Japanese Yen Tipped for BoJ Driven Recovery but BoE Offers Cautionary Tale

- Written by: James Skinner

-

"It’s core CPI that matters" - CIBC Capital Markets.

Image © Leonid Andronov, Adobe Stock

The Japanese Yen is close to the biggest fallers on the market for a second year running and while forecasters say an eventual shift in Bank of Japan (BpJ) interest rate policy should ultimately lead to a recovery, the Bank of England's (BoE) ongoing experience with inflation suggests that the opposite could easily become true.

Japanese exchange rates rose across the board in the Tuesday trading session as stock markets tumbled across the globe and rallying government bonds helped to pull down borrowing costs but the Yen remained close to the worst-performing major currency for the year even with its recent gains.

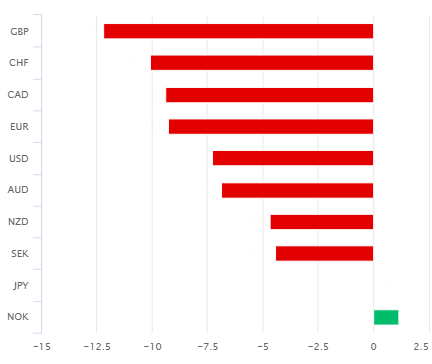

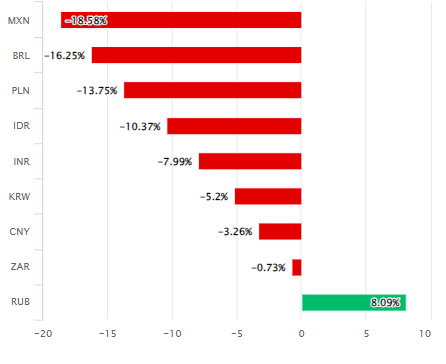

Only the Norwegian Krone and Russian Rouble have fallen further against the Dollar this year in what many analysts say is the result of the growing divergence between the Bank of Japan where interest rates and bond yields remain near zero, and central banks in other major economies where interest rates have mostly risen.

"One of our strongest conviction trade recommendations recently was to short EUR/JPY. While Foreign Exchange Strategy was stopped out of that trade at 154 last week, we still believe this could be the best G10 FX trade in the next year," says Mathieu Savary, head of European strategy at BCA Research.

"What has been driving the yen lower in recent months was the use of the currency to fund carry trades given persistent BoJ dovishness compared to a hawkish Fed and ECB. However, the world a year from now will likely be one of monetary policy convergence rather than divergence," he writes in a Monday research note.

Above: Japanese Yen relative to G10 and G20 currencies in 2023. Click either for closer inspection.

Savary and colleagues anticipate that both the Federal Reserve and European Central Bank (ECB) will succeed in returning inflation to their target levels before year-end and that this could enable them to begin reducing interest rates, resulting in less downward pressure on the Yen relative to the Dollar and Euro.

Savary and colleagues' is a scenario that would pay off if doubts over whether the inflation target can be met sustainably over the medium-term lead the Bank of Japan (BoJ) to persist with its subzero interest rate policy and Yield Curve Control policy, which has so far been the case under new governor Kazuo Ueda.

Non-financial News;

British Titanic submarine rescue mission with high-tech vehicle 'blocked by US officials'

British rescue mission for Titan ‘blocked by US officials’...

...

Notes: President Vladimir Putin once reportedly blocked a British rescue mission involving a submarine.

Its name was Kursk and its crew later perished, perhaps even needlessly or due to the Kremlin actions.

"With the dust having settled on Friday’s BoJ meeting, 10yr JGB yields are well clear of the YCC ceiling (0.39%)," says Adam Cole, chief FX strategist at RBC Capital Markets.

The yield on the 10-year Japanese government bond is prevented from rising above 0.5% by the upper limit of the BoJ's tolerance band, which is set to 50 basis points or 0.5% on either side of the zero level and enforced using BoJ bond purchases whenever sales are significant enough to test the tolerance band.

Above: EUR/JPY shown at daily intervals alongside USD/JPY and GBP/JPY.

"Governor Ueda said that the BoJ was fighting an inflation undershoot rather than overshoot and said the sustainability of wage growth is still uncertain, although he did also acknowledge that the slowdown in inflation is taking longer to materialize," says Isabella Rosenberg, an FX strategist at Goldman Sachs.

"He emphasized that the BoJ would “carefully examine” the inflation outlook for the July meeting and also expects to publish some information from its ongoing policy review in July," Rosenberg and colleagues write in response to last week's Bank of Japan monetary policy decision.

Decades of low and even too-low inflation are widely said to have left the BoJ fearing that a monetary policy change could do unnecessary damage to the Japanese economy and lead the current inflation to recede back toward too-low levels but the current experience of the UK economy suggests the opposite might be true.

In the UK households have reportedly been reluctant to accept further reductions in the value of their income and spending so are said to have resorted to extending the terms of their mortgages, thereby reducing the impact of increases in the Bank of England (BoE) Bank Rate and so helping to sustain spending in the real economy.

Above: GBP/JPY shown at weekly intervals alongside USD/JPY and EUR/JPY.

This has, however, been reported at a time when the UK's core inflation rate - often taken to be the better measure of domestic price pressures - has shown signs of reversing its earlier declines and got economists and markets worrying about what the BoE might have to do in order to ensure that it eventually returns to the 2% target.

The mortgage term extension trend in the UK now leaves the BoE with a choice between having to go even further with its interest rate on Thursday and an alternative scenario in which the Pound would risk being crushed as the market questions the bank's 'credibility' - its ability to control inflation.

"It’s core CPI that matters. Having seen core prices spike to a fresh cyclical high at 6.8% in April another extension would risk amplifying BoE pricing into Thursday’s decision. Currently around 29bps are priced," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets, in reference to UK inflation figures out on Wednesday.

Inflation figures for May are out in the UK on Wednesday and if they suggest the April spike in core inflation was anything other than a quirk of the new financial year then it would make the BoE's forthcoming policy decision even more difficult and in a way that might be ominous for Japan and the BoJ.

Above: GBP/JPY shown at monthly intervals alongside USD/JPY and EUR/JPY.

For Sterling, the trouble is that if the BoE has to go further with Bank Rate, it would risk inviting or otherwise exacerbating concerns about the sustainability of government-issued debt in the UK, which was just more than 100% of GDP at the last count.

"The interest rate shock for mortgages and UK public interest expenses (the average duration of UK Gilts is 13.7y) cannot be underestimated in the medium term and could at some point turn against the currency," writes Kenneth Broux, a strategist at Societe Generale, in a Tuesday market commentary.

Japan's debt to GDP was sits at more than 260% and so the BoJ could find itself in an even more difficult position than the BoE if by the time that inflation and wage growth are able to satisfy the BoJ that its target will be met sustainably, the inflation then proves as difficult to address as it has in the UK.

It's the sort of thing that might lead any policy normalisation at the Bank of Japan to have highly adverse implications for the Yen, and irrespectively of how high rates ultimately rise: In other words, it could theoretically create a depreciation spiral not normally seen in currencies other than those of 'emerging market' economies.