Dollar-Yen: Intervention Target Rises to Around 165 says ING

- Written by: Gary Howes

Image © Adobe Images

The Dollat-Yen exchange rate level at which Japanese authorities might intervene in the market has risen, according to a new analysis from ING Bank.

The Japanese Yen continues its fall against the Dollar and there has been no let up in speculation amongst market watchers and participants as to when Japanese authorities would step in to defend the currency's value.

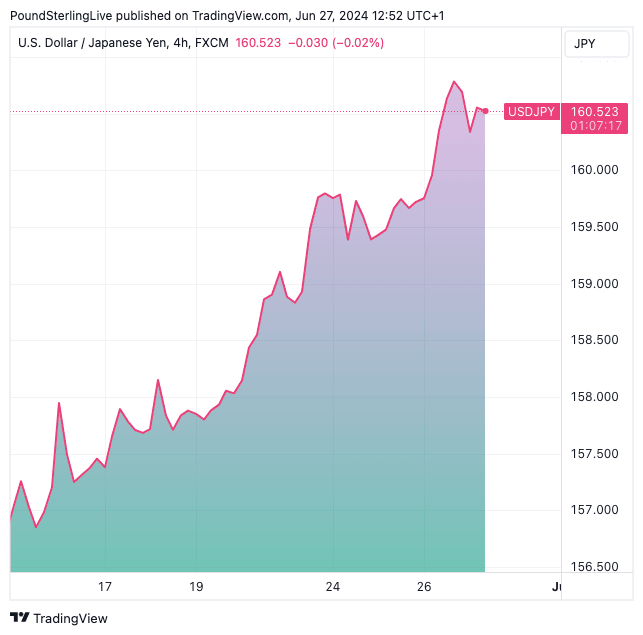

The Dollar to Yen exchange rate has risen to 160.40 and is now above levels that prompted authorities to intervene in May. Over the course of May, authorities spent 9.79 trillion yen ($62.23 billion) intervening in the foreign exchange market to support the Yen.

The move helped stabilise the currency's depreciation trend, suggesting some degree of success for the authorities who are not against deprecation per se, instead arguing it is the pace of depreciation that matters.

"FX intervention alarms are as loud as they get, but we have to make a couple of considerations," says Francesco Pesole, FX Strategist at ING.

He explains that Japan’s top currency official, Masato Kanda, had indicated in February that a 10 yen move in USD/JPY over a month was to be considered as "rapid", implicitly offering some clues on the levels

for intervention.

"The latest moves have been described as “rapid”, but not “excessive”, which may be the new term for a 10 yen move in USD/JPY. In April, USD/JPY had risen from a low of 150 to a high of just below 160 over a little less than a month when Japan intervened, which is consistent with Kanda’s hint," says Pesole.

Over the course of the past 30 days, the low for Dollar-Yen was 154.60, "which would by the same logic place the intervention level at 164/165," says Pesole.

ING thinks that having already spent $61bn on official FX intervention, authorities will be cautious.

"What has been clear is that FX interventions are a temporary measure to curb volatility, not a solution to a structurally oversold currency. Ultimately, Japanese officials know US macro and the Fed matter more than anything else for the yen," says Pesole.

He says there may be an incentive to wait until tomorrow’s core PCE before intervening again.

"Should US data fuel more USD strength, then intervention would become almost inevitable – but with the new line in the sand potentially closer to 165, as mentioned," says Pesole.