggests the current move higher is supported by underpinning confidence.

A final chart pattern which is suggestive of upside in the future is the inchoate double bottom pattern which is in the process of forming since May and is highlighted on the chart with a grey line which resembles an outline of the letter 'W'.

For the double bottom to give a bullish signal the exchange rate must break above the top of the 'W' or the intervening peak of the double-bottom, which in this case is at the June 07 148 highs. Assuming it does it should surge higher to about the same distance again as the height of the original pattern extrapolated higher. This would suggest a move all the way up to about the level of the 200-day MA at 149.50.

The Yen may be vulnerable to further loses due to easing global trade tensions but against the Pound, it could also fall if the latter strengthens from easing Brexit risks.

Whilst there is still much uncertainty about whether Prime Minister May's Brexit compromise can survive if it weathers the next few days the markets will probably start to price in a softer Brexit which will result in more upside for GBP/JPY.

Yet not everything is rosy for the pair. The overall trend is still technically down; the threat of a hard Brexit remains credible; the Yen could also see a renaissance in the event of a break down in global trade.

Further risks stem from the longer-term implications of recent positive Japanese wage data in May, which surprised to the upside.

"The pace of wage gains in Japan is accelerating markedly, thanks to the exceptionally tight labor market," says Yoshiaki Nohara, a reporter for Bloomberg News, adding, "Earnings jumped in May as the results of spring wage talks came in and the jobless rate hit a quarter-century low."

A Japan with rising inflation would see a substantial change in the outlook for Bank of Japan (BOJ) monetary policy and the possible end to the money-printing stimulus measures which have been so deleterious to the Yen.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here