Dollar-Yen: "JPY Gains, If Seen, Could Remain Temporary" Says Saxo Bank

Image © Adobe Stock

Written by Charu Chanana, Market Strategist at Saxo Bank. A podcast on these views can be found here.

The Bank of Japan’s Friday meeting has the most potential to surprise among a ton of central banks announcing policy decisions this week.

A hawkish surprise by the BOJ remains a low probability, high risk event, with expectations remaining aligned to bring no changes to the policy and keeping the short-term interest rate target unchanged at -0.1% and that for the 10-year bond yield around 0% after the bank tweaked the settings of its yield-curve-control policy at the last meeting in July.

However, FX concerns are likely to be at the core of this week’s meeting especially with verbal intervention getting louder and wider in the past few weeks.

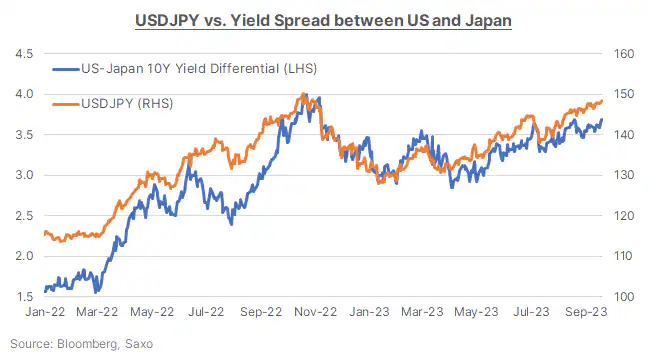

The Fed’s hawkish message last night has also meant that the pain on the yen may be sustained as US yields continue to rise, and US Treasury Secretary Yellen signalled this week that Japan has US support if they wanted to intervene in the FX markets.

More importantly, that gives room to Governor Ueda to talk about the yen more directly, to the extent that he could raise the expectations of a policy pivot due to the volatility in the yen. Again, low probability but high-risk event.

Inflation dynamics also continue to get trickier with rising energy prices. Nationwide CPI print for August is due on Friday morning ahead of the BOJ decision, and headline CPI is expected to soften but stay above the target at 3.0% YoY (prev. 3.3%) while core is seen firm at 4.3% YoY.

Plans for further government subsidies raise the risk of further inflation pressures, and may keep BOJ on action alert.

Also worth noting is that Ueda-san’s comments that the BOJ may have enough information by the end of the year on wage pressures had resulted in a significant forward adjustment in expectations that BOJ could end its negative interest rate policy to early 2024 form late 2024 earlier.

Image courtesy of Saxo Bank.

However, if there is no follow up on those comments, markets will likely assume that those comments were only directed towards supporting the yen rather than signalling any real threat of policy normalization.

Having given some hints on policy direction and FX over the last few weeks, the BOJ has now exposed themselves going into this week’s meeting. No follow up on either could bring the yen bears back with a vengeance.

A strong hawkish tilt such as hinting that raising rates or enduing YCC are real options for the foreseeable future could, however, bring 10-year Japanese government bond yields close to the 1% ceiling which will likely force the central bank to buy more bonds, a negative side-effect of the current YCC policy.

This means Ueda is likely to face a tough challenge to sound neutral at Friday’s meeting, and any indications on policy normalisation will remain subtle and modest at best, and unlikely to turn around the weakness of the Japanese yen. The carry strategy likely has more room to run with FX volatility remaining low.

While hawkish hints remain likely at the BOJ’s Friday meeting, JPY gains, if seen, could remain temporary amid the rising trend in US yields. However, a host of resistances above 148 for USDJPY, and intervention risks, make the upside more limited as well.