Buy Japan says BlackRock

- Written by: Gary Howes

Image © Adobe Images

The world's largest asset manager says it views Japan as a long-term bet.

In a new analysis, BlackRock says Japan's "stable macro outlook – with mild inflation feeding higher wages and corporate pricing power – reinforced the upbeat outlook for equity returns on strategic horizons of five years or longer."

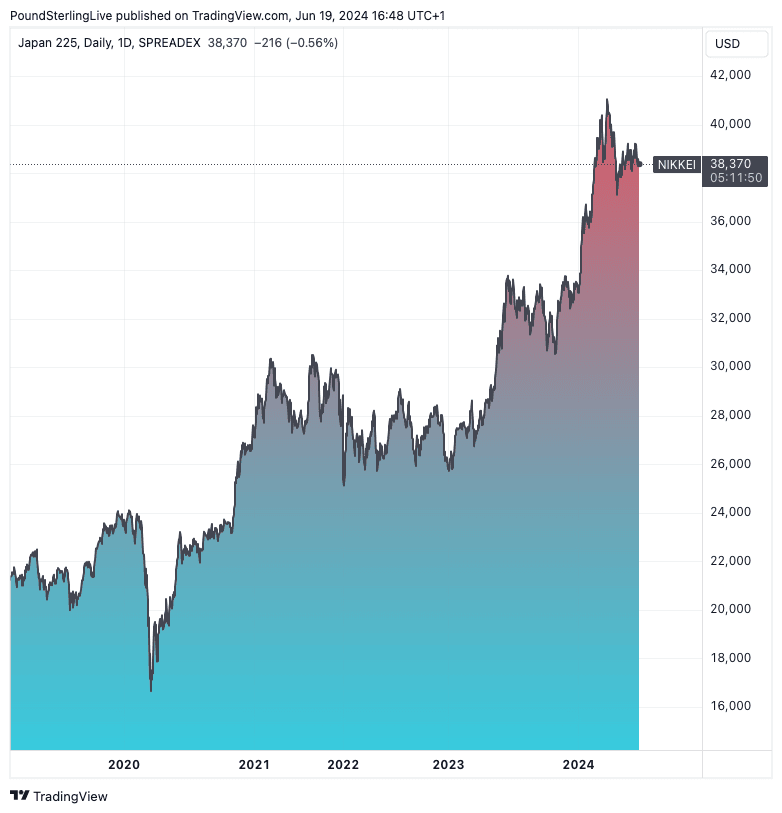

The call comes as Japan's stock market undergoes what BlackRock analyst Vivek Paul describes as a "blistering" rally.

"Japanese stocks warrant a higher allocation on such horizons of five years or longer than the benchmark would suggest," he says.

Above: The Nikkei's blistering run.

BlackRock thinks Japan’s macroeconomic backdrop is conducive for risk-taking by investors, whereas this is not the case in other developed economies.

Regarding the issue of Japanese interest rates, economists at the New York-based asset manager think the Bank of Japan will only raise interest rates cautiously from here to protect the renaissance.

"Inflation’s long-awaited comeback in Japan brightens the outlook for corporate profits as companies can raise prices on products and services while rising wages are set to support consumer spending. Ongoing corporate reforms aimed at boosting shareholder value are another positive," says Paul.

BlackRock says 'mega forces' also make Japan attractive. These are big structural shifts, like demographic divergence and digital disruption like artificial intelligence.

These are expected to shape investment returns now and over the long term.

"An aging population has focused Japanese authorities on unlocking productivity gains via technological innovation. And efforts to move to a lower-carbon economy point to an infrastructure spending surge that could provide investment opportunities," says Paul.