Japanese Yen and Euro Losses: One Possibly Underappreciated Contributor

- Written by: James Skinner

-

Image © Adobe Images

The Japanese Yen and Euro sustained heavy losses in the first half of the year and for a variety of reasons but underappreciated among them is the possible sale of reserve assets by countries seeking to fend off the strong U.S. Dollar.

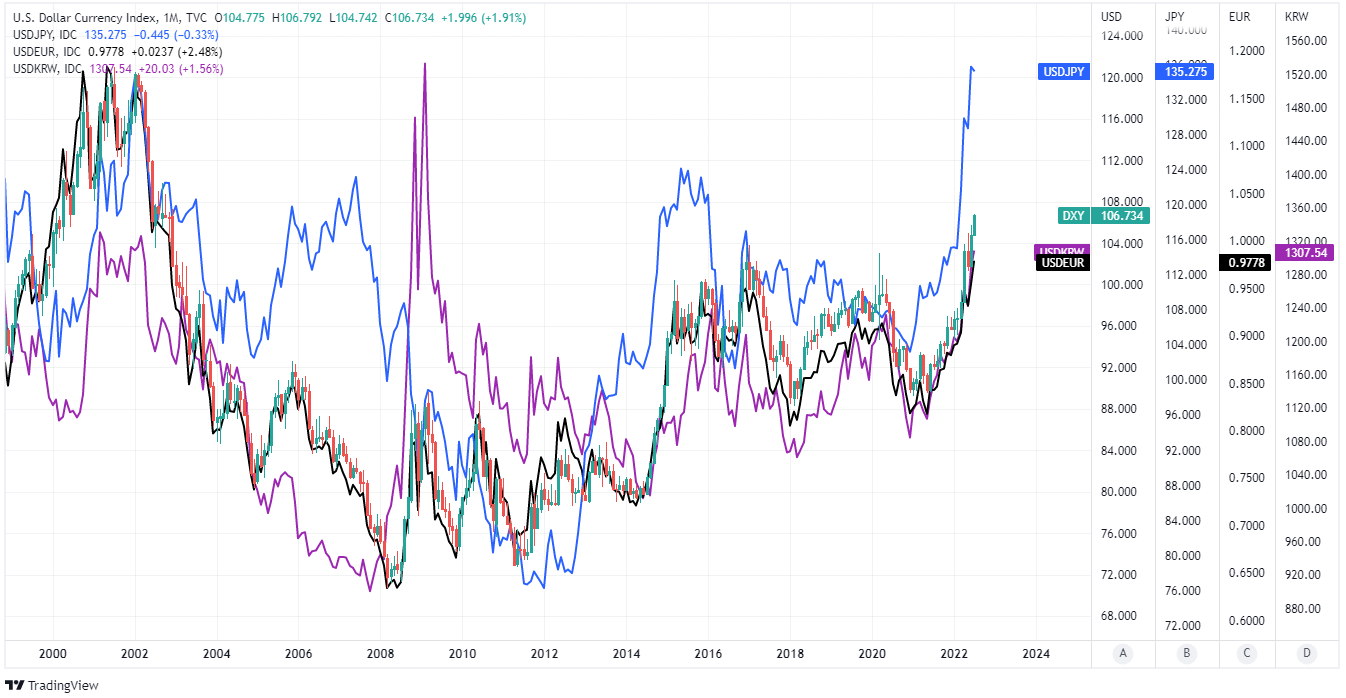

Japan’s Yen has held up better than the Euro this week with the latter slipping to new 20-year lows on Tuesday and Wednesday while many around the market contemplated the economic risks stemming from disrupted natural gas supplies.

But the Euro’s losses are not out of sync with those sustained by the Yen last quarter when each notched heavy declines amid widespread strength in the U.S. Dollar, which has pushed almost all currencies lower in recent months.

The U.S. Dollar Index had risen by 11.6% for 2022 by Wednesday while the Dollar itself had also gained over all but two of the G20 currencies and it’s in this kind of a market where countries might be most likely to sell official foreign exchange reserves in order to support their own currencies.

“Korea announced that its FX reserves had declined $9.4bn in June. Not all of that will be FX intervention,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

“The issue here is that after Asian central banks intervene to sell USD/Asia, the next step is for their portfolio management team to sell EUR/USD in order to rebalance the euro weight in their FX reserves back to benchmark levels,” Turner and colleagues said on Tuesday this week.

Any sale of official reserve assets is something that would be likely to add to losses of currencies like the Euro, Japanese Yen and Sterling as these are the three largest reserve currencies after the U.S. Dollar, and each is also susceptible in and of themselves to strength in the U.S. Dollar too.

That, and any sales carried out, would potentially explain the disparity between the above referenced currencies and others in the G10 and G20 groupings, which is a disparity that has been notable during the most recent months.

Many of the non-U.S. reserve currencies were among the worst performers for the year within the G10 grouping on Wednesday while developing economy currencies within the G20 group had sustained lesser losses relative to the U.S. Dollar than even some of the G10 currencies.

"With the EUR approaching early millennium levels we may get some comments on FX intervention too (joint FX intervention was used to help support EUR in its early years)," says Jordan Rochester, a strategist at Nomura.

Official disclosures from some individual countries and from the International Monetary Fund (IMF) do support the idea of there having been some selling in recent months, although the changes reported by the IMF will also have been influenced by moves in both currency and government bond markets.

Data released by the IMF last Thursday showed a sizable decline in “allocated reserves” held by countries at the end of the first quarter and given that a number of central banks publicly announced interventions in that period, it’s unlikely that all of the changes were driven by currencies and bonds.

“This looks like a real headwind for EUR/USD this summer and may be one of the reasons why EUR/USD struggles to make it much above 1.05 now,” ING’s Turner also said.

The fall in the value of allocated reserves was worth some $370.75 BN for the first quarter of the year while declines in holdings of Japanese Yen and Euro denominated assets were the largest, however, since then the U.S. Dollar has only gone from strength to strength.

This may mean that reserve sales continued last quarter, if not grew further in size, but to the extent that they have this would also indicate that at least some of the losses sustained by the big reserve currencies may only be temporary because countries would likely seek to rebuild their reserves at a later date.

To the extent that this is correct, any reversal of the above referenced processes could, in turn, support a recovery of the big non-Dollar reserve currencies as and when strength in the U.S. Dollar does eventually dissipate.

"USDJPY continued its dramatic upward march in June, reaching a high of 136.59 - the weakest level of JPY vs USD since 1998. Prior to that high, on June 10th, Japanese authorities verbally intervened in the currency, issuing a rare joint state from the Bank of Japan, the Ministry of Finance and the Japanese Financial Services Authority," Exante Data writes in a recent newsletter.

"Interestingly, cross border portfolio flows show that foreign investors sold a record $36bn in JGBs in the week ended June 19th, or nearly half of the amount of BoJ purchases (chart below). This helps explain the persistent JPY weakness, even if (nominal) rate differentials have narrowed somewhat over the past few weeks," the newsletter also noted.