Dollar-Yen is Biggest Mover Following Ueda Intervention

- Written by: Gary Howes

Above: File image of Bank of Japan Governor Ueda. © European Central Bank, reproduced under CC licensing

The Japanese Yen looks like it wants to go higher, backed by a 'hawkish' central bank governor.

Bank of Japan Governor Kazuo Ueda told parliament on Friday that he remains committed to raising interest rates should the country’s inflation and economic growth remain on track.

"USD/JPY briefly weakened by about 0.7% below 145.50," says Carol Kong, an analyst at Commonwealth Bank. "Governor Ueda reiterated his guidance the BoJ will continue to raise interest rates if economic data evolves in line with its forecasts."

The latest assessment by the Bank of Japan's governor places Japan as the only G10 economy where interest rates are likely to rise in the coming months, whereas they are expected to fall elsewhere. This divergence in policy can help the Yen recover more of the losses recorded over recent years.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"USD/JPY is the biggest mover in the G10 FX space this morning with the comments from BoJ Governor Ueda in the Diet helping to lift the yen. As we have stated here before, the sharp drop in USD/JPY in July into August is changing the behaviour of market participants and the price action is increasingly looking like there being greater appetite to sell USD/JPY on rallies," says Derek Halpenny, analyst at MUFG Bank Ltd.

Halpenny says the previous market reflex was to buy Dollar-Yen on dips.

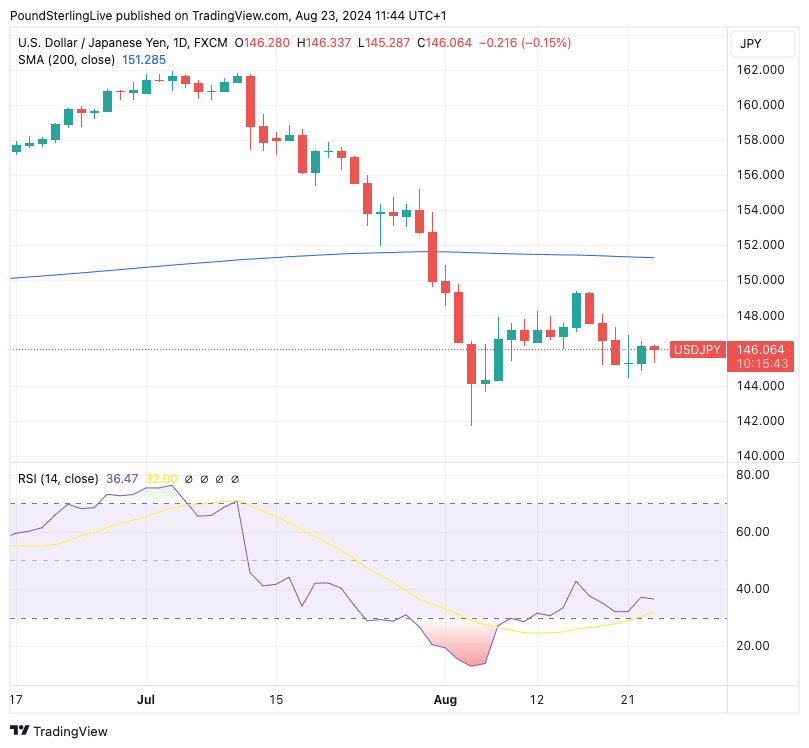

Above: USD/JPY shows downside momentum is intact on its daily chart.

"The yen buying today is understandable given Governor Ueda showed very little sign of a shift in the views and plans of the BoJ following the financial market turmoil earlier this month," adds Halpenny.

"Japan’s short-term rates are still very low. If the economy is in healthy condition, they will move up to levels we consider neutral," said Ueda.

According to Commonwealth Bank's Kong, some market participants had expected Governor Ueda to sound more cautious because the BoJ was accused of contributing to the recent market ruction with its hawkish rate hike in July.

The Japanese OIS market is now pricing a 34% chance of a 25bp rate hike by year‑end. "We continue to expect the BoJ to deliver another rate hike in October 2024, followed by two more in April and July 2025," says Kong.

Halpenny notes Ueda was very firm in arguing the steps taken at the July policy meeting were justified. "He also did not shy away from repeating the guidance from the July meeting that the policy rate can gradually move higher toward the neutral rate if the BoJ forecasts continue to be realised."