Japanese Yen Turns Fire on the Dollar

- Written by: Richard Perry, Hantec Markets

Image © Adobe Stock

The Dollar-Yen exchange rate has turned sharply lower as markets turn to the Japanese Yen's superior safe haven status and analyst Richard Perry of Hantec Markets says this is likely to be a session packed with volatility.

A rally that was already fatigued has turned sharply sour this morning as the yen has taken on significant gains on the news about President Trump’s COVID infection.

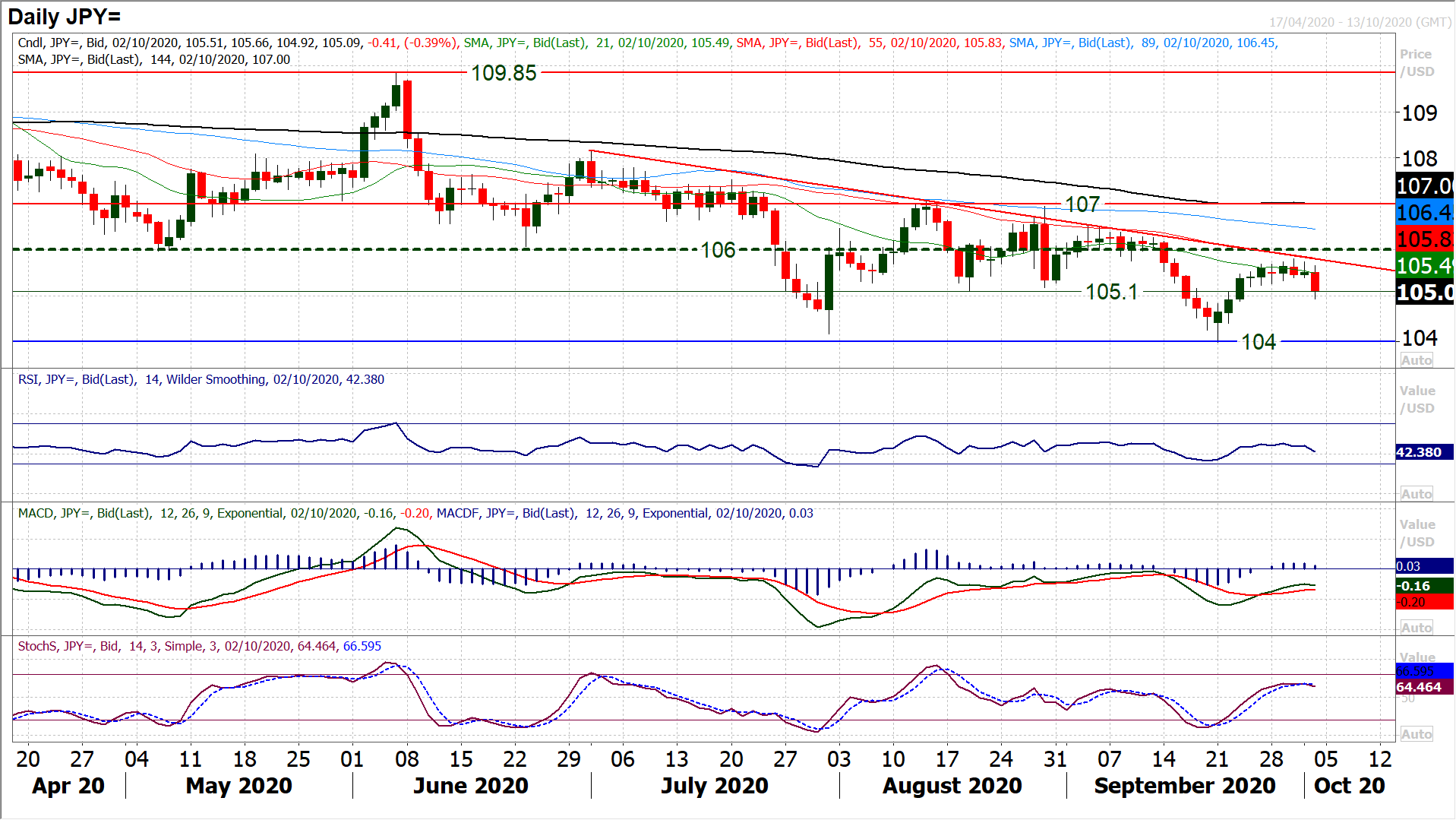

Resistance was forming around the three month downtrend and 55 day moving average yet again, but this has turned into sharp selling pressure on USD/JPY early today.

Support built up above 105.20 throughout the past week has been broken and hourly indicators are turning sharply lower. With Nonfarm Payrolls later today and US traders yet to react to the news on Trump, this is likely to be a session packed with volatility.

How the dust settles tonight will be interesting.

A close under 105.10/105.20 would be technically negative, with Stochastics bear crossing and RSI falling away, both with downside potential.

Closing consistently below 105.10 really does re-open 104.00 once more. Unless the bulls can react quickly, this looks very much to be once more as a Dollar/Yen rally being a chance to sell.

President Trump has tested positive for COVID-19.

The implications of this could be numerous and it is far too early to gauge its true impact.

Firstly and primarily, someone in their mid-70s getting coronavirus is worrying and whatever your politics, it is something that no-one should wish on another person and we wish President Trump a speedy recovery.

When we look into the impact of the news, this is where things get far more complicated.

What are the implications to major markets of Trump’s mortality and for the Presidential Election? There will be some wild conspiracy theories banded around, and a lot of conjecture over how this impacts on the election.

Ultimately, it means uncertainty and volatility.

Accordingly, markets are initially reacting with flows into safe havens, but this will be a volatile session. Does the dollar benefit from this or not?

When the leaders of the UK and Brazil were struck with COVID, their currencies were sold off, however, the dollar is still a classic safe haven. The yen seems to be a safe bet right now, as is gold.

However, how long with markets be reacting to this? US traders still need to respond, and there is the added volatility impact of Nonfarm Payrolls today.

Equities have fallen sharply in the US and there is a knock-on impact in Europe today.

Risk off also means oil is sharply lower. However, events such as these tend to generate knee-jerk reactions that unwind.

Unless Trump’s mortality is called into question, it is likely that this move will be short-lived. It just depends upon how long. In the meantime, be prepared for a bumpy road on major markets.

The Nonfarm Payrolls report dominates the economic calendar today but there are also some other important data points to watch out for.

In the European morning, we see flash Eurozone inflation at 1000BST, with headline HICP expected to remain negative at -0.2% year on year in September (-0.2% YoY in August), whilst core HICP is expected to improve slightly to +0.5% (from +0.4% in August).

Then focus turns to the US Employment Situation at 1330BST, with the headline Nonfarm Payrolls expected to show +850,000 jobs in September (although this is down from the +1.371m jobs in August). The US Unemployment rate is expected to continue to reduce, to 8.2% (from 8.4% in August).

Furthermore, Average Hourly Earnings are also expected to have grown by +0.2% on the month meaning the year on year growth is at +4.8% (+4.7% in August).

Later in the US session the revised Michigan Sentiment is at 1500BST with the slightest of upward revisions to 79.0 (from 78.9 at the flash reading, up from a final reading of 74.1 in August).

US Factory Orders at 1500BST are expected to have grown by +1.0% on the month in August (following a jump of +6.4% in July).