Japanese Yen Sellers Looking to Book Profits Near 'Kuroda Line'

- Written by: James Skinner

- JPY sellers target USD/JPY move to 125

- Fed-BoJ divergence, energy prices cited

- Profit-taking may scupper rally near 125

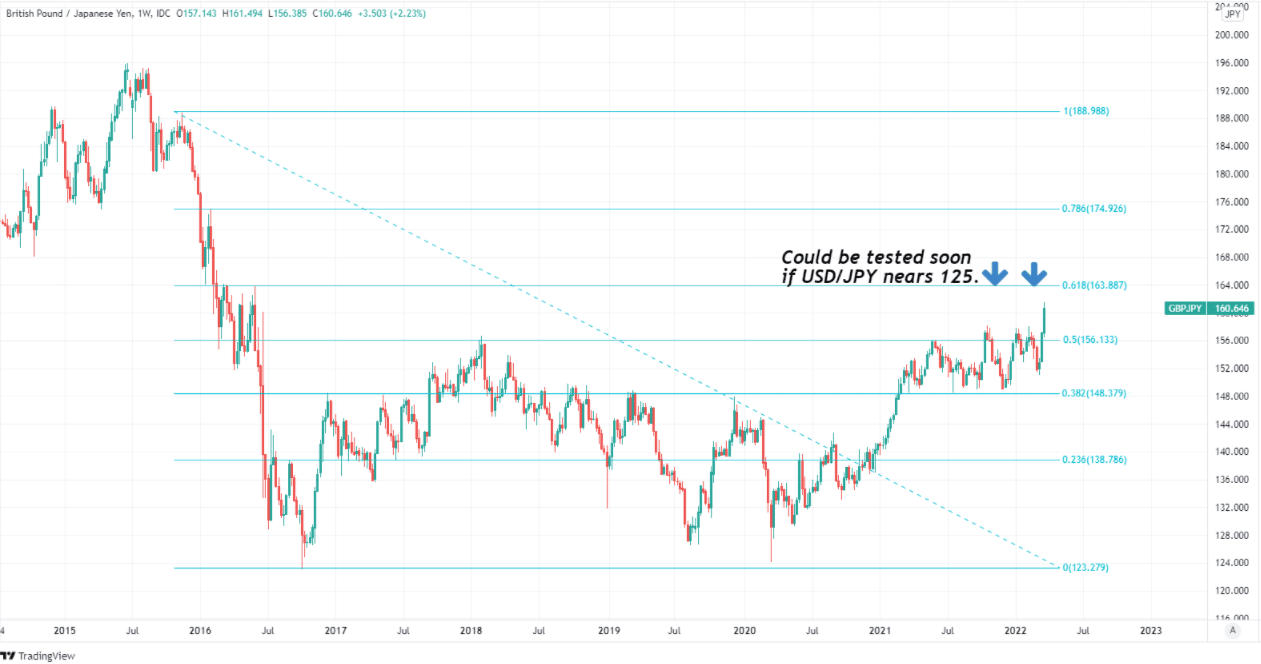

- GBP/JPY may see post-referendum high

Above: File image of Haruhiko Kuroda © European Central Bank, reproduced under CC licensing.

The Yen rebounded strongly from multi-year lows ahead of the weekend but with some recent sellers looking to book profits closer to the oft-cited ‘Kuroda line’ near 125 in USD/JPY, there is a risk of further losses for the Japanese currency over the coming days and weeks.

Japan’s Yen was the outperformer among major currencies on Friday as steep losses from earlier in the week partially reversed ahead of the weekend and in tandem with a stall in the recently-rising spread or gap between U.S. and Japanese government bond yields.

The U.S.-Japan yield spread has been widely cited as one driver of this week’s steep sell-off in the Yen, although it stalled on Friday following the release of March inflation data for Tokyo and remarks from finance minister Shun'ichi Suzuki and Bank of Japan (BoJ) Governor Haruhiko Kuroda.

“The 10-year JGB traded as high as 0.24% overnight, the highest for the cycle, and would theoretically require the BoJ to come out and declare explicit renewed defence of the yield cap as it did back in February,” says John Hardy, head of FX strategy at Saxo Bank.

Statistics Bureau data suggested Tokyo’s inflation rate rose faster than markets had expected this month even after excluding changes in energy and food costs, which potentially explains the increase in Japanese yields and some of Friday’s rebound in the Yen.

Above: USD/JPY shown at daily intervals alongside spread or gap between 10-year U.S. and Japanese government bond yields.

But with BoJ Governor Kuroda telling the Japanese parliament overnight that the current mix of inflation pressures is unlikely to sustainably deliver the BoJ’s two percent inflation target, it's possible that Friday’s recovery by the Yen is merely an interlude ahead of further weakness.

With the BoJ doubtful that its inflation target will be met at any point in the near future, it’s widely perceived as being especially unlikely to change its monetary policy at any point in the near future and all the while, Federal Reserve policy is set to boost the appeal of the Dollar relative to the Yen.

“Powell made it seem like the Fed's dot-plot may be too low and strongly indicated that a series of 50s is on the table as soon as the next meeting. The implication is that the Fed is rushing to get to neutral. This should keep rate differentials firmly tilted towards USDJPY topside,” says Mazen Issa, a senior FX strategist at TD Securities, referring to a Tuesday speech from Fed Chairman Jerome Powell.

This month’s updated forecasts suggested the Federal Reserve is on course to lift its interest rate sharply over the coming year or more, likely taking it above the targeted rate of inflation and further on to a level that would lead to outright ‘tight’ monetary conditions.

Above: USD/JPY shown at weekly intervals with Fibonacci retracements of 2015 fall indicating likely areas of technical resistance to a further rally.

Fed policymakers have, meanwhile, indicated the bank could move even faster than was implied by the March dot-plot of forecasts and all of this suggests that returns offered to investors in U.S. assets could soon far exceed those available in Japan.

“This should help enforce a floor under USDJPY; the break above 120 suggests that a new 120/125 range is upon us for now. With the yen poorly positioned from the ongoing commodities terms of trade shock, which is likely to continue. Together, USDJPY has nowhere to go but up, and our screen on positioning suggests that yen weakness is the more considerable risk,” TD Securities’ Issa said in a note to clients on Tuesday.

The growing gulf between the Fed and BoJ is one major factor cited by TD Securities’ Issa and colleagues when telling clients on Tuesday to consider betting on the rally in USD/JPY extending to the 125 area over the coming weeks where they’ve also suggested that clients book profits on the trade.

“One thing to watch for in USDJPY is pushback from policymakers in Japan. I’m not sure we’re quite there yet, but the 123.50/125.00 level is almost certain to attract some attention,” says Brent Donnelly, president of Spectra Markets and a veteran currency trader.

Above: GBP/JPY shown at weekly intervals with Fibonacci retracements of 2016 fall indicating likely areas of technical resistance to a further rally.

“Remember: It was Kuroda’s comments on the weak yen at 125.00 that marked the end of the Abenomics trade in 2015 and that 123.65/125.85 zone is huge. Some people referred to 125.00 as “The Kuroda Line” back then,” Spectra Markets’ Donnelly also said on Thursday.

Many analysts and other market observers have reset their sights on the 125 level in USD/JPY since it surpassed a key technical resistance level just above 120 on the charts earlier this week, although most of them have also expressed reluctance to chase the exchange rate beyond 125.

This is in part because officials have previously expressed concern about the Yen falling below that level, leading parts of the market to suspect that the risk of government intervention would grow if the exchange rate rises beyond there.

That psychology and the resulting profit-taking by speculative traders could potentially be enough to halt the USD/JPY rally itself over the coming days and weeks, although in the interim the uptrend in the Dollar exchange rate is also suggestive of further gains ahead for GBP/JPY.

GBP/JPY tends to closely reflect the relative performance of Sterling and the Yen when each is measured against the Dollar, and would be likely to rise with USD/JPY unless in the interim the main Sterling exchange rate GBP/USD also sustains losses equivalent to those of the Yen.