Japanese Yen Outperforms as 'Short Squeeze' Risk Lingers

- Written by: James Skinner

- JPY outperforms major peers after BoJ policy update

- Strength may result from an ongoing 'short squeeze'

- Amid lack of appetite for foreign government bonds

Image © Adobe Stock.

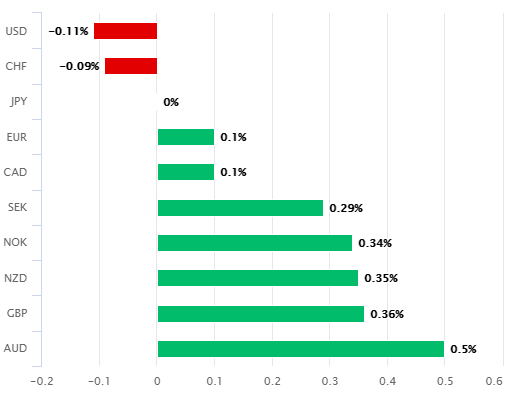

The Japanese Yen outperformed most major currencies on Tuesday following the April policy decision from the Bank of Japan (BoJ) and amid demand for safe-haven currencies, although it may have scope to rise further in the coming weeks according to a range of analysts.

There may be more to the Japanese Yen’s Tuesday outperformance than simple demand for safe-haven currencies like the Dollar, Swiss Franc and Yen, which all outperformed riskier prospects like those underwritten by commodities including the Australian and New Zealand Dollars.

Speculative investors have in recent months held one of their largest wagers against the Japanese currency for years, which has also been their largest active bet for or against any currency this year, although in April there’ve been signs that some of them at least are rethinking.

With this USD/JPY has fallen 1.1%, chopping the exchange rate’s 2021 increase back to around 5% in the process, although some analysts are looking for the Yen to strengthen further.

"This quarter's decline in USDJPY has been orderly thus far, but as we noted in our FX Positioning Report from Friday, a large long-USDJPY position still exists on the IMM, and we suspect there is a similar position held by 'Mrs. Watanabe' in Japan,” says Greg Anderson, global head of FX strategy at BMO Capital Markets.

Above: USD/JPY shown at daily intervals with GBP/JPY (orange).

Anderson says USD/JPY could fall to 106 or even below if institutional money manager positions tracked by the Commodity Futures Trading Commission in the U.S. continue to exit bets against the Japanese currency.

Meanwhile, technical analysts at RBC Capital Markets say the 107.70 level is key to the evolution of price action in USD/JPY, with any break below there indicating that further losses are in the pipeline.

It’s not clear however that declines in USD/JPY would be enough to weigh on the Pound-to-Yen exchange rate, which has held stubbornly around or above the 150.0 level even as the Yen has edged tentatively higher this month.

"A daily close below 107.70 would end the current uptrend, with the resulting trend reversal exposing the 50% retracement at 106.78 initially, followed by 106.22 as prices move deeper into the Ichimoku cloud" says George Davis, chief technical strategist at RBC Capital Markets.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Tuesday’s outperformance by the Yen came in the wake of April’s BoJ policy decision in which the bank left the calibration of all policy instruments unchanged while presenting a mixed bag of forecast changes in which inflation was tipped lower while GDP growth expectations were upgraded.

The economic growth outlook was revised higher despite a deteriorating coronavirus picture in Japan which has seen the government declare its third state of emergency and in the process appeal to citizens for cooperation in a voluntary ‘lockdown’ of Tokyo, Osaka, Kyoto and Hyogo.

Japan is evidently lagging behind other major economies in terms of coronavirus vaccinations and infection trends, although over the coming weeks at least it could be investors’ large speculative bet against the Yen and developments in the global bond market which matter most to the currency.

Above: RBC Capital Markets graph showing USD/JPY technical indicators, analysis.

“Total foreign sovereign bond holdings are at best likely to be maintained. Most of the major lifers plan to reduce holdings of hedged bonds (although this will partly be due to big UST redemptions this year), offsetting this with increases in unhedged foreign sovereign bonds,” says Imogen Bachra, a rates strategist at Natwest Markets.

Capitulation of wagers against the Yen may have something to do with a possible disappointment at the lack of investor outflows this month following April’s turning of the tax year in Japan, a country which is typically a big buyer of foreign financial assets.

Some speculative investors and traders may have fathomed this year that Japanese investors would’ve been keen to snap up foreign bonds due to recent increases in yields, anticipating that the Yen would suffer as a result before betting against it accordingly.

However, data from the Ministry of Finance has this month revealed that Japanese investors were actually large sellers of overseas bonds last quarter while the investment plans of large Japanese life insurance companies have shown limited appetite for overseas assets.

The few exceptions to this limited appetite are debt markets in Australia and Canada,” according to Natwest Markets.