Japanese Yen May Curb GBP/JPY Rally if Renminbi's Break Higher Lifts Other Asian Currencies

- Written by: James Skinner

- GBP/JPY’s rally waning as JPY’s decline ebbs

- JPY bottoms as RMB turns, but upside limited

- GBP/JPY well supported, even as rally curbed

- Japan’s third wave battle sees JPY in slow lane

Image © Adobe Stock

The Pound-to-Yen exchange rate edged higher on Tuesday making it one of only two pairs to remain in the black on what was a down day for Sterling, although the rally has been slowing for a while and could now be curbed further in the weeks ahead if a turn higher by the Renminbi leads the Japanese Yen to bottom out.

Sterling was lower against all major currencies other than a downsizing Dollar and the Japanese Yen although gains were marginal at best and nonetheless left the Pound-to-Yen exchange rate floundering just beneath the 155.0 round number.

The Pound-to-Yen exchange rate was still up by 9.31% for the 2021 year-to-date on Tuesday but has since May 10 been floundering around between 153.50 and 154.80, painting onto the charts in its wake a picture of an uptrend that looks to be waning.

This year’s gains for GBP/JPY have built as a result of both strength in Sterling as well as weakness in the Yen, although the Japanese currency’s move lower was also ebbing on Tuesday alongside earlier strength in the Pound.

“Although BoJ Governor Kuroda may be becoming more optimistic upon the global outlook, this has yet to impact the domestic environment. The risk of the Tokyo Olympics being cancelled continues to grow. The US government warning that American citizens should not visit Japan is the latest threat. An extension in the state of emergency remains probable, underlining cancellation concerns,” says Jeremy Stretch, head of FX strategy at CIBC Capital Markets.

Above: Pound-to-Yen exchange rate shown at daily intervals alongside USD/JPY.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“In the near term expect 108.55/60 to continue to contain the downside with rallies contained by 109.00/10,” Stretch says, referring to USD/JPY.

GBP/JPY’s gains have slowed around the same time as the concurrent uptrend in USD/JPY has waned, reflecting an ebbing depreciation of the Japanese Yen which could be indicative of a tentative impulse to begin bottoming out.

Tuesday’s price action comes after Bank of Japan (BoJ) Governor Haruhiko Kuroda acknowledged light shining from the other end of the pandemic tunnel but warned of extensive challenges bedeviling Japan’s economy as well as the risks and uncertainties which still cloud the outlook for it.

“The current set of lockdowns end on May 31. PM Suga said he will decide this weekend whether to extend them,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

“Within the G10, 8 of 9 currencies are showing gains against the USD, with only JPY showing a slight setback. European currencies, led by SEK, are at the forefront of gains for once,” Gallo adds.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Japan remains behind the U.S., Canada, UK and some other European countries in the race to vaccinate against the coronavirus and is this week still battling a third wave of infections that risks prolonging a related state of emergency and dealing a further blow to the economy by potentially cancelling July’s already-delayed Olympic Games.

Japan’s economy has given few if any reasons for an exchange rate recovery of late, which may be why the Yen has lagged behind other Asian currencies including the Renminbi as the latter breaks above stubborn resistance levels to score three-year highs against the U.S. Dollar this week.

“China’s State Council said last week in its weekly meeting that China will work to ensure the supply of commodities and keep their prices stable. It has been the second consecutive week that China’s State Council flagged their concern about the recent rally of commodity prices,” says Tommy Xie, head of Greater China research at OCBC Bank in Singapore.

The Renminbi pushed the USD/CNH exchange rate below the landmark 6.40 level on Tuesday in a tentative effort to overcome a resistance barrier that has proven insurmountable to the Chinese currency three times already this year.

Price action comes amid rising concern in Beijing about the impact that rising Dollar-denominated commodity prices are having on the production costs of Chinese firms.

Above: Pound-to-Yen exchange rate shown at daily intervals alongside USD/JPY and USD/CNH.

It also comes within days of a Peoples’ Bank of China (PBoC) official having suggested in one of the bank’s magazines that the State Administration of Foreign Exchange (SAFE) “appropriately appreciate the RMB” via a lower USD/CNH exchange rate in order to curb the impact.

The Renminbi’s break higher against the Dollar could be weighing on USD/JPY and would be a leading candidate to explain this week’s tentative bottoming out of the Japanese Yen as well as other regional counterparts, given that Asian currencies have a long-established tendency to trade as an almost unique and distinct block.

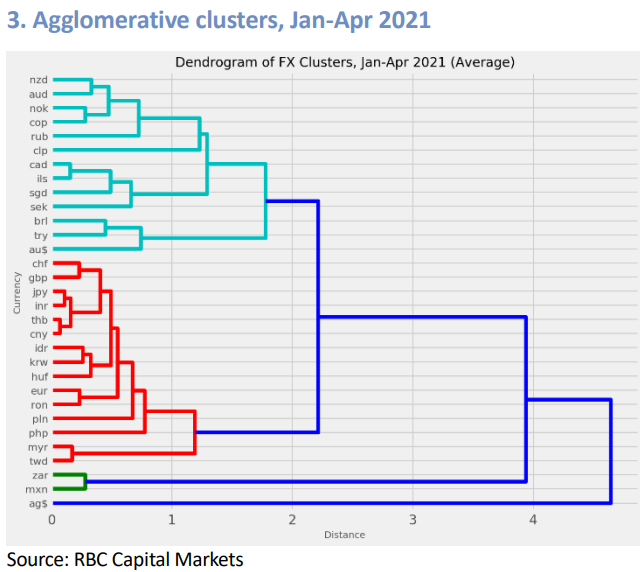

That pack tendency has only strengthened this year, according to statistical analysis carried out by RBC Capital Markets going back to the final quarter of 2020, the results of which are illustrated in the graph at the bottom of the page.

“We update the “unsupervised machine learning” clustering exercise undertaken last year, and covering a more comprehensive sample of global currencies, but excluding pegged currencies. The analysis uses the agglomerative hierarchical clustering algorithm,” says Alvin Tan, head of Asia FX strategy at RBC Capital Markets.

“Asian currencies continue to behave distinctly from other non-Central and Eastern Europe emerging market currencies, distinguished by smaller correlations to global equities, lower beta to the US dollar, and lower implied volatility. An interesting finding this time is the consistency of CHF being linked closely with Asian currencies in both periods under study,” Tan adds.

Above: RBC Capital Markets’s agglomerative hierarchical clustering analysis. Readers should interpret the graph from left to right and on the understanding that the shorter the representation of a currency along the X-axis; the more closely related that currency is with its attached cluster. The red cluster is most pertinent.