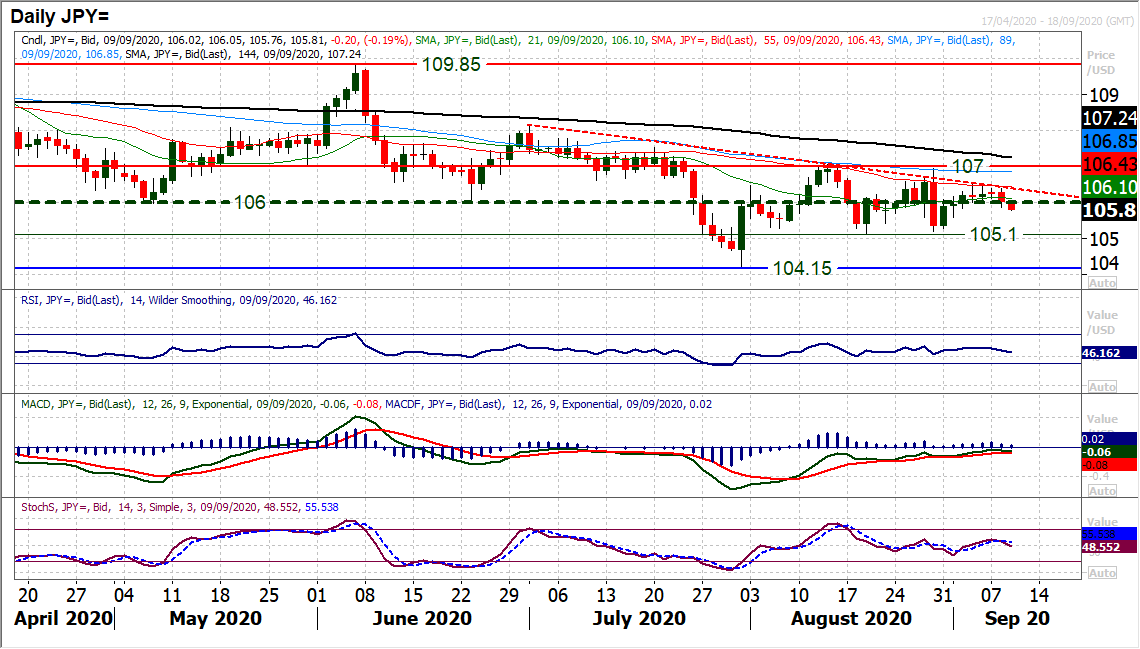

USD/JPY Forecast: 105.10 is "Preferred Target"

- Written by: Richard Perry, Hantec Markets

Image © Adobe Stock

The Dollar-Yen exchange rate is seen at 105.99 at the time of writing with a period of compression extending into the mid-week session. Analyst and technical forecaster Richard Perry at Hantec Markets says the downside is preferred.

Even in the face of growing USD strength, the negative sentiment across major markets yesterday has really driven a safe haven bias and JPY outperformance.

This has resolved an indecisive phase of trading with a decisive negative candlestick.

Moving the market back to the 106.00 pivot is again a rejection of the 106/107 area for the bulls.

This key overhead supply remains a real stumbling block for recovery.

The rallies are also declining too, with the move once more having failed around the two month downtrend (falling today at 106.40) and the falling 55 day moving average (today around 106.45).

A breach of the support band 105.80/106.00 would being the one month range lows back into play, meaning 105.10 becomes the focus again. This remains our preferred target too.

Resistance is growing at 106.50 under the key 107.00 level.

The Wall Street sell-off has become a significant issue for risk appetite.

The rout in the tech stocks may amount to little more than a sector rotation when the dust settles, however, the rattling impact in the meantime is hitting sentiment across major markets.

The sell-off is just one factor though, with a slew of other risk negative headlines hitting across markets today.

Infection rates of COVID-19 are accelerating higher, whilst one of the leading vaccination trials (by AstraZeneca and Oxford University) has been put on hold due to an adverse reaction in one human participant.

The prospect of the UK and EU being able to agree on a trade deal before the 15th October soft deadline is looking increasingly unlikely, with UK Gilt yields and sterling falling hard. Furthermore, the potential for agreement on a US COVID aid fiscal support package also seem remote as both Republicans and Democrats continue to be way apart in their demands.

This is all adding up to risk aversion across major markets. Equities continue to fall, whilst US bond yields are falling (with a “bull flattening” yield curve, which tends to reflect risk aversion).

In forex, the dollar rally continues and the Japanese yen is a key outperformer now. Oil is falling hard on the perceived hit to demand from second waves. It is time to bunker down.

The Bank of Canada is the main focus on the economic calendar today, with a bit of US employment data snuck in too.

The Bank of Canada monetary policy is at 1500BST and there is no expectation of any change to the +0.25% interest rate, and whether the BoC retains an encouraging outlook will be watched.

The US JOLTS jobs openings are at 1500BST too, with an expectation of to 6.00m in July (up +1.8% from 5.89m in June).