The Japanese Are Selling their Yen

- Written by: Gary Howes

Image © Adobe Images

Japanese onshore FX players appear to be selling yen and supporting USD/JPY during Asian trading hours, according to analysts and market observers.

The findings suggest a predictable pattern of play in FX markets that can be highly useful to participants involved in Yen transactions.

Analysis from Japan's Nomura bank shows Japanese importers and retail investors are driving flows that are keeping USD/JPY resilient in the face of expectations of Bank of Japan (BOJ) rate hikes.

"Recently, USD/JPY has tended to rise during Asian trading sessions, which we attribute to onshore FX player flows," said Yujiro Goto, FX strategist at Nomura. "Japanese importers might be dip-buying USD/JPY, while households have been net purchasing foreign equities via NISA accounts."

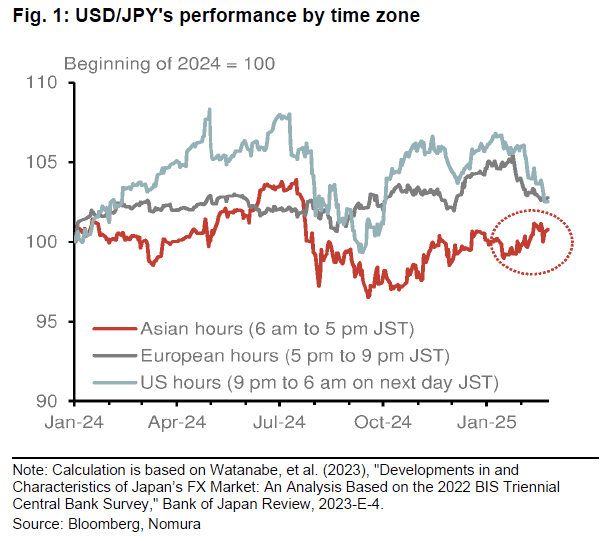

Image courtesy of Nomura.

"As I keep mentioning, Japan has been selling JPY most nights. A durable trend in USDJPY is usually accompanied by Japanese participation but this mini-trend lower has been denied by Tokyo night after night," says Brent Donnelly, founder of Spectra Markets.

Nomura’s time-zone analysis (see chart) shows a pattern: USD/JPY strengthens during the Asian session, often reversing trends seen in New York trading hours.

The pair has remained near the 150 level despite fluctuations caused by external market events, such as U.S. tariff headlines and global risk sentiment shifts.

"Yen-selling flows from Japanese corporates, particularly importers, tend to be concentrated on dates ending in 5 or 0—a well-known pattern in Japan’s FX market," Goto added, referring to the Gotobi effect, where settlement dates spur demand for U.S. dollars.

Gotobi refers to the practice in Japan of making certain payments on specific days of the month.

Another factor keeping USD/JPY supported is the rise in foreign equity investments by Japanese households. Many have been increasing allocations to overseas stock markets through NISA accounts (tax-free savings plans), adding to persistent yen-selling pressure.

This dynamic contrasts with the widely expected BOJ rate-hike cycle, which should theoretically support the yen. However, Nomura analysts argue that importer flows and retail investments may keep USD/JPY elevated, offsetting the impact of rising Japanese interest rates.

While the BOJ’s tightening stance could limit USD/JPY’s upside, analysts believe yen-selling flows from Japanese corporates and households will continue to provide support around 150 in the near term.

“Expectations for BOJ rate hikes may cap gains in USD/JPY,” Nomura’s Jin Moteki noted. “But the consistent demand for foreign currencies from Japanese investors means the yen remains under pressure during Asian trading hours.”